Zambia’s default was a long time in the making

Bernhard Obenhuber

Oct 22, 2020

Covid-19 has left a trail of destruction across the global financial system and now looks as if it has triggered Africa’s first default during the pandemic. Earlier this month, Zambia skipped a $42.5 million interest payment to private creditors, effectively defaulting. While Zambia has been the first nation to approach the cliff edge, it is not alone. According to the IMF, over a third of African nations are either in debt distress or are approaching it, including some of the continent’s economic stars such as Ghana or Ethiopia.

For analysts and investors closely following Zambia’s plight, the nation’s default does not come as a surprise. The IMF’s annual Article IV bilateral consultation last year highlighted a myriad of economic risks facing the country. Its government’s development strategy focused on rapidly scaling up public investment to address infrastructure needs, resulting in a heavy reliance on non-concessional debt. With a rising interest rate, total public and publicly-guaranteed debt including arrears was 78% of GDP by the end of 2018. The debt service combined with higher imports saw the current account deficit widen to 2.6% of GDP in 2018. Perhaps most tellingly, Zambia’s external debt had increased sevenfold over the last 10 years. But with foreign exchange reserves dwindling, Zambia’s external financing requirement as a percentage of FX reserves for 2020 amounted to nearly 85% (using figures from the 2019 IMF Article IV Report) — which clearly puts the country in a very unstable position given the high concentration of its export products on just very few items — thus limiting its sources for foreign exchange reserves.

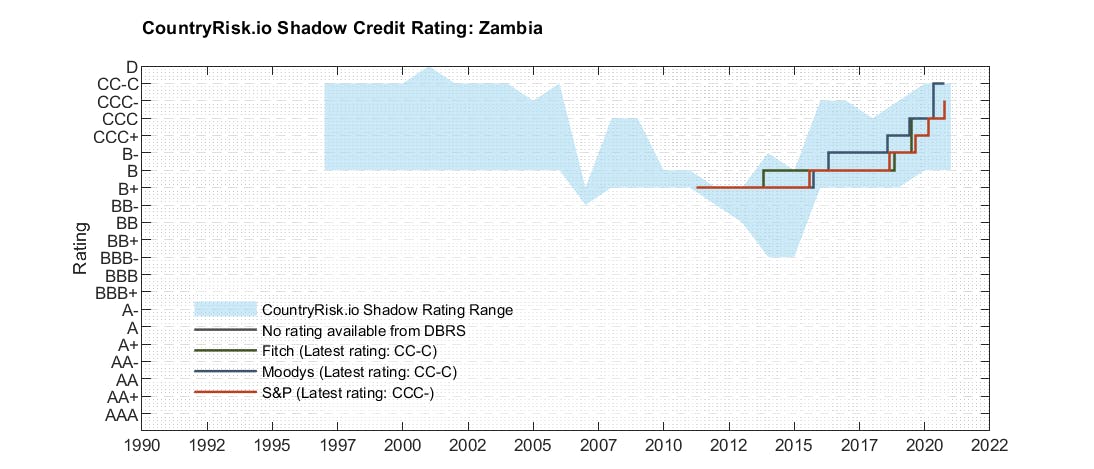

This heightened debt vulnerability combined with a lengthy drought and lagging growth had left Zambia in a precarious position. The charts below accurately depicted the likelihood of Zambia defaulting. CountryRisk.io’s shadow ratings for both the standard sovereign and ESG sovereign ratings* have hovered around the “CCC” level since 2018, and by February 2019, the rating agencies have slowly converged on CountryRisk.io’s shadow ratings. Clearly, both the level and range over time have been pointing toward a high probability of default.

Certainly, the IMF did warn that significant policy adjustments were needed immediately by Zambia to correct its many imbalances. However, given the fact that structural changes need time to take root, the clock was ticking, and it was only a matter of time before Zambia missed an interest payment.

Would an interest holiday improve Zambia’s SDG progress?

This week, a group of investors postponed voting until November 13 on Zambia’s request to delay $120 million in interest payments on its Eurobonds for six months. In the meantime, the question must be pondered whether an interest holiday could improve the nation’s progress in achieving its Sustainable Development Goals (SDG) targets. It seems unlikely, given the country’s macroeconomic imbalances are so abundant, tackling which would take priority as a first course of action for the government before focusing on extending basic social services, such as improving education, access to arable land, and reducing poverty and inequality.

Zambia’s default could have a ripple effect for other African nations suffering from debt distress compounded by the pandemic. The pandemic risks becoming a protracted debt crisis for developing nations, while putting achievement of the SDGs beyond reach and putting a decade of progress reducing poverty in jeopardy.

In Zambia’s case, investors are prepared to provide debt relief, but only as part of a comprehensive effort by all creditors and with the IMF’s endorsement. The talks are now being watched closely by other developing countries on the brink of default, and fixed-income investors do worry where the next potential default may be.

* CountryRisk.io’s sovereign risk scores can be viewed on https://www.countryrisk.io/. For API access, please contact us on [email protected].