Sovereign review, second quarter 2021: rating activity hits an all-time low

Dr. Moritz Kraemer

Jul 31, 2021

Summary

- Following an already subdued Q1, Q2 saw the lowest level of rating activity on record, with the Big Three agencies changing just 2% of their sovereign ratings.

- Once again, advanced economies enjoyed some positive rating actions, with downgrades limited to emerging and developing economies—primarily in Latin America & the Caribbean and Sub-Saharan Africa.

- Across all agencies, rating outlooks continue to improve, with rich countries seeing brighter forecasts than emerging and developing countries.

All quiet on the ratings front.

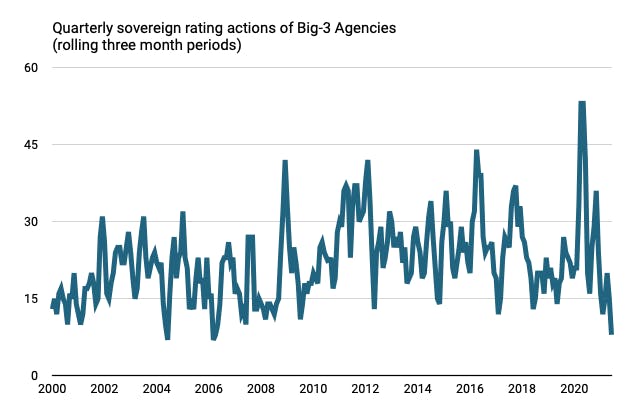

Eerily calm. The quarter ending June 2021 saw a total of just eight rating actions by the Big Three global rating agencies (Fitch, Moody’s and S&P Global). There have been only two quieter quarters since the beginning of the century, with seven actions each in the quarters ending June 2004 and March 2006 [i].

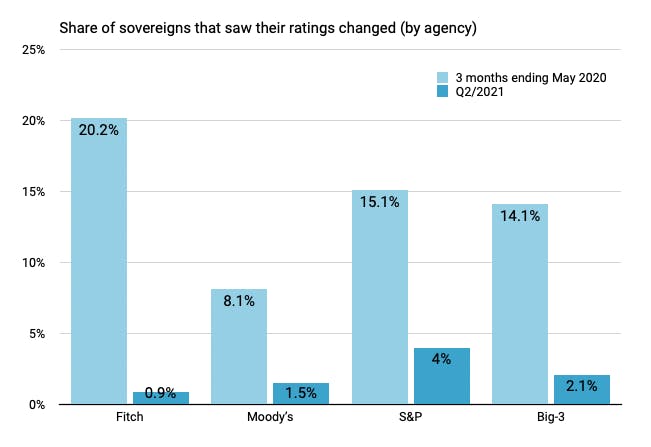

In Q2, the Big Three changed only one in fifty ratings. When we account for the fact that far fewer sovereigns were rated during those two historic episodes, we can conclude that Q2 was the least active quarter on record. As a share of the sovereign universe rated by the Big Three, the last quarter’s rating actions amounted to 2.1%, versus 2.5% in 2006. In relative terms, then, there has never been less to report on.

Two new defaults in the Caribbean. Belize and Suriname were lowered into default by Fitch and S&P, respectively, last quarter. For Belize, it was the fourth default in ten years. That said, to declare a default is merely to note the fact that an issuer missed a payment—it is neither technically a rating action nor a forward-looking rating opinion on the relative likelihood of default. So, if we exclude these two default declarations, the absolute number of Q2 rating actions was even lower at six. We haven’t seen a quarter with so few rating actions since 1994, when the sovereign ratings universe was a third of its present size.

June was the second month this year to see no rating changes. The other month was January, which—as we pointed out in our sovereign Q1 review—was the first month without a single sovereign rating change in almost 20 years (November 1993).

The calm after the storm. The first half of 2020 saw a torrent of rating changes that culminated in a pandemic-induced peak of 53 rating actions in the quarter ending April 2020. This was the highest number of rating actions in any three-month rolling period[1] ever. As a proportion of the sovereign rated portfolio, the quarter ending April 2020 was also the most active so far this century, with 14.1% of all ratings changed. This surpassed the previous record-holding quarter of Q4/2008, when 13.8% of ratings were changed following the collapse of Lehman Brothers and the onset of the Global Financial Crisis.

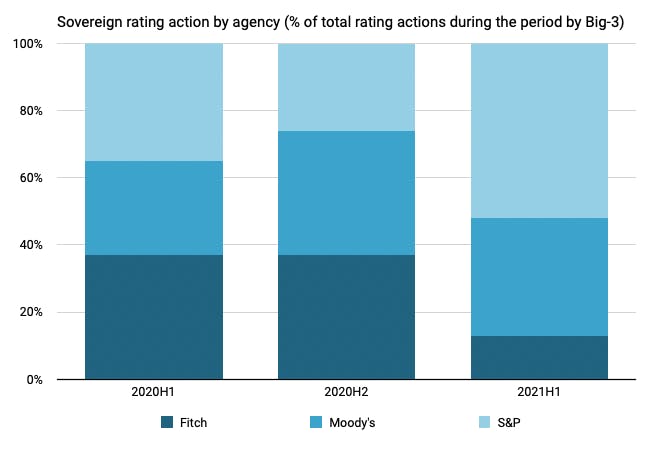

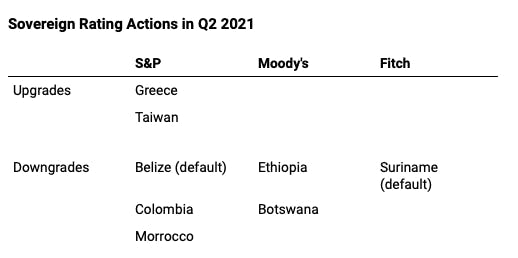

Fitch taking a step back. At the onset of the pandemic, Fitch was the fastest out of the rating adjustment blocks (see Figure 2) when it changed over 20% of its rated sovereigns, mostly downwards. Meanwhile, S&P and, in particular, Moody’s were much slower to react as the virus spread. But while overall rating activity has since slowed to a crawl, Fitch has almost ground to a halt, changing less than 1% of its sovereign ratings portfolio in Q2 this year. And since this amounted to nothing more than placing Suriname on default, Fitch didn’t make a single ‘real’ rating action during Q2.

S&P catching up. As we anticipated in our Q1 sovereign ratings review, having acted less quickly in the early part of the crisis, S&P has continued working down its to-do list. In Q2, S&P accounted for more than half of all downgrades. Meanwhile, Moody’s remained subdued (see Figure 3).

No ratings activity pick-up expected in Q3.Since the rush of activity last spring, the Big Three seem to have collectively assumed a ‘wait-and-see’ holding pattern. And since the summer months tend to be characterised by fewer rating actions—possibly due to the holiday season in the northern hemisphere, where most sovereign analysts are based—we also expect the lull to extend through the third quarter, barring any unforeseen shock. Indeed, as expected, the number of rating actions in July has been low: Fitch downgraded Tunisia and upgraded Cote d’Ivoire, while Moody’s upgraded Cyprus.

A closer look at individual rating actions

While the dearth of ratings activity doesn’t give us much to analyse, a few Q2 rating actions merit a closer look.

In our view, the most important actions were the downgrades to non-investment grade by S&P of both Colombia (May 19) and Morocco (April 2). Neither of these ‘fallen angels’ downgrades were unexpected, having each previously received negative outlooks. For Colombia, this was the country’s first return to a sub-investment grade rating since Fitch upgraded it to BBB- in June 2011. Here, S&P was once again the first to move a sovereign across the investment grade divide—Fitch followed a little later in early July, while Moody’s rating for Colombia is still two notches from the cliff[i]. The downgrade by S&P took place after the government’s plan to raise taxes to curb the burgeoning fiscal deficit was blocked by congress, as well as the recent mass street protests. Although, encouraged by the tax reform proposals, S&P had reaffirmed its investment grade only a month earlier (April 22), the unanticipated failure to pass those reforms triggered the downgrade.

S&P followed Fitch’s lead on Morocco’s downgrade to spec-grade, the latter having cut the country’s rating to below investment grade in October last year. Meanwhile, Moody’s had never granted Morocco the coveted investment grade rating in the first place. Explaining its downgrade, S&P cited deteriorating fiscal performance and increased use of guarantees. But while these negative trends are real, it’s unclear where S&P draws the line. After all, several other sovereigns have fiscal indicators that are deteriorating at a comparable or even faster clip without being subjected to downgrades. For example, citing concerns that its budget deficit was increasing from 3% to 4.5% of GDP, S&P had put Romania’s BBB- rating on a negative outlook in late 2019. The country sailed past that concern, with its deficitballooning to almost 10% in 2020 and S&P still projecting it to be 7% this year. But despite all this, while Morocco lost its investment grade rating, S&P left Romania’s rating untouched and even improved its outlook from negative to stable in April 2021. Of course, rating decisions are never clear-cut unless they are taken way too late. However, the Morocco–Romania comparison makes it clear that the Big Three could still do a lot more to explain the rationale behind their ratings decisions.

On that note, S&P unexpectedly upgraded Taiwan and Greece from stable outlooks, assigning positive outlooks after the updgrades, indicating that more good news is likely to be on the way. These decisions may be contentious—in the week after the Taiwan upgrade, The Economist’s title story on the island carried the headline “The most dangerous place on Earth”. But the bigger issue is the unclear signalling. Straight upgrades from a stable outlook (and throwing in a post-upgrade positive outlook for good measure), does not allow investors to anticipate agency actions. There are different conclusions on what may drive these sudden changes, from a change in the composition of the members of the credit committee, a too infrequent surveillance pattern, [ii] or some unexpected, significant positive developments. Clearly laying out such sudden credit-positive developments would help investors to better understand such surprise rating actions.[1]

In contrast, CountryRisk.io’s sovereign risk scores are entirely quantitative, and so the rationale behind our derived ‘rating’ changes is always transparent and unambiguous. See, for example, Chart 3 here.

Finally, Moody’s lowered Ethiopia’s rating to Caa1. This change was prompted by the expectation that Addis Ababa will restructure its debt under the G20 Common Framework, which would be classified as a distressed debt exchange and, therefore, a default. This follows similar actions by Fitch and S&P during Q1, and— as we explain here—we expect more African sovereigns to follow suit. We have reflected this expectation in the development of our risk scores and derived ratings.

The split between rating actions for rich and poor countries persists

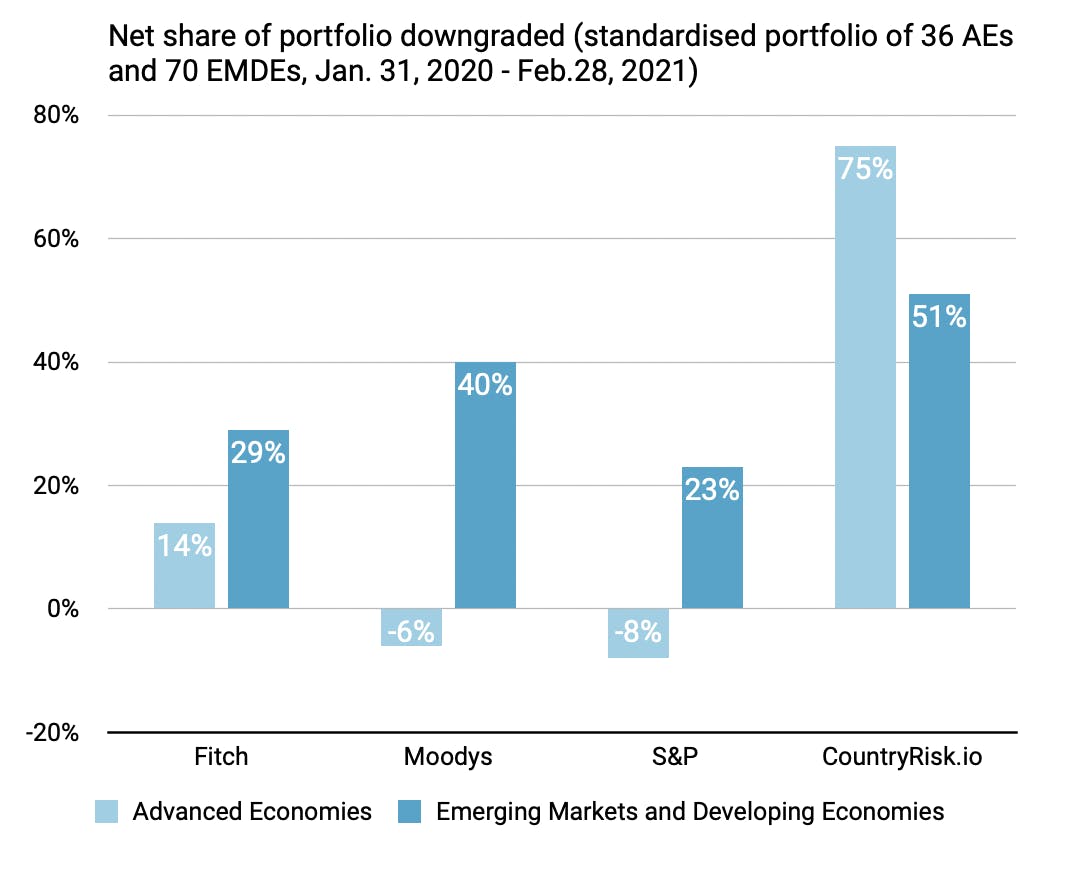

Emerging markets and developing economies (EMDEs) were hit hardest by downgrades during the pandemic. Chart 4, reprinted from our assessment of sovereign rating performance throughout the COVID-19 crisis, shows how, on a standardised portfolio (106 sovereigns rated by each of the Big Three), advanced economies got off virtually scot-free, despite their economies and public finances often being more severely affected than those of EMDEs. Accordingly—and in contrast to the Big Three—CountryRisk.io’s parametric assessment resulted in a more severe downward trend for rich countries than for poor.

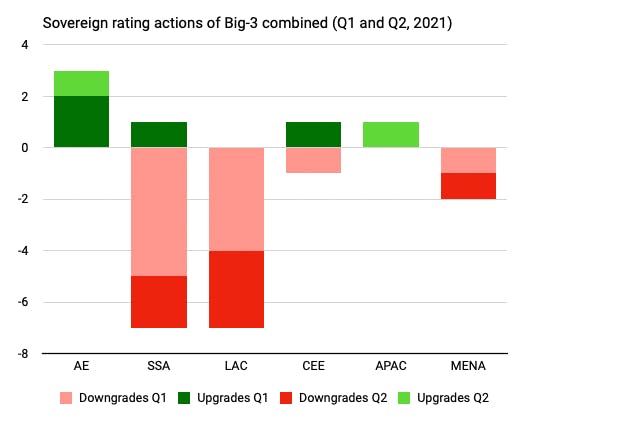

The division between rich and poor countries persists in the Big Three’s rating actions. Since early 2020, sovereigns in the Caribbean & Latin America and Sub-Saharan Africa have been hit hardest by rating downgrades. That’s still the case. Chart 5—which shows the absolute combined number of the Big Three’s upgrades and downgrades (see Table 1 for full details)—reveals that these two regions remain the most affected by downgrades, accounting for around 80% of the total (including default declarations). Again, advanced economies were treated more leniently in both Q1 and Q2. Indeed, advanced economies actually received some moderate upgrades in 2021 without being subjected to a single negative rating action. Meanwhile, there were no rating actions in the Emerging Europe (CEE) region during Q2. And there was almost as little to report in the Middle East and North Africa (MENA), which saw just one downgrade: Morocco by S&P; and Asia-Pacific (APAC), which saw one upgrade: Taiwan by S&P (see section above on the discussion of individual rating actions).

CountryRisk.io’s risk scores show that advanced sovereigns exhibited vulnerability during the pandemic. Unlike the Big Three, CountryRisk.io’s parametric assessment during the pandemic resulted in a more severe downward trend for rich countries than for poor (see Figure 4). CountryRisk.io’s easy-to-use platform uses an algorithm to generate sovereign risk scores—beyond selecting the input data, we apply no further direct discretion. Although we convert our sovereign risk scores into the standard rating scale symbols for comparability, our scores are not ‘ratings’ in the regulatory sense. CountryRisk.io does not hold a rating license and has no intention of applying for one. Nevertheless, we designed our platform’s sovereign risk scores to measure the same credit risks as the equivalent regulatory-approved ratings from the Big Three agencies.

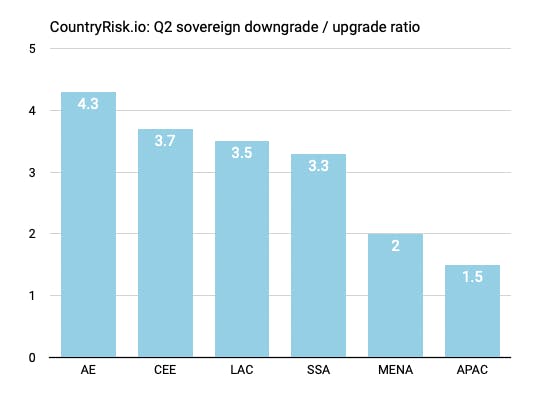

At CountryRisk.io, we continue to believe that rich countries are subject to deteriorating credit risk. Our credit scores show a continued weakness for advanced economies. Consequently, we recorded four times as many advanced sovereign downgrades as upgrades in Q2 (Figure 6)—a weaker ratio than that of any specific EMDE-region. We also take a dimmer view of CEE. That said, setting advanced economies aside, our model is in broad agreement with the Big Three when it comes to the relative resilience of the APAC and MENA regions and the relative vulnerability of Sub-Saharan Africa and Latin America & the Caribbean. Even so, rich and poor sovereigns alike still experience a downgrade overhang in our model (equivalent to a ratio larger than one in Figure 6) as the social, economic, and financial consequences of the pandemic continue to make themselves felt—although, all things being equal, rich sovereigns continue to see more negativity than EMDEs. This finding was reflected in greater detail in our risk update following the IMF and World Bank Spring Meetings.

More downgrade pressure for highly rated sovereigns makes sense. Historic observation suggests that the probability of default changes only incrementally between ratings at the top end of the scale. In contrast, reducing an already-low rating by the same number of notches indicates a bigger increase in the likelihood of default. Therefore, a constant increase in default probability should lead to bigger downgrades at the top of the ratings ladder, where most rich countries reside. And, unlike the Big Three’s rating actions, this is what our sovereign risk scores have shown.

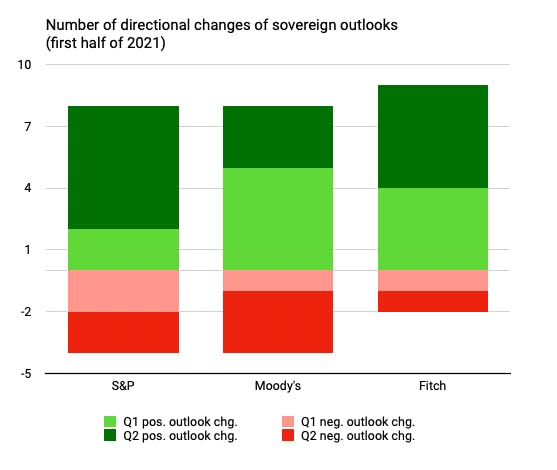

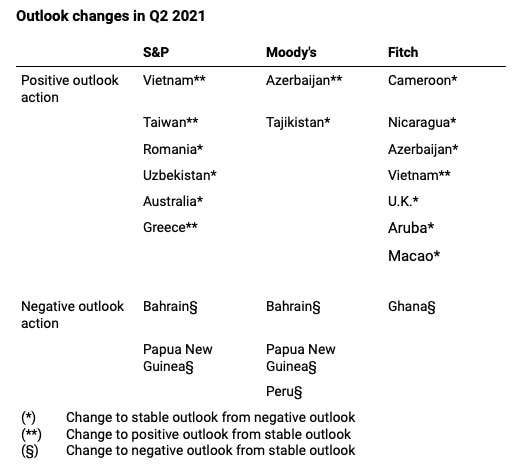

The sovereign weathervane: ratings outlooks turning even more positive

Outlooks keep improving at all agencies. Unlike CountryRisk.io, the Big Three agencies use rating outlooks to indicate whether the next change for a sovereign is more likely to be an upgrade (in the case of positive outlooks) or a downgrade (negative outlooks). So far this year, all three agencies have shown a strong tendency to improve outlooks during both Q1 and Q2 (see Chart 7 and Table 2 for details). This may indicate that, as far as the agencies are concerned, the worst may be behind us in terms of net downgrades.

Once again,advanced economies see only outlook changes in a positive direction.The pattern we saw in rating changes is mirrored in the Big Three’s rating outlooks, with advanced economies and CEE sovereigns once again seeing their outlooks brighten most (see Table 2, which excludes outlook changes that coincide with a rating change in the indicated direction of the previous outllok. For example, if a sovereign is upgraded as its outlook is changed from positive to stable, that outlook change would be excluded). Meanwhile, despite the recovery in the price of oil, one of MENA’s main exports, theregionstill saw its outlook worsen overall during Q2. All of this suggests that we can expect the directional ratings divide between rich and poor countries to continue through the rest of this year and into 2022.

[1] All sovereign ratings data are taken from tradingeconomics.com

[1] All sovereign ratings data are taken from tradingeconomics.com

[1] Historically, S&P has been the first agency to lower a sovereign to non-investment grade in 80% of cases. For details, see: ‘First Mover Disadvantage: The sovereign ratings mousetrap’, CEPS Research Paper, Brussels, by Moritz Kraemer, Patrycia Klusak and Huong Vu).

[1]There is some evidence that the agencies may in many cases not hold credit committees when fundamental credit factors change, but when they are due for regulatory purposes. See Yen Tran, Huong Vu, Patrycja Klusak, Moritz Kramer, Tri Hoang (2021):“Leading from behind:Sovereign credit ratings during the Covid-19 pandemic”, University of Cambridge, Bennett Institute Working Paper, March 17, 2021