Natural Language Generation: Your Superpower

Bernhard Obenhuber

Mar 29, 2023

Some time ago, we and our advisors agreed to target two ambitious new features for our platform:

- An “instant” credit risk committee.

- Country risk reports that can be generated at the touch of a button.

These goals are, to say the least, bold. And we knew that the path to achieving them—if such a path even existed—was unclear.

Spoiler alert: we haven’t achieved these goals… yet. In the meantime, though, let’s take a look at our progress so far and what’s coming up in terms of further research and development.

Why did we bother setting these goals?

In most organisations, credit risk committees follow processes that are rigid and time-consuming, which makes them slow to respond to sudden risk events and puts enormous pressure on what are often very small teams. We wanted to create the “ideal world” in which credit risk committees can deliver high-quality country risk analyses without the need for such onerous processes. If we succeed, analysts who use our platform will be able to keep up with more risk events as they happen while easing what is currently an almost impossible task: covering 200 countries with teams that often contain fewer than five people.

A typical credit risk committee has its key dates pretty much defined for the entire year in advance. In the week before a committee meeting, various departments aggregate numbers (e.g. exposure by country) and economists prepare or update relevant country risk profiles. Then, the requisite PowerPoint presentations are sent to stakeholders before being presented to the committee at the meeting. If the discussion touches on topics not covered in the slide deck, the committee must rely on the knowledge of its members or expert guests. After the meeting, the slide deck is archived and meeting minutes outlining the committee’s decisions (e.g. changes to country limits) are distributed and entered into the organisation’s systems. Countless hours are spent on administering these processes.

Meanwhile, event risks can and will occur without any regard for the committee’s schedule. If we can enable the “production process” to be completed more quickly or even in real time, credit risk committees will be able to incorporate new event risks into their analyses sooner.

This would also reduce the burden of the “production process” itself. Country risk practitioners are no stranger to the time-consuming task of prepping country risk reports, a huge part of which includes diligently keeping your datasets updated with new economic data and, of course, completing the rating process. This includes pondering the result and whether the rating and outlook you’ve assigned are justified, before writing everything up into a narrative that includes a thoughtful analysis and forward-looking assessment.

Crucially, all of this has to be done at breakneck speed. Because—as many country risk teams would agree—there are rarely enough analysts to cover 200 countries at anything like an unhurried, deliberate pace. Fortunate teams might have as many as eight analysts; others often have just three to five. For analysts lucky enough to cover exotic countries, the only saving grace is that you’ll likely only have to complete the process once a year (barring event risks that force new ratings or assessments) for each country. Because gathering meaningful data and writing reports on countries in emerging markets, as exotic countries often are, can be extremely challenging and mentally taxing.

Super-charging your team

We believe that a promising approach to creating our “ideal world” is to use modern data analytics techniques to give your analysts superpowers that make them more productive and efficient.

Our approach combines three techniques:

- Quantitative sovereign risk modelling to approximate the country’s sovereign default risk.

- Natural language generation using fixed heuristics to convert data to text.

- Large language models to improve the style and flow of the text.

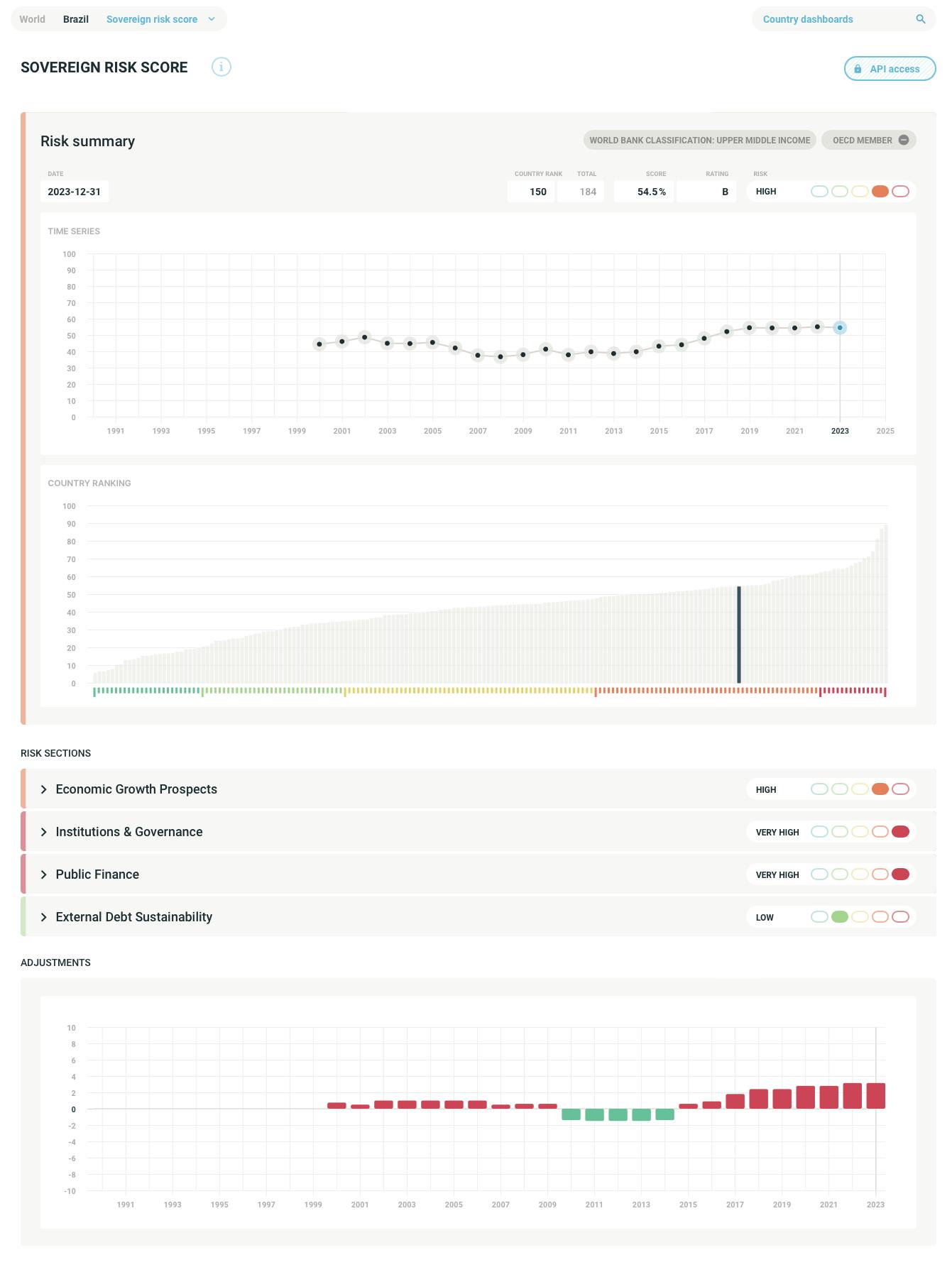

Keeping it short regarding the first point (you can read more about the methodology here), we use our sovereign risk score methodology to calculate the sovereign credit risk for around 200 countries. Our data pipeline is fully automated and can run on a daily, weekly, or monthly basis. The model’s outcome is a set of risk scores, mapped letter ratings, and details of the underlying indicators. You can see a screenshot of the Sovereign Risk Score for Brazil below.

For those with the domain knowledge and a knack for numbers, it’s easy to derive the country’s economic narrative from this information. However, for non-experts, the model’s outcome might amount to little more than a confusing list of numbers. What really matters—the story—is missing.

This is where Natural Language Generation (NLG) comes into play. Coming under the umbrella of Natural Language Processing (NLP), NLG is the process of generating text that reads like it was written by a human. Often, the text is based on a data set, such as our Sovereign Risk Score results.

Here’s a simple example:

Input: Sovereign Risk Score Brazil: 54.5 / High Risk

Output: The Sovereign Risk Score of Brazil based on CountryRisk.io’s purely quantitative methodology is 54.5. This score can be mapped to the “high risk” category, which indicates elevated default risk.

There are different approaches to translating numbers to natural language. In our case, we want to be certain that the text accurately conveys the meaning of the numerical Sovereign Risk Score. So, we defined a report template with a fixed structure and a set of rules for converting data into text. We also added variations in terms of wording and sentence lengths.

Of course, we could add even more variations to the report template, but we thought that there might be a better approach by using large language models like the ones provided by openAI. Overall, they can create some very well-written texts. But there is also the significant risk of algorithmic hallucination that leads to some nonsense results. In addition, such models do not know the recent events or any economic concepts (e.g., economic transmission channels, say, from monetary tightening to the aggregate economy, exchange rate, labour market, and the like.). Clearly, not helpful for a credit risk committee report or a country risk report.

For these reasons, we limited the language model’s task to “just” rewriting an existing text. Specifically, we gave the model the following input prompts:

- “Please rewrite: The Sovereign Risk Score of Brazil based on the purely quantitative methodology developed by CountryRisk.io is 54.5 that…”

- “Please rewrite the text and explain why good country statistics are important: The data quality of Brazil is…”

- “Please rewrite and explain why it is important for sovereign risk: The latest numbers for economic growth was…”

- “Please write an executive summary for: The Sovereign Risk Score…”

We also varied the length of the generated text by sampling from a uniform distribution with defined limits. For example, we specified that the generated text should have a length of between 200 and 500 tokens.

While the language model creates impressively written sentences, it still has some significant flaws that we need to manage carefully. For instance, the model struggles with comparing numbers, as this example shows:

Input: The last available data point for Change of Domestic Credit to GDP Ratio (5yr average) is 18.0789 for 2024. It has declined over the past 4 years. The peer group value for the same indicator is lower (5.1465). The income peer group value for the same indicator is lower (10.2614). The rating peer group value for the same indicator is lower (7.5642). The value for neighbouring countries is lower (11.0476).

Compared to all peer groups, Brazil has a higher change of domestic credit to GDP ratio. Now, let’s see how openAI rewrites this paragraph. It comes to a different conclusion:

Output: The latest available data for Change of Domestic Credit to GDP Ratio (5yr average) for 2024 is 18.0789, which has decreased over the past 4 years. This indicator's value is lower compared to its peer group (5.1465), income peer group (10.2614), rating peer group (7.5642), and even lower than its neighbouring countries value (11.0476).

This is neither good nor helpful. One way to “avoid” this problem is to only allow the model rewrite single sentences:

Input: The peer group value for the same indicator is lower (5.1465).

Output: The value of the same indicator for the peer group is lower (5.1465).

However, what seems to work well for rewriting entire paragraphs is feeding the model more explicit statements:

Input: The last available data point for Brazil for Change of Domestic Credit to GDP Ratio (5yr average) is 18.0789 for 2024. It has declined over the past 4 years. The peer group value for the same indicator is lower (5.1465) than the one of Brazil. The income peer group value for the same indicator is lower (10.2614) than the one of Brazil. The rating peer group value for the same indicator is lower (7.5642) than the one of Brazil. The value for neighbouring countries is lower (11.0476) than the one of Brazil.

Output: The latest available data for Brazil's Change of Domestic Credit to GDP Ratio (5yr average) for 2024 is 18.0789, which has decreased over the past four years. Compared to the peer group average for the same indicator, Brazil's value is higher (5.1465). Likewise, the income peer group, rating peer group, and neighbours' values are all lower (10.2614, 7.5642, and 11.0476, respectively) than Brazil's.

This is an improvement. But if you look closely, you’ll see that a new issue (it references the value of 5.1465 to Brazil and not to the peer group that would be correct) has emerged in the output paragraph. So, we made additional adjustments to the input prompt before settling on the following version:

Input: For Brazil, the latest data point for the indicator GDP per capita (PPP-adjusted, 5yr average) is 14841.6418 for 2023. It has declined over the past 3 years, for Brazil. The peer group value of 18446.0449 is higher than the one of Brazil. The income peer group value of 16885.3474 is higher than the one of Brazil. The rating peer group value of 14141.8722 is broadly in line with the one of Brazil. The value for neighbouring countries of 13235.4114 is lower than the one of Brazil.

Output: For Brazil, the 2023 GDP per capita (PPP-adjusted, 5yr average) is 14841.6418, a decline from the previous three years. Brazil's value is lower than the peer group value of 18446.0449 and the income peer group value of 16885.3474. The rating peer group value of 14141.8722 is more or less in line with that of Brazil's, while the value for neighbouring countries is lower at 13235.4114.

This output paragraph makes comparisons and refers to values correctly, while also reading well.

Country risk report

We’ve included the results of our exercise at the end of this blog post. We also generated a set of accompanying charts, although they were too extensive to include here. This example focused on a specific country, but we can easily use the same process to generate text describing the risk exposure of an organisation.

Use cases

We see two main uses cases for this approach:

- Drafting: The seasoned analyst can use AI-generated content to add more colour and up-to-date news and information to a report, along with better transitions between its various sections.

- Creating standardised country reports or modules that can be used in different places and systems.

At CountryRisk.io, we’re focusing our development efforts on these areas. As we mentioned earlier, this is only an update on our progress to date, and we still have a lot to do. However, we’ve already done enough to be confident that, sooner or later, further developments in NLP will enable us to realise our “ideal world”.

We have several improvements in our development pipeline. First, we want the generated texts to contain more forward-looking statements. Such statements can be easily integrated for all indicators where forecasts are available, either by generating them in-house or acquiring them from institutions like the IMF. Second, we want to reduce the rigidity of the report structure in terms of paragraph sequencing and length while continuing to describe specific risk factors accurately. Third, we are considering the addition of content elements that refer to the latest news or upcoming elections. Finally—and most ambitiously—we would like to add macro-economic concepts to the heuristics to deliver significant improvements in the economic narratives.

Is there a future for country risk analysts and economists?

Yes! That said, we also believe that these jobs will evolve to require expertise in defining data pipelines, translating domain knowledge into heuristics, and understanding the limits of different models.

As ever, if you’d like to learn more about our work, please do drop us a line.

PS: We spent around USD 2 on testing the approach outlined in this blog post, which includes the examples shown throughout. Calling the openAI API for one country risk report would likely cost under USD 0.10. For organisations looking to streamline their expenses, there’s some food for thought…

------------------------------------------------------------

# Country Report: Brazil

*29-Mar-2023*

### Summary

Brazil's Sovereign Risk Score is currently calculated to be high risk with a value of 54.4972. This score ranges between 0 and 100, with higher values indicating higher risk and a negative trend over the past 3 years. When compared to a rating agency scale, the mapped rating of this score would be a B letter rating.

Sovereign credit risk is the risk of a government or other public institution failing to meet its financial obligations. It is the risk that a government will default on its debt, or will not be able to meet its other financial obligations, such as repaying its loans or making interest payments. As governments are not normally perceived to be as financially sound as companies, sovereign credit risks are generally higher than those associated with other types of debt.

### Rating Agency Information

The credit ratings assigned to Brazil by Standard and Poor's, Moody's and Fitch are BB-, Ba2 and BB- respectively. On average, the ratings of the three agencies are more optimistic than the shadow rating provided by CountryRisk.io, which is based solely on quantitative data.

A sovereign credit rating is an assessment of the creditworthiness of a country’s government. It is based on the country’s ability and willingness to service its debt. Credit ratings are issued by credit rating agencies, such as Standard & Poor's and Moody's, and are used by investors and lenders to assess the risk of investing in a particular country. Higher ratings indicate that the country is more likely to repay its debt, while lower ratings indicate a greater risk of default.

### Contribution to Risk Information

The risk section Institutions & Governance contributes the most to risk, calculated as very high risk. External Debt Sustainability contributes the least to risk. The table below summarizes the results on a risk-section level and compares them with the peer group.

### Data Quality Assessment

Good country statistics are important as they provide an accurate picture of the current state of a nation. The data quality rating of 100% indicates that the available share of indicators is reliable and up-to-date. This consistency over the past 10 years shows that data quality has remained stable, which is a positive sign for future data. With accurate, reliable data, governments and organizations can make sound decisions to improve the lives of their citizens.

### Risk Section: Economic Growth Prospects

Brazil's Economic Growth Prospects risk area is assessed as high risk due to its low economic wealth and weak economic growth rates. This negative momentum has been observed over the past five years and is most heavily influenced by GDP per capita (PPP-adjusted, 5yr average), which contributes 52% to the risk section. Strengths within this area include Real GDP Growth Average (5yr average, relative to world), Change of Domestic Credit to GDP Ratio (5yr average), Investments to GDP (5yr average), and Inflation Rate Average (5yr average, relative to world). Weighing the credit profile are GDP per capita (PPP-adjusted, 5yr average) and Gross savings to GDP (5yr average).

#### Indicator Assessment: GDP per capita (PPP-adjusted, 5yr average)

In Brazil, the latest GDP per capita (PPP-adjusted, 5yr average) for 2023 is 14841.6418, which has decreased in the last two years. The peer group value for the same indicator is 18446.0449, which is higher than Brazil's. The income peer group value of 16885.3474 is also higher than Brazil's, while the rating peer group value of 14141.8722 is in line with the country's. However, the value for neighbouring countries is 13235.4114, which is lower than Brazil's.

GDP per capita (PPP-adjusted, 5yr average) is an important indicator for sovereign risk analysis because it measures the average income of a country's population over the past five years. This indicator is important because it provides a measure of a country's economic health and stability. This indicator is also important because it

#### Indicator Assessment: Gross savings to GDP (5yr average)

In Brazil, the Gross savings to GDP (5yr average) indicator for 2023 stands at 15.7723, a decline from the past 5 years. In comparison, the peer group average is 23.9397, the income peer group average is 18.6534, and the rating peer group average is 22.5898, all higher than the one for Brazil. Neighbouring countries have a lower value of 14.1162.

Gross savings to GDP (5yr average) is an important indicator for sovereign risk analysis because it provides insight into a country's fiscal health and ability to meet its debt obligations. A higher savings rate indicates that the country is likely to have enough money to pay its debt, while a lower savings rate could indicate a potential risk of default. By looking at the 5yr average, analysts can gain a better understanding of the country's overall fiscal health as well as any potential changes in their economic policies. Furthermore, it can help to identify potential vulnerabilities in a country's financial system, which could be a sign of future economic instability.

#### Indicator Assessment: Real GDP Growth Average (5yr average, relative to world)

Brazil's Real GDP Growth Average (5yr average, relative to world) for 2023 is -1.2027, showing a decline over the past 5 years. However, Brazil's value is still higher than its peer group (-0.62461), income peer group (-0.40837), and rating peer group (1.374) values, and is also higher than the value for neighbouring countries (-3.0857).

Real GDP growth average (5yr average, relative to world) is an important indicator of sovereign risk analysis because it provides insight into the economic health of a nation. It measures the rate of economic growth of a country relative to the world average, revealing the amount of growth or contraction the economy is experiencing. This information is important to investors as it can help determine the risk associated with investing in a particular country. If a country is experiencing higher than average economic growth, it is likely to be a better investment

#### Indicator Assessment: Change of Domestic Credit to GDP Ratio (5yr average)

Brazil's Change of Domestic Credit to GDP Ratio (5yr average) for 2024 is 18.0789. This is a decrease from the previous two years. The peer group value of 5.1465, the income peer group value of 10.2614, the rating peer group value of 7.5642, and the value for neighbouring countries of 11.0476 are all lower than Brazil's.

The change of domestic credit to GDP ratio (5yr average) is an important indicator for sovereign risk analysis because it provides an indication of how much credit the government is taking on relative to its total economic output. This can be an important indicator of the government's capacity to service its debt and repay its creditors. The higher the ratio, the greater the risk that the government will not be able to meet its debt obligations and the higher the sovereign risk. The 5yr average also provides greater context and insight into the trend of the domestic credit to GDP ratio, which can give investors a better understanding of the government's fiscal health and creditworthiness.

#### Indicator Assessment: Investments to GDP (5yr average)

For Brazil, the latest available data point for Investments to GDP (5yr average) is 18.621 for 2025, which has decreased over the past 3 years. The Investment to GDP value for Brazil's peers is 25.782, higher than Brazil. The Investment to GDP value for Brazil's income peers is 23.0142, higher than Brazil. The Investment to GDP value for Brazil's rating peers is 26.268, higher than Brazil. The Investment to GDP value for Brazil's neighboring countries is 15.3137, lower than Brazil.

Investments to GDP (5yr average) is a key indicator of sovereign risk analysis because it measures the health of the economy. This indicator measures the amount of capital invested into a country's economy over a period of five years. This provides insight into the potential future growth of the economy, as well as the

#### Indicator Assessment: Inflation Rate Average (5yr average, relative to world)

In Brazil, the Inflation Rate Average (5yr average, relative to world) is currently 0.40267 for 2023. Over the past two years, the rate has remained fairly stable. Compared to its peer group, Brazil's rate of -0.4245 is lower than the group's average. Similarly, the income peer group value of 2.0409 and rating peer group value of 0.65688 are both higher than Brazil's value. Lastly, the average inflation rate for neighbouring countries is 1211.498, which is also higher than Brazil's.

The inflation rate average (5yr average, relative to world) is an important indicator for sovereign risk analysis because it provides a measure of the stability of a country's inflation rate. Inflation affects the value of a country's currency, which has a direct impact on its ability to borrow and pay its debts. By looking at the average inflation rate for a given country

### Risk Section: External Debt Sustainability

In terms of Brazil's External Debt Sustainability, the risk classification has been categorized as low risk due to the country's economic wealth and solid economic growth rate. However, the risk section has decreased over the last five years. The indicator with the most significant impact on this risk section is the Current account balance to GDP Average (5yr average), which contributes 43% to the total risk section. Factors that support the credit profile include the Net external debt to GDP (5yr average), IMF Reserve Adequacy Ratio (5yr average), Net external debt to Exports (5yr average), Short term external debt to FX reserves (5yr average), and Import coverage ratio (in months, 5yr average). On the other hand, the Current account balance to GDP Average (5yr average), Net international investment position to GDP (5yr average), FX reserves growth (5yr average), and Export growth average (5yr average) weigh the credit profile.

#### Indicator Assessment: Current account balance to GDP Average (5yr average)

In Brazil, the most recent Current Account Balance to GDP Average (5yr average) is -1.769 for 2025. It has decreased over the past 3 years. The peer group value of -1.663 is higher than Brazil's. The income peer group value of -2.6943 is lower than Brazil's. The rating peer group value of -3.8493 is lower than Brazil's. The value for neighbouring countries of -0.69825 is higher than Brazil's.

The current account balance to GDP average (5yr average) is an important indicator for sovereign risk analysis because it provides a measure of a country's balance of payments. This is an important indicator of a country's financial and economic stability, as it measures the amount of money a country is making on its exports, imports, investments, and transfers. A country with a high current account balance to GDP average is typically seen as having a stable economy and is viewed as having less sovereign risk than a country with a low current account balance to GDP average. This indicator helps investors and analysts assess the risk of investing in a particular country.

#### Indicator Assessment: Net international investment position to GDP (5yr average)

In 2023, the 5-year average of Brazil's Net International Investment Position to GDP was -39.2884. This indicator has increased over the past 3 years for Brazil. However, these values are still lower than its peer group (-27.917), income peer group (-32.8994), rating peer group (-20.59), and neighbouring countries (-0.82603).

The net international investment position to GDP (5yr average) is an important indicator for sovereign risk analysis because it provides information about a country's financial health, as it measures the value of the country's external assets and liabilities. This indicator provides insight into a country's debt burden, as well as its ability to service its debts. It also provides an indication of a country's risk of default, as higher levels of debt may indicate a higher risk of default. This indicator can be used to compare a country's debt burden to other countries, and to evaluate its ability to pay back its debt.

#### Indicator Assessment: FX reserves growth (5yr average)

Brazil's 5-year average FX reserves growth for 2023 is -1.5449. In the past 3 years, this indicator has been on the rise. When compared to its peer group, Brazil's value of -1.5449 is lower than the peer group value of 7.0923, the income peer group value of 10.4451, and the rating peer group value of 8.042. However, Brazil's value of -1.5449 is higher than the value of its neighbouring countries, which is -7.0428.

FX reserves growth is an important indicator for sovereign risk analysis because it provides insight into a country's ability to meet their external obligations in the event of an economic crisis. A country with a high FX reserves growth indicates that they have a strong and consistent flow of foreign

#### Indicator Assessment: Export growth average (5yr average)

The last available data point for Export growth average (5yr average) in Brazil is 1.7172 for 2023. In comparison to the past 3 years, Brazil's export growth has increased. The peer group value of 0.39556 is lower than Brazil's, while the income peer group value of 3.4767 and rating peer group value of 4.3161 are both higher than the one of Brazil. When compared to neighbouring countries, the value of 0.76055 is lower than Brazil's.

Export growth average is an important indicator for sovereign risk analysis because it provides a measure of the health of a nation’s economy. When export growth is strong, it indicates that the nation is producing a high-value product or service that is in demand in foreign markets. This increases the overall income of the nation, which in turn can lead to a stronger currency and higher credit ratings. Conversely, sluggish export growth can point to an economy that is not taking advantage of global opportunities, thus leading to lower credit ratings and an increased risk of default. Therefore, the five-year export growth average can provide

#### Indicator Assessment: Net external debt to GDP (5yr average)

Net external debt to GDP (5yr average) for Brazil in 2023 is 13.5987. Over the past 5 years, this indicator has been decreasing. However, the values for Brazil's peer group (29.6913), income peer group (35.254), rating peer group (23.418), and neighbouring countries (31.9453) are all higher than Brazil's.

Net external debt to GDP (5yr average) is an important indicator for sovereign risk analysis because it measures a country's ability to pay its external debts. This indicator provides insight into a country's financial stability, debt sustainability, and creditworthiness as it compares a country's external debt to its economic output. It also helps to determine a country's ability to manage its debt obligations and the potential risks associated with default or restructuring. A higher

#### Indicator Assessment: IMF Reserve Adequacy Ratio (5yr average)

The latest IMF Reserve Adequacy Ratio (5yr average) for Brazil in 2022 is 142.0624, which is higher than the values of its peers, neighbouring countries, and income group. Over the past two years, this ratio has increased for Brazil. The peer group value stands at 107.9431, the income peer group value is at 120.842, and the rating peer group value is at 106.2089. The value for neighbouring countries is 96.197, all of which are lower than Brazil's.

The IMF Reserve Adequacy Ratio (5yr average) is an important indicator for sovereign risk analysis because it reflects a government's ability to respond to external shocks. This ratio measures a country's reserves as a percentage of its total imports over a five-year period. It provides an indication of whether a country has the financial resources to pay for its imports and other financial obligations in the event of an economic crisis. A low ratio means that the country is vulnerable to external shocks and may be at risk of defaulting on its debt. This indicator can help investors assess the risk associated with investing in a country's sovereign debt.

#### Indicator Assessment: Net external debt to Exports (5yr average)

Net external debt to Exports (5yr average) for Brazil in 2023 is 80.1581, showing a decline in the past four years. Compared to its peer group, Brazil's value is lower, with values of 109.7935, 117.9011, and 110.5612 respectively. The value of neighbouring countries is even higher, at 174.8794.

The Net External Debt to Exports (5yr average) indicator is important for sovereign risk analysis because it provides a measure of a country's ability to service its external debt. It is calculated by dividing the total net external debt of a country by the total value of its exports over a five-year period. A high ratio indicates that the country is more vulnerable to external debt default and is more likely to experience financial distress. This indicator is a key measure of a country's external debt burden and its ability to manage the risk associated with it.

#### Indicator Assessment: Short term external debt to FX reserves (5yr average)

The latest data point for Brazil's Short-term External Debt to Foreign Exchange Reserves (5yr average) is 21.4083 for 2023. This figure has decreased over the past 5 years. The peer group figure of 31.2467 is higher than Brazil's, as well as the income peer group value of 43.3776 and the rating peer group value of 34.3026. The value of neighbouring countries is also higher at 25.2309.

This indicator is important for sovereign risk analysis because it provides an indication of a country's ability to pay back its short-term external debt obligations. The 5-year average of this metric is also helpful in understanding the long-term trends in debt levels and the ability of the country to pay back its obligations over time. This is important because it can help to identify potential risks of default or other financial issues that may arise in the future. Additionally, the ratio of short-term debt to FX reserves can help investors determine the risk level of investing in a particular country.

#### Indicator Assessment: Import coverage ratio (in months, 5yr average)

In 2023, Brazil's Import Coverage Ratio (measured as a 5-year average) was 15.7643, an increase from the previous two years. Compared to its peer group, with a value of 6.3525, Brazil's Import Coverage Ratio is higher. Similarly, Brazil's value is higher than its income peer group (8.1237), rating peer group (7.8982), and neighbouring countries (7.177).

The import coverage ratio is an important indicator for sovereign risk analysis because it gives investors insight into a country’s ability to pay for its imports. It measures a country’s capacity to finance its current account deficits. This ratio is calculated by dividing the amount of imports a country has in a given period of time by the amount of foreign exchange

### Risk Section: Institutions & Governance

As of 2023, Brazil's risk classification for Institutions & Governance is calculated to be very high, constituting a credit negative. Over the past five years, the indicator that has had the greatest impact on this risk section is Government Effectiveness (5 year average), which accounts for 42% of the total risk score. Despite this, Rule of Law (5 year average) and Regulatory Quality (5 year average) are two strengths in this area, while Government Effectiveness (5 year average) and Control of Corruption (5 year average) are two weaknesses.

#### Indicator Assessment: Government effectiveness (5 year average)

For Brazil, the indicator Government effectiveness (5 year average) for 2023 is 37.6603. This value has increased over the past 5 years. However, the peer group value of 59.7756, the income peer group value of 46.3957, and the rating peer group value of 44.62 are all higher than Brazil's, while the value for neighbouring countries of 39.1026 is broadly in line with Brazil's.

Government effectiveness is an important indicator for sovereign risk analysis because it measures the level of efficiency of a government in executing their responsibilities. It encompasses aspects such as rule of law, regulatory quality, control of corruption and government spending. A government with a high level of effectiveness is more likely to be able to handle economic and political risks, while a government with a low level of effectiveness may struggle to handle unexpected events or financial crises. By analyzing the government effectiveness over a five-year average, investors can get a better understanding of the government's ability to manage risk and make decisions that will benefit the economy.

#### Indicator Assessment: Control of corruption (5 year average)

For Brazil, the Control of Corruption (5 year average) indicator for 2023 is 38.141, which has decreased over the past two years. Its peer group value of 45.9936, income peer group value of 44.3677, rating peer group value of 40.1328, and value for neighbouring countries of 40.2644 are all higher than Brazil's.

Control of corruption is an important indicator for sovereign risk analysis because it helps analysts understand how a government is managing and handling its resources. A government with a high control of corruption rating is likely to be more efficient and effective in managing its finances, and issuing debt. This in turn, can lead to a lower risk of defaulting on loans, better economic growth, and a more stable business environment. By understanding the control of corruption, analysts can better predict the risk of sovereign default and the potential for economic growth in a country or region.

#### Indicator Assessment: Rule of law (5 year average)

For Brazil, in 2023 the Rule of law (5 year average) indicator value is 45.3526, up from the prior three years. Brazil's value of 45.3526 is lower than the peer group value of 50.2137, but broadly in line with the income peer group value of 45.8071 and higher than the rating peer group value of 39.9725 and the value for neighbouring countries of 30.5689.

The rule of law is an important indicator for sovereign risk analysis because it indicates the strength of the legal system in a country. A strong rule of law ensures that the government is held accountable for its actions and that citizens have access to justice and protection of their rights. A five-year average of the rule of law can provide a good indication of the stability of the legal system over time. This is important for

#### Indicator Assessment: Regulatory quality (5 year average)

In Brazil, the 5 year average Regulatory Quality indicator for 2023 is 48.3974, which has decreased over the past 4 years. The Regulatory Quality indicator for Brazil's peer group is 63.7821, higher than Brazil's value. The Regulatory Quality indicator for Brazil's income peer group is 46.9551, broadly in line with Brazil's value. The Regulatory Quality indicator for Brazil's rating peer group is 41.369, lower than Brazil's value. The Regulatory Quality indicator for Brazil's neighbouring countries is 37.0994, also lower than Brazil's value.

Regulatory quality is an important indicator for sovereign risk analysis because it measures the degree to which the government enforces regulations in its economy. A low regulatory quality score indicates that the government is not enforcing its regulations and is therefore more likely to experience economic instability and sovereign risk. By looking at the five year average regulatory quality score, analysts can get a better picture of the government's ability to enforce regulations over the long-term and make more informed decisions about the country's sovereign risk.

### Risk Section: Public Finance

As of 2023, Brazil's risk classification of the Public Finance area is quite high, which is a credit negative. Over the past five years, however, the country has shown a positive momentum. The most influential indicators to the overall risk rating are General government debt to GDP (5yr average) and Interest payments to total revenues (5yr average), which together account for 64% of the total risk score. Strengths in this area are General government debt to GDP (5yr average), Interest payments to expenses (5yr average), and Government revenue to GDP (5yr average). The weaknesses, on the other hand, are Interest payments to total revenues (5yr average) and Fiscal balance to GDP (5yr average).

#### Indicator Assessment: General government debt to GDP (5yr average)

In Brazil, the 5-year average of General government debt to GDP as of 2023 is 91.2243. Over the past 3 years, this indicator has decreased. Compared to a peer group average of 43.7104, Brazil's value is higher. Similarly, the income peer group average of 58.2187 and the rating peer group average of 57.7854 are both lower than Brazil's value. Meanwhile, neighbouring countries' average of 114.149 is higher than Brazil's.

General government debt to GDP (5yr average) is an important indicator for sovereign risk analysis because it provides insight into a country’s overall financial health. It measures the amount of debt a government has relative to the size of its economy, giving analysts an indication of the country’s ability to service its debt. High levels of debt relative to GDP can signal a higher risk of default, while low levels of

#### Indicator Assessment: Interest payments to total revenues (5yr average)

The latest data point for the indicator Interest payments to total revenues (5yr average) for Brazil in 2023 is 22.7019, which is an increase from the past two years. Compared to its peer group, Brazil has a higher value (11.8889) than its peers, as well as higher values than its income and rating peer groups (9.988 and 13.9273 respectively). Additionally, Brazil's value of 22.7019 is higher than that of its neighbouring countries (9.1924).

Interest payments to total revenues is an important indicator for sovereign risk analysis because it indicates how much of a government's income is being used to pay interest on its debt. If a government is spending too much of its income on interest payments, it could be a sign that the government is overburdened by high levels of debt and will be unable to pay back its loans in the future. This indicator can help investors and analysts assess the financial health of a country and its ability to pay back its debt.

#### Indicator Assessment: Interest payments to expenses (5yr average)

In Brazil, the 5-year average Interest payments to expenses for 2023 is 17.1886, representing an increase over the past 5 years. Compared to its peer group, Brazil's value is significantly higher, with a peer group value of 9.6772, income peer group value of 9.0312, rating peer group value of 12.2102, and neighbouring countries value of 9.0129.

Interest payments to expenses is an important indicator for sovereign risk analysis because it provides an indication of the country’s ability to fund its debt obligations. A high ratio of interest payments to expenses indicates that the country is at risk of defaulting on its debt obligations due to its inability to generate enough revenue to cover its costs. This is a key indicator that helps to identify countries that may be at a higher risk of defaulting on their debt.

#### Indicator Assessment: Fiscal balance to GDP (5yr average)

For Brazil, the Fiscal balance to GDP (5yr average) for 2023 is -7.2892. Over the past 4 years, this value has decreased. When compared to the peer group, income peer group, rating peer group, and neighbouring countries, Brazil's value is lower than each of theirs, with the peer group value being -3.4588, income peer group value being -3.2521, rating peer group value being -4.7115, and neighbouring countries value being -5.7581.

Fiscal balance to GDP (5yr average) is an important indicator for sovereign risk analysis because it measures a country's ability to finance its government operations. It provides an indication of whether a government is able to generate enough revenue to cover its expenses, either through taxation or borrowing. A high 5-year average indicates that the government is generating sufficient revenue to cover its expenses, and is therefore less likely to default on its debt obligations. A low 5-year average suggests that the government is having difficulty generating sufficient revenue to cover its expenses, which increases the risk that it will default on its debt obligations. By analyzing the 5-year average of a country's fiscal balance to GDP, sovereign risk analysts can gain insight into the government's financial health and whether it is likely to default on its debt

#### Indicator Assessment: Government revenue to GDP (5yr average)

The 5-year average of Government revenue to GDP for Brazil in 2023 is 30.6788, which has decreased in the past 3 years. This value is higher than the peer group value of 20.7837, in line with the income peer group value of 30.2784, and greater than the rating peer group value of 22.5911 and the neighbouring countries value of 22.4644.

Government revenue to GDP (5yr average) is important for sovereign risk analysis because it indicates the government's ability to generate revenue to cover expenses and fund public programs. This indicator provides insight into the stability of the government's revenue-raising capacity, and it can give an indication of the potential for sovereign default in the future. A low ratio may indicate a government's inability to generate enough revenue to cover its expenses, which could lead to a sovereign default. Conversely, a high ratio may indicate a stable government capable of raising enough revenue to cover its expenses, reducing

### Settings

Focus area: Sovereign Risk Score

Peer countries:

- MEX

- CHL

- IDN

Peer countries (neighbours):

- BOL

- URY

- VEN

- COL