We’ll always have Paris: Climate change and sovereign creditworthiness

Dr. Moritz Kraemer

Nov 08, 2021

World leaders are congregating at COP26 in Glasgow this fortnight in yet another attempt to flesh out a credible plan for keeping climate change under control. And with hopes for a global breakthrough remaining modest, there’s even more reason to gauge the risks that further warming of the planet would pose for the creditworthiness of sovereigns.

New research provides insights into the havoc that climate change could wreak on the sovereign ratings of rich and poor countries alike. That said, it also provides reassurance that stabilising the planet’s temperature in line with the Paris agreement will benefit sovereign ratings[i].

In the film Casablanca, Humphrey Bogart uttered the famous line that titles this article as his character reminisced about halcyon days gone by. That is not what we’re doing. Indeed, it is exactly what we cannot afford to do in the context of climate change which, in the words of Nicholas Stern, is the biggest market failure in history. As estimates of the economic consequences of climate change continue to grow, financial markets and business leaders are facing growing pressure to factor climate risks into their decision-making. Fortunately, what we will always have is the Paris of the eponymous Agreement, which makes it clear that we can be the master of our climatic destiny if we can only muster the will to take control. As such, we should view the latest research not as a harbinger of doom, but as a call to arms for swift and comprehensive mitigation action.

Still, a fundamental challenge remains: decision-makers lack the risk information they need. It is not enough to know that climate change might somehow be harmful to your portfolio. Markets need credible, digestible information on how climate change translates into material risks. However, an explosion of environmental, social and governance (ESG) ratings and voluntary, ad hoc, unregulated corporate climate disclosures has created a confusing hotchpotch of unfamiliar, incomparable, conflicting metrics.

As we have shown elsewhere, ESG indicators allow for an excessively wide variance of outcomes for corporate and sovereign issuers alike. Depending on which indicators you choose, the same sovereign can end up at the both the top and the bottom of the ESG scale. It’s a choose-your-own-adventure story that has failed to give investors and other stakeholders reliable risk guidance.

Climate-enhanced sovereign ratings

Understanding the shortcoming of current approaches is what motivated a group of environmental and financial economists at the University of Cambridge’s Bennett Institute for Public Policy to have a stab at the world’s first “climate-smart” sovereign credit ratings[i]. The report provides a clear warning: climate change will affect the ratings of rich and poor countries alike. And the downgrades could begin this decade.

By linking climate science with economic models and real-world best practice in sovereign ratings, the authors avoid subjective ESG go-betweens. Instead, their methods directly simulate the effect of climate change on economic outcomes and sovereign credit ratings for 108 countries under three different warming scenarios.

To that end, the authors developed a random forest machine learning model to predict sovereign credit ratings, which they trainedon ratings issued by S&P between 2015 and 2020. Then, they combined climate economic models with S&P’s own natural disaster risk assessments to develop a set of climate-adjusted economic indicators that describe the various warming scenarios. Finally, the authors fed this climate-adjusted macroeconomic data into the ratings prediction model to simulate the effect of climate change on sovereign ratings.

Sovereign ratings feeling the heat

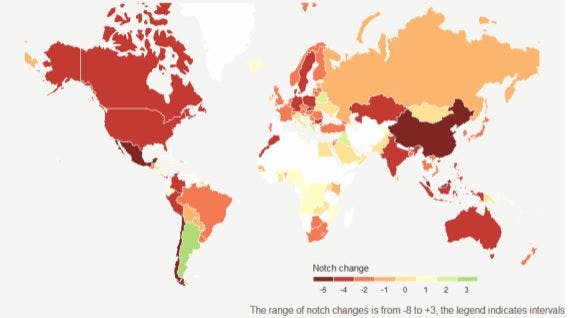

Unlike much of the climate economics literature, this research found that the material impacts of climate change could be felt early as 2030. Under Representative Concentration Pathway (RCP) 8.5—a high-emissions climate scenario that closely traces recent historical emissions, leading to global warming of about 5 °C by the end of the century compared to the preindustrial average—63 sovereigns (58%) will suffer climate-induced sovereign downgrades of approximately one notch by 2030. This wave of downgrades will broaden and deepen to encompass 80 sovereigns (74%) that will face an average downgrade of 2.5 notches by 2100.

Figure 1 shows the magnitude and geographical distribution of sovereign ratings changes predicted by our model by 2100 under RCP 8.5. The most affected nations include Canada, Chile, China, India, Malaysia, Mexico, Peru and Slovakia, all of which are set receive downgrades exceeding five notches. More importantly, the results show that virtually all countries—rich or poor, hot or cold—will suffer downgrades should carbon emissions continue on their current trajectory[i].

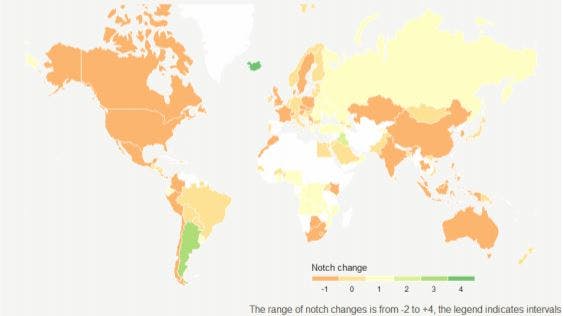

Second, the simulations strongly suggest that stringent climate policies consistent with the Paris Agreement will result in minimal climate impacts on ratings, with an average downgrade of just 0.65 notches by 2100 (Figure 2). Considering the multiple-decade time frame, this would be a mere blip.

There are, however, some caveats. Due to a lack of scientifically credible quantitative estimates of how climate change will impact society and politics, these variables are excluded from the model. For example, Honduras continues to feel the effects of the deterioration of its social fabric and domestic security that followed the devastation caused by Hurricane Mitch in 1998. This ongoing situation has contributed to the stunting of business confidence and growth prospects, while adding to the fiscal burden required maintain a modicum of law and order in the country. Similarly, climate change could lead to further corrosion of societal order, resulting in climate refugees and mass migration across the globe. And since none of these effects are captured by the ratings model used to calculate the ratings impact of climate change, the report’s findings are likely to be conservative estimates. As such, the results should be interpreted as scenario-based simulations rather than predictions.

High-emissions scenarios like RCP 8.5 closely track recently observed trajectories and remain useful over near- to mid-term timescales. However, the pace of renewables deployment and climate policies, like the banning of new petrol and diesel vehicle sales, offer hope that future trajectories may fall closer to low-emissions scenarios, such as the Paris-compatible RCP 2.6 scenario.

COP26, then, is a pivotal opportunity to steer the globe towards the Paris goals. Should a breakthrough be achieved, safeguarding sovereign creditworthiness would be a significant positive side-effect. But should our leaders fail, rising sea levels could overwhelm the flood defences of the River Clyde, immersing the very convention centre in which the climate summit is being held.

The road to long-term ratings

The bottom line is that it’s possible to ‘do climate finance’ without compromising on scientific credibility, economic rigour or decision-readiness. Existing climate science and economics can support credible, decision-ready green finance indicators. As such, this research is of interest to investors, sovereigns and credit ratings agencies alike. And with governments issuing ever-longer dated bonds that life insurance companies and pension funds eager to match their own long-term liabilities are eating up,the long-term creditworthiness of sovereign issuers is a vital consideration for investors.

With a reliable yardstick for assessing sovereign creditworthiness beyond the current decade yet to materialise, this research has the potential fill the gap. Data on adaptation and resilience is only going to become more crucial. And by using the recently adopted UN System of Environmental Economic Accounts – Ecosystem Accounts (SEEA-EA) as a framework for tracing environmental investments and expenditure, national statistics offices could also play a decisive role.

[1] You can watch a replay of a CountryRisk.io webinar on the research discussed in this article here.

[1] The author is member of that research group.

[1]Some sovereigns are shaded green and would, therefore, experience upgrades. But this is not to suggest they will be climate change winners. Instead, this is more likely a reflection of the fact that they’re currently very low-rated relative to the outcome calculated by the AI ratings model. For example, Argentina’s economic fundamentals would suggest it should be rated higher than it is. The reason it isn’t is that the AI model doesn’t account for rating factors such as the default history of serial defaulters or socioeconomic and ethnic strife, as in the example of Iraq.