Methodology

Introduction

This document details the scope and methodology of CountryRisk.io’s framework for assessing AML country risk.

Overview

Given the significance of globalisation to trade and financial flows, it’s becoming increasingly important to identify, assess and manage money laundering and terrorist financing (ML/TF). Although national legislation, the regulatory landscape, industry-body recommendations and international enforcement continue to grow because of this need, so do more efficient ways of monitoring developments and identifying erring countries. The objective of CountryRisk.io’s AML Country Risk Scores is to classify countries according to their level of ML/TF risk. Our community members can use these classifications as part of country due diligence and as input for individual business transactions.

Risk Sections

To calculate the AML Country Risk Scores, we look at five risk sections covering a wide range of institutional risk factors relevant to ML/TF.

Money laundering

A topic as multifaceted as money laundering and terrorist financing needs equally multifaceted assessments. So, this risk section takes two broad perspectives.

First, it considers whether any widely recognised and followed institutions classify a country as having a high risk of money laundering inside its borders. To do this, we look at the International Narcotics Control Strategy’s (INCS) assessment, which identifies countries with significant money laundering issues; and the Financial Action Task Force’s (FATF) ‘black list’ (i.e. high-risk countries subject to a call for action) and ‘grey list’ (i.e. countries under increased monitoring).

Second, this section accounts for the quality of each country’s anti-money laundering efforts and enforcement. We assign risk points based on the FATF’s mutual assessments for effectiveness and technical aspects, as well as the total Financial Secrecy Score and its anti-money laundering sub-index.

Quality of institutions

A productive market economy requires a well-defined system of rules, regulatory frameworks and property rights to underpin the operational environment and mitigate risks. The rule of law fosters accountability in people, businesses, public entities and governments. However, a framework is only as good as its implementation. So, we consider a country to have strong rule of law and enforcement when it has: (i) a clear separation of powers between the legislative, judicial and executive branches; and (ii) laws and regulations that are predictable and promote fair and efficient activities between all parties involved.

Corruption

A key factor in determining the likelihood of money laundering activities in a given country is the prevalence of corruption in different segments of its economy (i.e. its private or public sector entities). Widespread corruption leads to an erosion of trust in the system and institutions, inefficient resource allocation, higher wealth inequality and lack of incentives for innovation. High incidences of bribery in the public and private sectors, along with legal corruption—in which powerful private sector entities or individuals influence the shaping of laws to protect their interests—also correlate with an increased risk of money laundering.

Transparency

Transparency is essential to preventing illicit activities and money laundering. In the AML context, transparency refers to the quality and depth of ownership and financial information disclosure by private sector companies, along with how governments and other public sector entities allocate funds.

Sanctions

Economic sanctions are a vital policy tool that governments and international organisations use to fight illegal activities, such as money laundering, terrorism financing and human rights violations. They can target sanctions at an entire country (also known as comprehensive sanctions), or towards legal entities or groups of individuals (also known as targeted sanctions). As part of our ML/TF country risk assessment, CountryRisk.io determines whether the United Nations (UN), European Union (EU), Office of Foreign Assets Control (OFAC) and Her Majesty’s Treasury (HMT) include a country on their respective sanctions lists.

Data

To calculate the AML Country Risk Score, we use 19 indicators chosen for their informational value and data availability. These indicators cover a wide range of international multilateral institutions, including the World Bank and Organisation for Economic Cooperation and Development (OECD); and special interest organisations that focus on relevant subjects, such as the World Justice Project and FATF.

| Indicator | Source | Description |

|---|---|---|

| Sanctions | UN, EU, OFAC, HMT | The sanctions indicator assesses whether a specific country is included on any of the four sanctions lists issued by the European Union, United Nations, UK and US. |

| Global Forum on Transparency and Exchange of Information for Tax Purposes | OECD | The Global Forum conducts peer reviews to assess the standard of exchange of information on request, and rates jurisdictions’ compliance with the international standard of transparency and exchange of information on request. |

| FATF country lists (black and grey lists) | FATF | The black list—referred to by the FATF as ‘Call for Action’ nations—is the standard shorthand description for the FATF’s list of ‘Non-Cooperative Countries or Territories’ (NCCTs). Issued since 2000, the black list highlights countries that the FATF judges to be non-cooperative in the global fight against money laundering and terrorist financing. Non-appearance on the blacklist was perceived to be a mark of approval for offshore financial centres (or ‘tax havens’) that are regulated well enough to meet all of the FATF’s criteria. However, in practice, the list included countries that did not operate as offshore financial centres. The FATF regularly adds and removes countries from the black list. The FATF grey list, as the media generally calls it, is now formally named the ‘Jurisdictions under Increased Monitoring’ list. |

| FATF effectiveness assessment | FATF | A country must demonstrate that, in the context of the risks to which it is exposed, it has an effective framework to protect its financial system from abuse. The assessment looks at 11 key areas or immediate outcomes to determine the effectiveness of a country’s efforts. |

| FATF technical assessment | FATF | The FATF assessment also looks at whether a country has met all the technical requirements of each of the 40 FATF Recommendations in its laws, regulations and other legal instruments to combat money laundering and the financing and proliferation of terrorism. |

| Financial Secrecy Index | Tax Justice Network | The Financial Secrecy Index ranks jurisdictions according to their secrecy and the scale of their offshore financial activities. This politically neutral index is a tool for understanding global financial secrecy, tax havens or secrecy jurisdictions, and illicit financial flows or capital flight. |

| Financial Secrecy Index: Anti-Money Laundering | Tax Justice Network | A sub-index from the overall Financial Secrecy Index that assesses anti-money laundering. |

| International Narcotics Control Strategy Report (INCSR): Major Money Laundering Jurisdictions | US State Department | The INCSR is the US Government’s two-volume country-by-country report that describes efforts to combat all aspects of the international drug trade, chemical control, money laundering and financial crime. It also lists major money laundering jurisdictions. |

| Freedom in the World | Freedom House | Freedom in the World is Freedom House’s flagship annual report that assesses the condition of political rights and civil liberties around the world. |

| Rule of Law | World Bank Worldwide Governance Indicators (WGI) | Rule of Law captures perceptions of the extent to which agents have confidence in and abide by the rules of society, with a particular focus on the quality of contract enforcement, property rights, the police and courts, as well as the likelihood of crime and violence. |

| Regulatory Quality | World Bank Worldwide Governance Indicators (WGI) | Regulatory Quality captures perceptions of the ability of governments to formulate and implement sound policies and regulations that permit and promote private sector development. |

| Financial Development Index | International Monetary Fund (IMF) | The IMF Financial Development Index assesses financial institutions’ and markets’ development in terms of their depth (size and liquidity), access (the ability of individuals and companies to access financial services) and efficiency (the ability of institutions to provide financial services at a low cost and with sustainable revenues, along with the level of activity of capital markets). |

| Rule of Law Index | World Justice Project (WJP) | The WJP Rule of Law Index presents a portrait of countries’ rule of law by assigning scores and rankings in eight areas: constraints on government powers, absence of corruption, open government, fundamental rights, order & security, regulatory enforcement and civil & criminal justice. |

| Regulatory Quality | World Justice Project (WJP) | Measures whether government regulations—such as labour, environmental, public health, commercial and consumer protection regulations—are effective and fairly enforced without improper influence. |

| Corruption Perception Index (CPI) | Transparency International | The CPI ranks countries “by their perceived levels of public sector corruption, as determined by expert assessments and opinion surveys”. The CPI generally defines corruption as “the misuse of public power for private benefit”. |

| Control of Corruption | World Bank Worldwide Governance Indicators (WGI) | Control of Corruption captures perceptions of the extent to which public power is exercised for private gain, including both petty and grand forms of corruption as well as “capture” of the state by elites and private interests. |

| Business extent of disclosure index | World Bank | The business extent of disclosure index measures the extent to which investors are protected through the disclosure of ownership and financial information. The index ranges from 0 to 10, with higher values indicating more disclosure. |

| International Development Association’s Resource Allocation Index (IRAI) | World Bank International Development Association (IDA) | The IRAI is based on the results of the IDA’s annual Country Policy and Institutional Assessment (CPIA), which evaluates the quality of a country’s present policy and institutional framework. |

| IRAI: Transparency, accountability and corruption in the public sector sub-index | World Bank International Development Association (IDA) | This criterion assesses the extent to which the executive, legislators and other high-level officials can be held accountable for their use of funds, administrative decisions and results. |

| Open Budget Index (OBI) | International Budget Partnership (IBP) | The OBI is based on the results of the the IBP’s Open Budget Survey, which assesses budget transparency based on the amount and timeliness of budget information that governments make publicly available. |

Country coverage

The underlying geographic universe of the AML Country Risk Score includes 250 countries and territories. However, different indicators have different levels of country coverage, ranging from 70 countries for the World Bank’s IDA Resource Allocation Index (IRAI) to 207 countries for the Political Stability Index. In short, some of the indicators have significant data gaps. However, accounting for the size of the economy (i.e. contribution to global GDP) for each country covered, most indicators cover around 95% of the global economy. The World Bank’s IRAI, which measures transparency, accountability and corruption in the public sector, is the clear outlier, capturing less than 10% of global GDP. Nevertheless, we include the IRAI indicator because, in focusing on frontier and developing nations, it provides valuable information for this specific group of countries.

Besides country coverage, we selected the indicators on the basis of other criteria, such as:

- Available history: Is there a long history of regular updates? This allows us to assess whether an indicator is too volatile.

- Reporting lag/latest datapoint: When was the index last updated? Will it be updated again in the future?

- Methodology changes: Is the methodology used for calculating the index revised regularly? Frequent and significant changes lead to a lack of comparability over time, while modest changes suggest that the indicator continues to be developed to reflect a changing environment.

- Basis of indicator: Is the indicator based on original (survey) data, or is it a composite of other indicators?

| Indicator | Indicator Availability (number of countries) | Indicator Availability (Share of World GDP) |

|---|---|---|

| Sanctions | 249 | 100% |

| Global Forum on Transparency and Exchange of Information for Tax Purposes | 249 | 100% |

| FATF country lists (black and grey lists) | 249 | 100% |

| FATF effectiveness assessment | 102 | 72% |

| FATF technical assessment | 102 | 72% |

| Financial Secrecy Index | 133 | 98% |

| Financial Secrecy Index: Anti-Money Laundering | 133 | 98% |

| International Narcotics Control Strategy Report (INCSR): Major Money Laundering Jurisdictions | 249 | 100% |

| Freedom in the World | 194 | 99% |

| Rule of Law | 207 | 99% |

| Regulatory Quality | 207 | 99% |

| Financial Development Index | 183 | 99% |

| Rule of Law Index (WJP) | 127 | 95% |

| Regulatory Quality (WJP) | 127 | 95% |

| Corruption Perception Index (CPI) | 179 | 99% |

| Control of Corruption | 207 | 99% |

| Business extent of disclosure index | 215 | 99% |

| International Development Association’s Resource Allocation Index (IRAI) | 70 | 2.4% |

| IRAI: Transparency, accountability and corruption in the public sector sub-index | 70 | 2.4% |

| Open Budget Index (OBI) | 116 | 92% |

As part of the index calculation, we also provide a quantitative Data Quality measure for each country. We base this measure on the number of available indicators for that country divided by the total number of indicators included in the model. The mapping table between the share of available indicators and data quality is shown below.

| Share of Available Indicators | < 20% | 20% < 40% | 40% < 60% | 60% < 80% | 80% < 100% |

|---|---|---|---|---|---|

| Data Quality Classification | Very Poor | Poor | Medium | Good | Very Good |

Countries with less than 30% of available indicators automatically receive the risk category “Not Available”.

For the model specification, it’s important to select indicators that: a) measure aspects of relevance for the overall objective; and b) have an informational value comparable to the other indicators in the model.

It is, therefore, unsurprising that the indicators exhibit a relatively high mutual correlation, as shown in the table below. For instance, the Financial Secrecy Index and the World Bank Rule of Law Index have a correlation of 0.28. Nevertheless, this correlation serves to add information and granularity, especially for higher-risk countries.

| Indicator | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sanctions | 1.00 | 0.27 | 0.23 | 0.03 | 0.02 | -0.04 | -0.05 | 0.02 | 0.43 | -0.06 | 0.38 | 0.53 | 0.30 | 0.45 | 0.38 | 0.35 | 0.36 | 0.17 | 0.36 | 0.34 |

| Global Forum on Transparency and Exchange of Information for Tax Purposes | 0.27 | 1.00 | 0.04 | 0.39 | 0.33 | 0.42 | 0.29 | -0.14 | 0.60 | 0.21 | 0.21 | 0.45 | 0.49 | 0.48 | 0.46 | 0.57 | 0.47 | 0.58 | 0.55 | 0.59 |

| FATF country lists (black and grey lists) | 0.23 | 0.04 | 1.00 | 0.02 | -0.16 | 0.05 | -0.02 | 0.11 | 0.12 | 0.00 | -0.04 | 0.21 | 0.03 | 0.09 | 0.14 | 0.07 | 0.13 | 0.09 | 0.17 | 0.15 |

| FATF effectiveness assessment | 0.03 | 0.39 | 0.02 | 1.00 | 0.87 | 0.37 | 0.63 | -0.21 | 0.41 | 0.22 | 0.28 | -0.05 | 0.45 | 0.23 | 0.32 | 0.44 | 0.29 | 0.52 | 0.38 | 0.42 |

| FATF technical assessment | 0.02 | 0.33 | -0.16 | 0.87 | 1.00 | 0.25 | 0.62 | -0.20 | 0.35 | 0.15 | 0.32 | 0.09 | 0.36 | 0.22 | 0.23 | 0.32 | 0.22 | 0.32 | 0.21 | 0.23 |

| Financial Secrecy Index | -0.04 | 0.42 | 0.05 | 0.37 | 0.25 | 1.00 | 0.41 | 0.06 | 0.37 | 0.43 | 0.21 | 0.14 | 0.52 | 0.34 | 0.28 | 0.40 | 0.25 | 0.44 | 0.43 | 0.42 |

| Financial Secrecy Index: Anti-Money Laundering | -0.05 | 0.29 | -0.02 | 0.63 | 0.62 | 0.41 | 1.00 | 0.13 | 0.41 | 0.24 | 0.05 | 0.12 | 0.55 | 0.35 | 0.42 | 0.51 | 0.38 | 0.45 | 0.47 | 0.46 |

| International Narcotics Control Strategy Report (INCSR): Major Money Laundering Jurisdictions | 0.02 | -0.14 | 0.11 | -0.21 | -0.20 | 0.06 | 0.13 | 1.00 | 0.09 | -0.07 | -0.19 | -0.17 | -0.18 | 0.03 | 0.17 | 0.03 | 0.14 | 0.00 | 0.18 | 0.11 |

| Corruption Perception Index (CPI) | 0.43 | 0.60 | 0.12 | 0.41 | 0.35 | 0.37 | 0.41 | 0.09 | 1.00 | 0.11 | 0.52 | 0.77 | 0.50 | 0.63 | 0.86 | 0.77 | 0.90 | 0.69 | 0.89 | 0.89 |

| Business extent of disclosure index | -0.06 | 0.21 | 0.00 | 0.22 | 0.15 | 0.43 | 0.24 | -0.07 | 0.11 | 1.00 | 0.17 | -0.16 | 0.32 | -0.08 | 0.00 | 0.20 | -0.01 | 0.33 | 0.16 | 0.19 |

| International Development Association’s Resource Allocation Index (IRAI) | 0.38 | 0.21 | -0.04 | 0.28 | 0.32 | 0.21 | 0.05 | -0.19 | 0.52 | 0.17 | 1.00 | 0.48 | 0.42 | 0.18 | 0.18 | 0.33 | 0.22 | 0.12 | 0.31 | 0.39 |

| IRAI: Transparency, accountability and corruption in the public sector sub-index | 0.53 | 0.45 | 0.21 | -0.05 | 0.09 | 0.14 | 0.12 | -0.17 | 0.77 | -0.16 | 0.48 | 1.00 | 0.48 | 0.69 | 0.66 | 0.46 | 0.70 | 0.22 | 0.59 | 0.52 |

| Open Budget Index (OBI) | 0.30 | 0.49 | 0.03 | 0.45 | 0.36 | 0.52 | 0.55 | -0.18 | 0.50 | 0.32 | 0.42 | 0.48 | 1.00 | 0.59 | 0.50 | 0.64 | 0.46 | 0.50 | 0.53 | 0.52 |

| Freedom in the World | 0.45 | 0.48 | 0.09 | 0.23 | 0.22 | 0.34 | 0.35 | 0.03 | 0.63 | -0.08 | 0.18 | 0.69 | 0.59 | 1.00 | 0.62 | 0.55 | 0.59 | 0.40 | 0.68 | 0.59 |

| Rule of Law | 0.38 | 0.46 | 0.14 | 0.32 | 0.23 | 0.28 | 0.42 | 0.17 | 0.86 | 0.00 | 0.18 | 0.66 | 0.50 | 0.62 | 1.00 | 0.84 | 0.91 | 0.71 | 0.89 | 0.88 |

| Regulatory Quality | 0.35 | 0.57 | 0.07 | 0.44 | 0.32 | 0.40 | 0.51 | 0.03 | 0.77 | 0.20 | 0.33 | 0.46 | 0.64 | 0.55 | 0.84 | 1.00 | 0.78 | 0.74 | 0.85 | 0.84 |

| Control of Corruption | 0.36 | 0.47 | 0.13 | 0.29 | 0.22 | 0.25 | 0.38 | 0.14 | 0.90 | -0.01 | 0.22 | 0.70 | 0.46 | 0.59 | 0.91 | 0.78 | 1.00 | 0.65 | 0.90 | 0.87 |

| Financial Development Index | 0.17 | 0.58 | 0.09 | 0.52 | 0.32 | 0.44 | 0.45 | 0.00 | 0.69 | 0.33 | 0.12 | 0.22 | 0.50 | 0.40 | 0.71 | 0.74 | 0.65 | 1.00 | 0.70 | 0.74 |

| Rule of Law Index (WJP) | 0.36 | 0.55 | 0.17 | 0.38 | 0.21 | 0.43 | 0.47 | 0.18 | 0.89 | 0.16 | 0.31 | 0.59 | 0.53 | 0.68 | 0.89 | 0.85 | 0.90 | 0.70 | 1.00 | 0.92 |

| Regulatory Quality (WJP) | 0.34 | 0.59 | 0.15 | 0.42 | 0.23 | 0.42 | 0.46 | 0.11 | 0.89 | 0.19 | 0.39 | 0.52 | 0.52 | 0.59 | 0.88 | 0.84 | 0.87 | 0.74 | 0.92 | 1.00/th> |

Methodology

CountryRisk.io uses a purely quantitative approach to measuring ML/TF risk at a country level.

Statistical models use quantitative methods to establish relationships between certain factors—for example, the rule of law—and the strength of information security in each country. Such models are less prone to bias than purely qualitative methods, which makes them useful in terms of tractability of results and consistency over time. That said, we also understand that statistical models are vulnerable to biases that can influence the process of selecting, specifying and calibrating the model. Furthermore, some indicators reflect the subjective assessments of survey participants, although the large number of respondents significantly mitigates the adverse impact of that subjectivity.

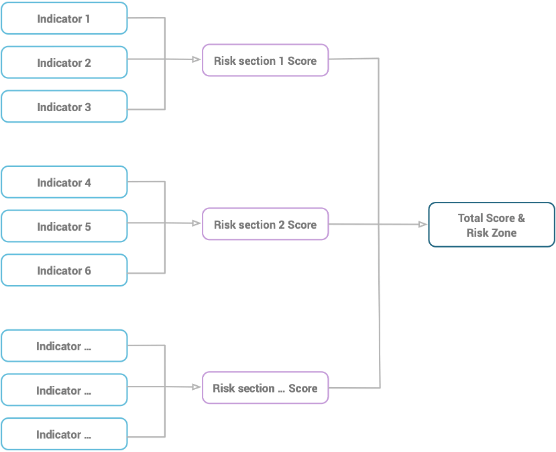

The AML Country Risk Index uses five risk sections to derive each country’s overall risk score: (1) Sanctions, (2) Money laundering, (3) Corruption, (4) Institutions and (5) Transparency. Each risk section includes several quantitative indicator assessments, each of which is given equal weight, to yield an initial risk section score. We then aggregate the five risk sections—which are weighted to reflect their relative importance—to produce an overall risk score, which we finally map to the risk zone classification.

Figure 1 shows a schematic of this process.

The respective weights of each risk section are as follows:

| Risk Section | Section Weight |

|---|---|

| Money laundering | 50% |

| Corruption | 20% |

| Institutional quality | 5% |

| Transparency | 5% |

| Sanctions | 20% |

Where no underlying indicators are available for a particular risk section, we distribute its weight between the other sections on a pro-rata basis to avoid the attendant risk of creating a downward bias in the overall risk assessment.

The table below shows an example where we have assumed that no data is available for the “Corruption” risk section. Here, the 20% weight of that section is proportionately redistributed. As a result, the weight of the “Sanctions” risk section increases from 20% to 25%, “Money Laundering” from 50% to 62.5%, and “Institutions” and “Transparency” from 5% to 6.25%.

| Risk Section | Section Weight | Indicators Available | Adjusted Section Weight |

|---|---|---|---|

| Money laundering | 50% | Yes | 62.5% |

| Corruption | 20% | No | N.A. |

| Institutional quality | 5% | Yes | 6.25% |

| Transparency | 5% | Yes | 6.25% |

| Sanctions | 20% | Yes | 25% |

Quantitative assessment of indicators

We assess quantitative indicators by assigning values along a risk spectrum ranging from low to high. The risk spectrum is divided into several intervals and risk points are assigned to each interval. For example, higher quality of institutions and governance, such as the rule of law, indicates a greater likelihood that contracts can be enforced through the legal system. Therefore, in our framework, countries with a weaker rule of law receive more risk points than those with a stronger rule of law (see Table 7). For instance, where a country has a Rule of Law indicator rating of 25, we would assign it a score of 100 out of 100 risk points.

| Rule of Law | 0 < 40 | 40 < 50 | 50 < 60 | 60 < 70 | 70 < 80 | 80 < 100 |

|---|---|---|---|---|---|---|

| Risk points | 100 | 80 | 60 | 40 | 20 | 0 |

Similarly, we assign risk points to the detailed FATF assessments where they are related to the level of compliance or effectiveness in specific areas.

| FATF Technical Assessment | Compliant | Largely Compliant | Partially Compliant | Non Compliant | Not Available |

|---|---|---|---|---|---|

| Risk points | 0 | 25 | 50 | 100 | 100 |

For example, if a country is rated as “Largely Compliant” for the “Transparency and beneficial ownership of legal persons” sub-index, we assign 25 out of a maximum of 100 risk points (see Table 8 above). We average the risk points across the respective sub-indices of the FATF’s effectiveness and technical assessments. We also apply the same methodology to similar types of indicators, such as the FATF black & grey lists and INCRS listings.

Translating total risk points into risk categories

We convert each country’s total risk points as a share of maximum possible risk points into five category ratings ranging from “Very Low” to “Very High” risk of money laundering. For instance, if the indicator assessments and their respective risk sections yield a total risk score of 35% (out of 100%), we map this score to the risk category of “Medium”. Table 9 summarises how we convert total risk points into a risk category. We also visually represent these ratings using a traffic light system with colours ranging from deep red to green.

It is important to note that there is no wholly objective way of determining the thresholds for each risk category. By and large, these are subjective decisions that should align with the organisation’s risk appetite. Classifying too many countries as “Very High Risk” would lead to highly restricted business activities, while classifying too many as “Very Low Risk” would lead to un-provisioned risk in the business’s portfolio.

| Risk Points Range | Risk Category | Interpretation |

|---|---|---|

| 0 - 20 | Very Low | Very low risk of money laundering and terrorism financing. Robust regulatory framework, low levels of corruption and implementation of best practices and industry body guidelines. |

| 20 - 30 | Low | Low risk of money laundering and terrorism financing activities. Some shortcomings in terms of regulatory framework or short track record of implementing prudent AML guidelines. |

| 30 - 40 | Medium | Some money laundering and terrorism financing activities due to lack of quality institutions. |

| 40 - 50 | High | High risk of money laundering activities or terrorism financing. Prevalent corruption in private and public sector and/or widespread organised crime. |

| 50 - 100 | Very High | Very high risk of money laundering and terrorism financing activities due to widespread corruption, poor institutions and lack of enforcement resources. |

Where less than 30% of all indicators are available, we classify the country as “Very High” risk.

Guidance for overruling

Community members conducting AML country risk assessments might want to adjust and overrule quantitative risk classifications for various reasons that lie outside of CountryRisk.io’s scope and control. Such reasons might include, for example:

- Close to threshold: If the AML country risk score is close to a risk category threshold value (e.g. “High Risk”), the community member might decide to overrule and adjust the final risk category.

- Country-specific developments not yet reflected in data: In the case of a sharply deteriorating domestic environment, the underlying data used in the index might not yet reflect that deterioration. Here, the community member might decide to override the risk zone classification; for instance, when news emerges about a significant money laundering incident in a specific country.

- Business reasons: A business might decide to override the risk category for commercial reasons specific to that business.

Governance process

- Update frequency: We update our AML Country Risk Index and publish it on the CountryRisk.io Insights Platform towards the end of each month. In addition, we update the data on an ad hoc basis whenever substantial new information becomes available.

- Model review and adjustments: CountryRisk.io strives to continuously improve its methodology, such as by incorporating new high-quality indicators as and when they become available. CountryRisk.io also consults external experts to review the model and any adjustments we make to it. We will reflect any changes in future versions of this methodology document.