The Second Wave: The Impact Of Covid-19 On Sovereign Ratings

Bernhard Obenhuber

Jun 08, 2020

The COVID-19 pandemic has caused immense pain to many people and economies across the world. The impact on our health, communities and daily lives has been immediate and profound. But while the effect on sovereign ratings might be just as extensive, it may take longer to show up on our screens and in our news feeds. At CountryRisk.io, we have tried to model some of these effects across a number of key economies. As we outline below, the results could be dramatic — even for countries with fundamentally strong economies.

Whatever it takes versus whatever is possible

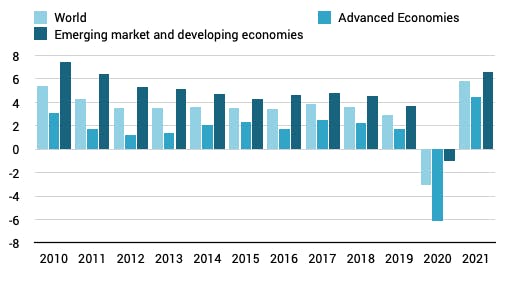

Most governments and international organisations acted swiftly to deliver significant fiscal and monetary stimuli to mitigate the economic fallout of the pandemic. These programmes dwarf the rescue packages that followed the 2008 financial crisis, which underscores the even more severe burden to aggregate demand. While we require the strong and unwavering commitment of all governments, the capacity to deliver financial interventions is highly variable. Those countries with an already high burden of debt can only do so much without risking their solvency. As a consequence, more than 100 countries have asked the IMF for emergency support — an unprecedented number.

Downgrades ahead

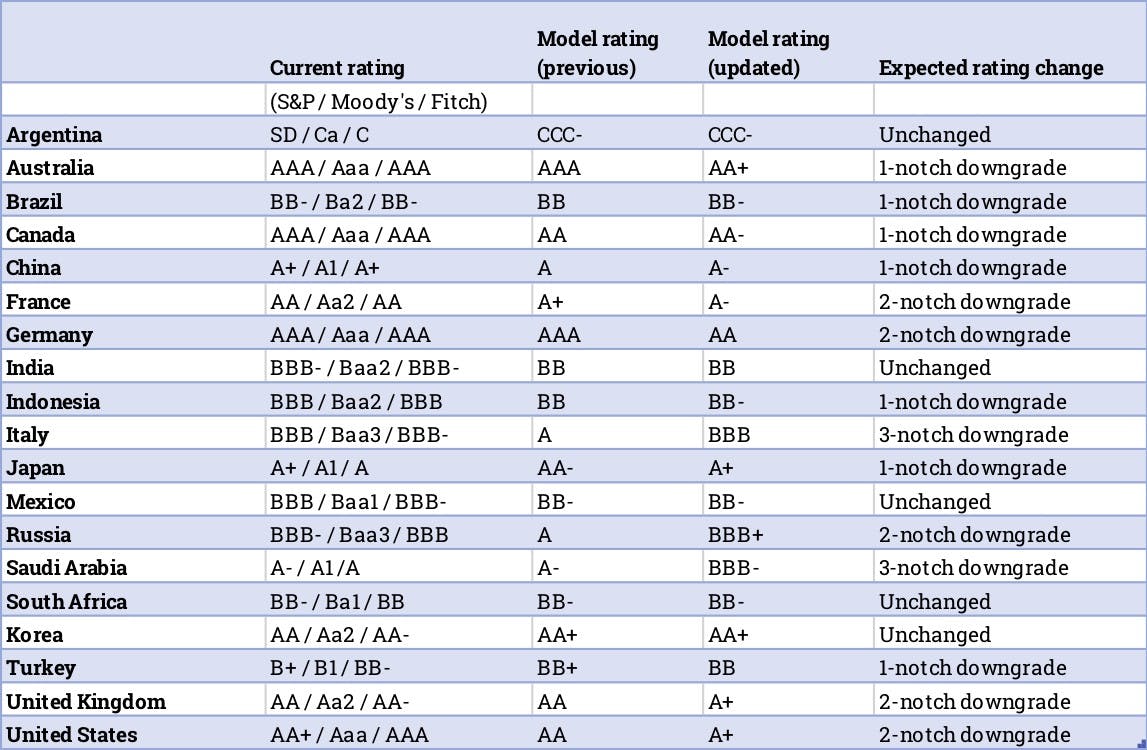

As corporate bankruptcies continue to climb, so do unemployment rates and calls for governments to offer more support. Accordingly, the question of sovereign rating downgrades has become more salient. At CountryRisk.io, we have investigated the COVID-19 pandemic’s impact on sovereign ratings to determine how they could change based on the deteriorating outlook.

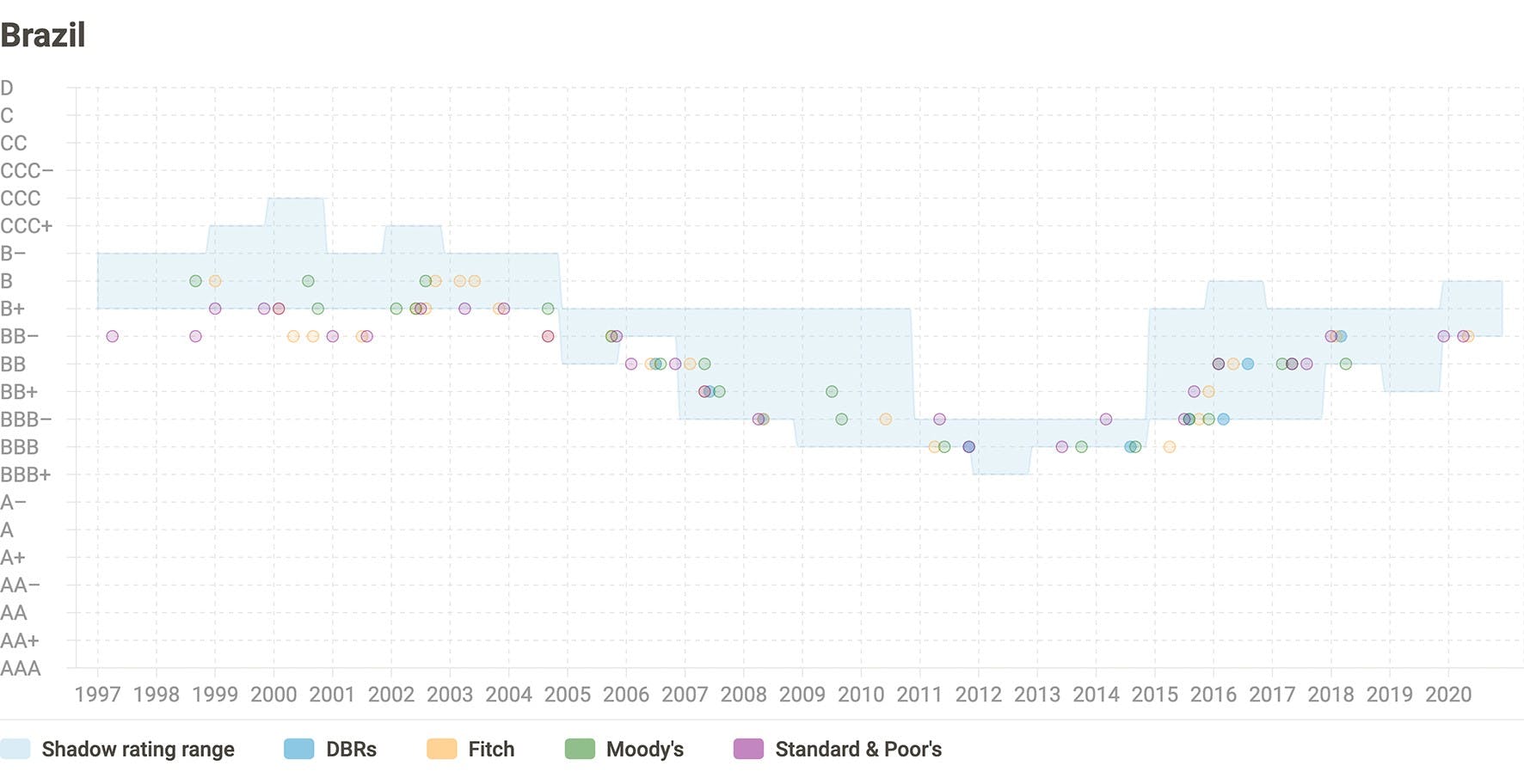

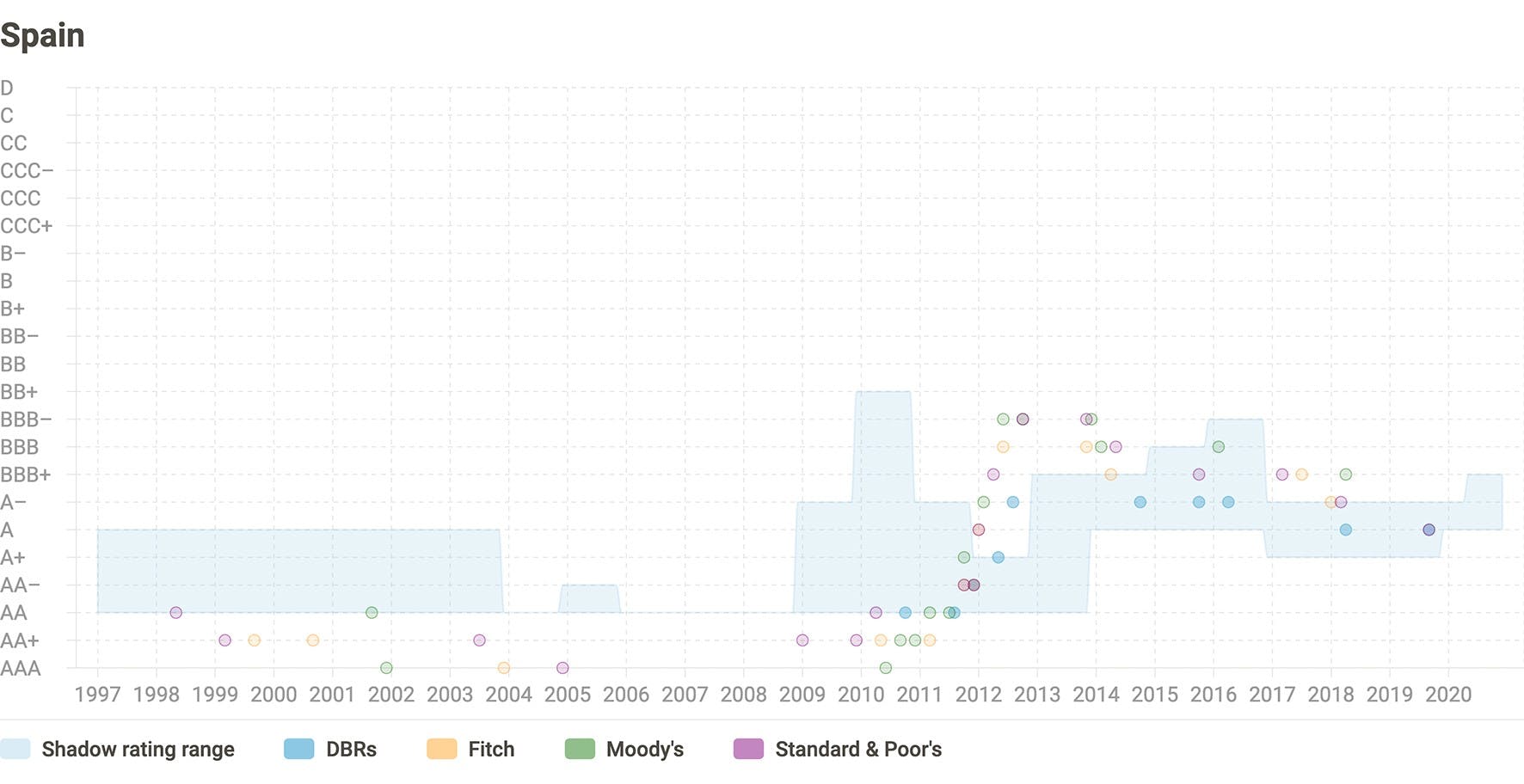

In sum, we found that many countries could see their ratings lowered by up to three notches, with even those countries that have strong fundamentals potentially seeing a one-notch downgrade. From a debt sustainability perspective, the key drivers are: the initial condition (i.e. debt as a share of GDP); new debt creation as a result of widening fiscal deficits; outright economic contractions for many, if not significant downward revisions in real GDP growth; and the interest rates to be paid on debt.

If rating agencies take a through-the-cycle position and assume a V-shaped recovery (or a “swoosh”-shaped recovery in the US), the number of actual downgrades could be low. However, should the deterioration prove to be sharper and more protracted than presently assumed, the pressure to downgrade may yet materialise.

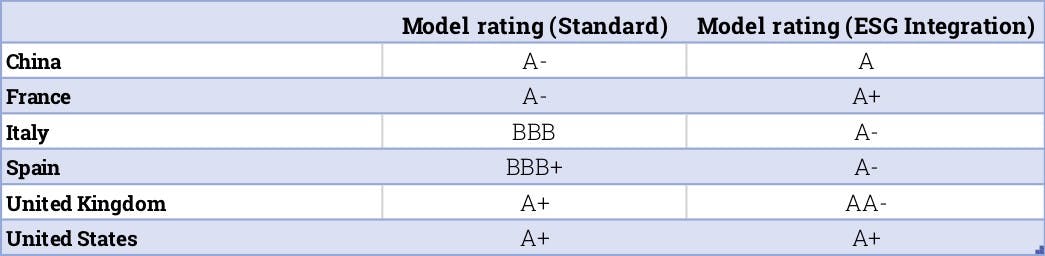

The “S” in ESG sovereign risk analysis

How would the picture change if we were to account for Environmental, Social and Governance, or ESG, factors in our sovereign ratings? CountryRisk.io has long advocated for this practice. And doing so has some surprising consequences, as the ratings of some countries improve or deteriorate when compared to their standard sovereign ratings (i.e., with no environmental or social factors included). Overall, we believe that including ESG factors creates better granularity in country and sovereign risk assessments.

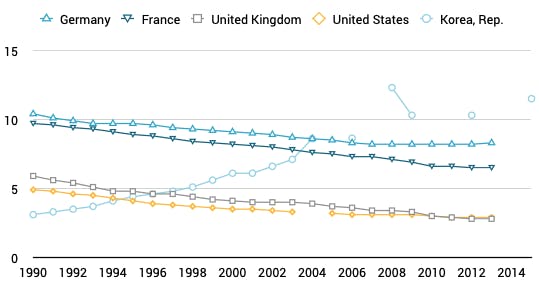

Not all economic crises are created alike. And this time, it really is different. Few investors — kudos to Bill Gates — had a pandemic on their radar. A crisis of this nature demands an increased focus on the “S”, which means looking at the strength and quality of a country’s healthcare system (e.g. number of intensive care beds), population health (e.g. prevalence of heart conditions) and overall capacity to deal with a crisis. An explanation for why and how an advanced economy such as the UK could end up surpassing the number of virus-related deaths per capita relative to its European peers may include factors related to an overall lack of pandemic preparedness in its healthcare system (see Chart 2).

Quantitative models and community expertise

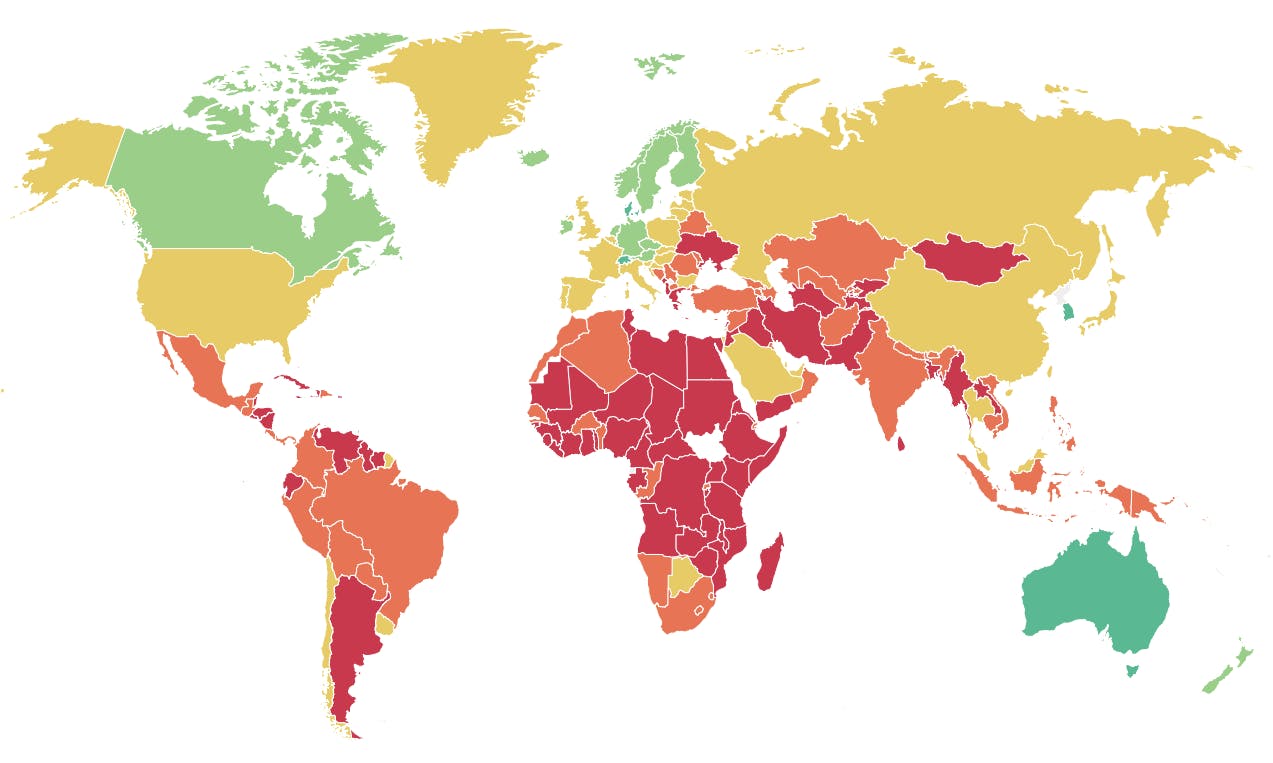

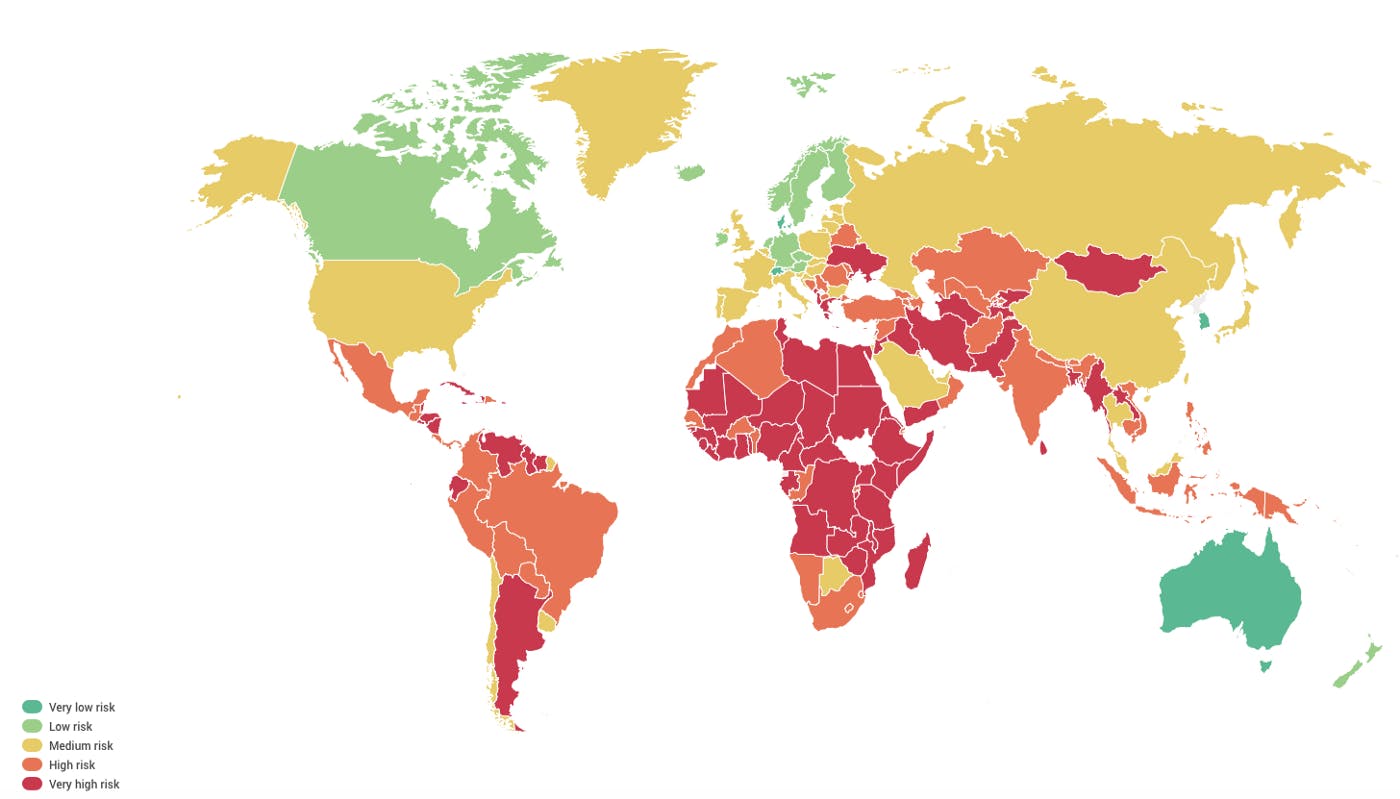

CountryRisk.io has developed a range of quantitative models that efficiently monitor 190 countries. Our sovereign risk scores account for a wide range of key macroeconomic variables and rank countries by level of credit risk. This visual summarises our current assessment:

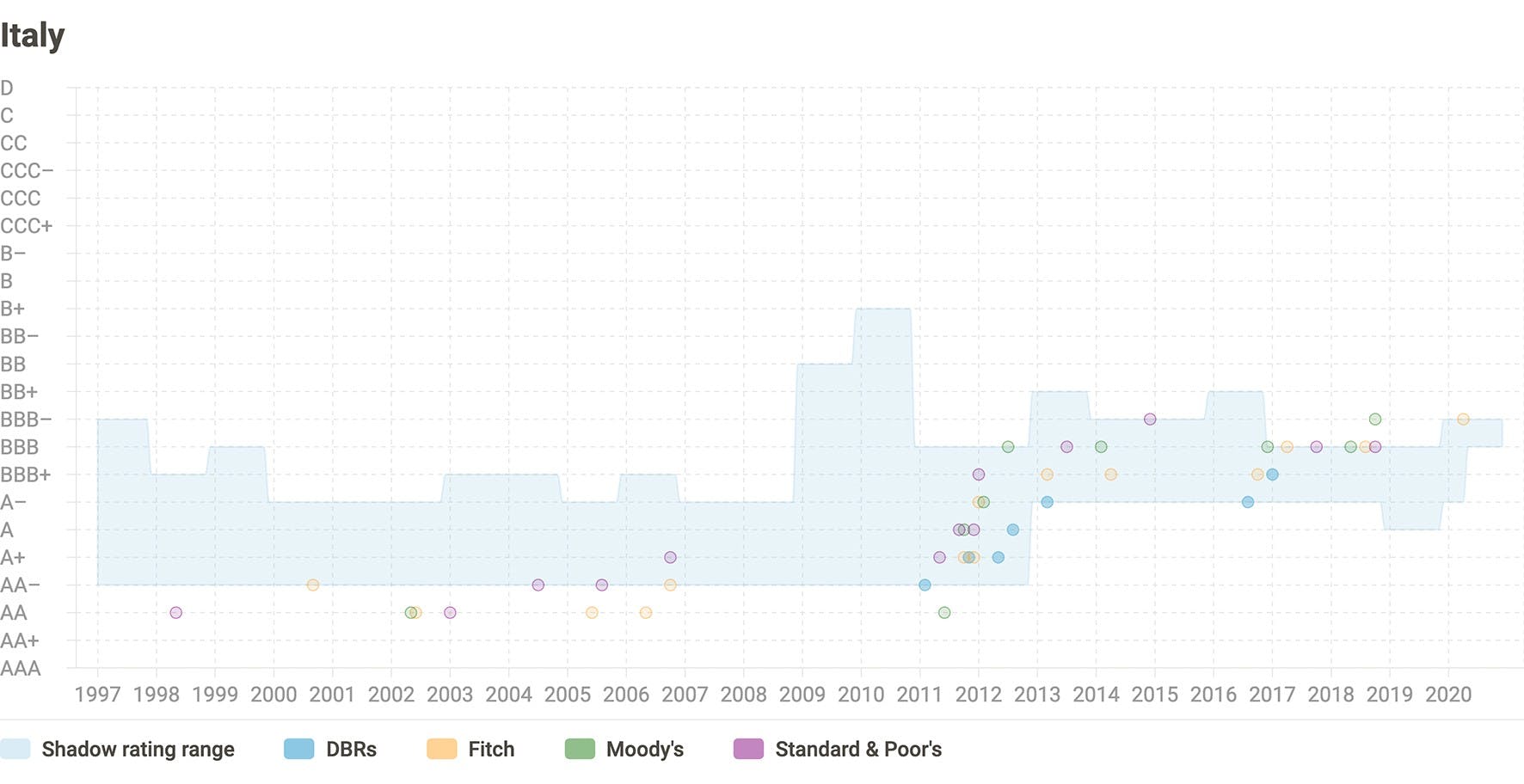

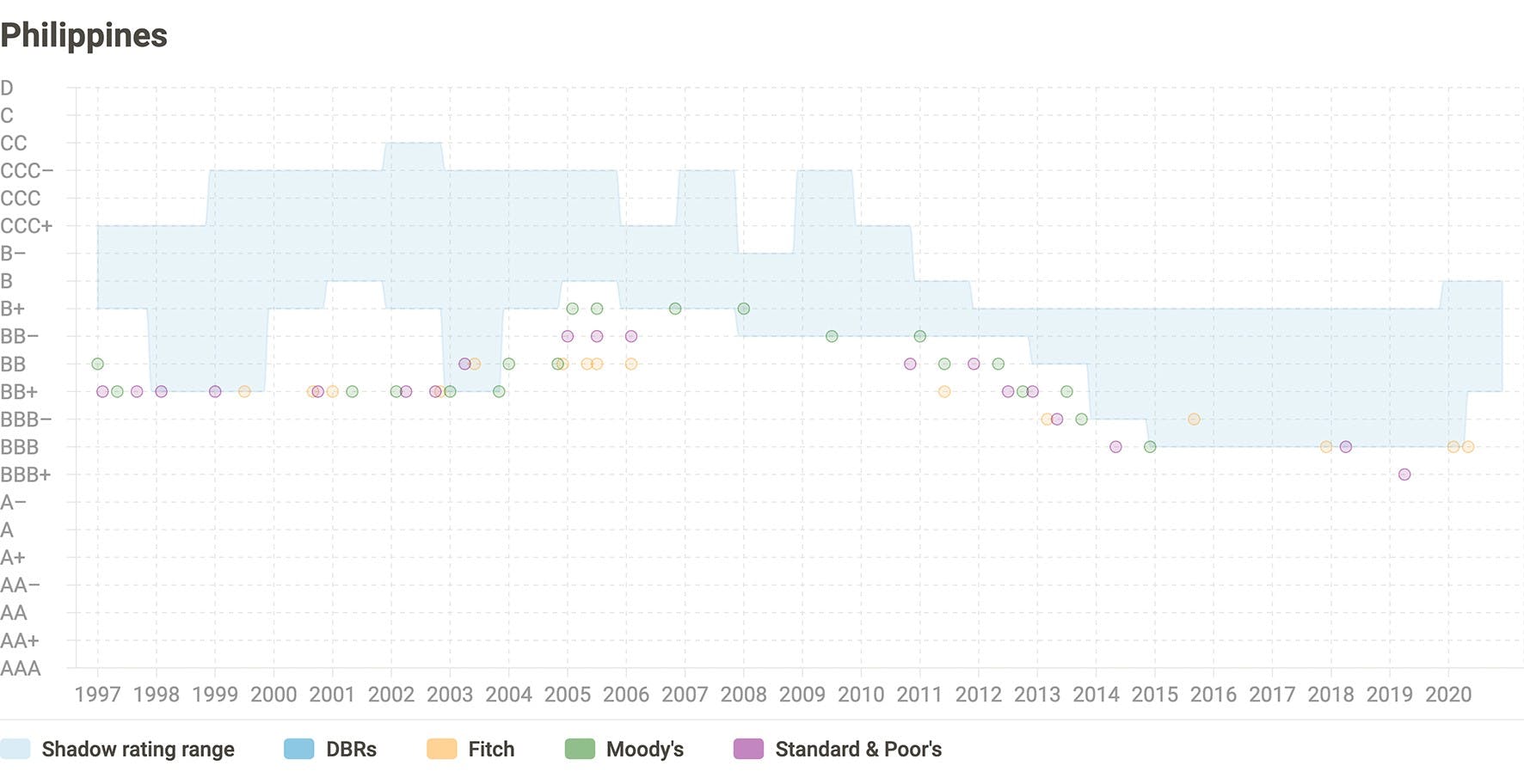

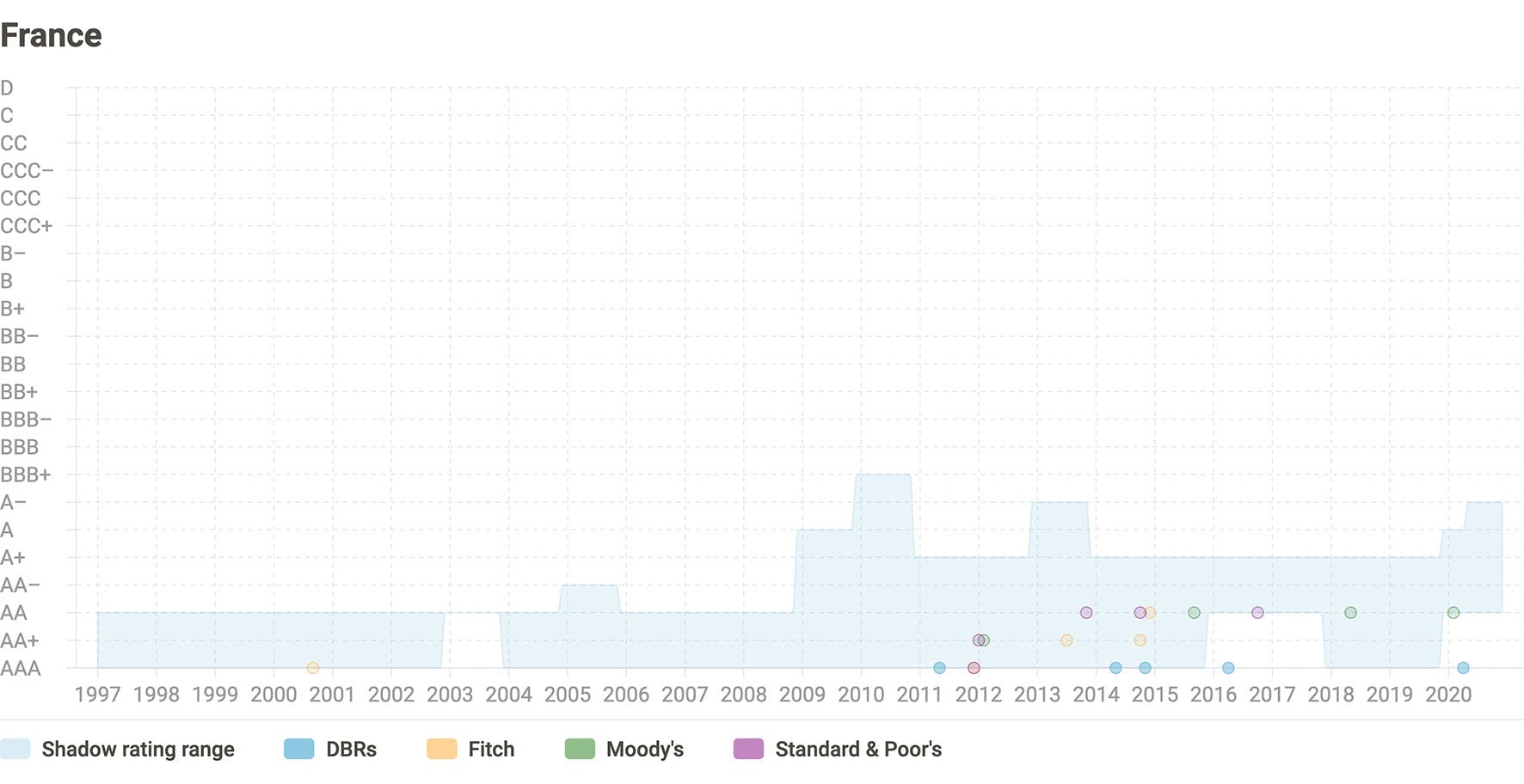

In addition, we also run several fundamentals-based sovereign credit models that help us to spot countries likely to face down- or upward rating pressures, thereby providing us with a heads-up on rating trends. We call these heads-ups Shadow Ratings, and you can find a selection of country charts below. While quant models are efficient and certainly useful, we firmly believe there is no perfect model. Thus, it’s helpful to consider a selection of suitable models, and so we have included a range of model-implied ratings in our charts.

Our years of experience in analysing country and sovereign risks have taught us that not all relevant risk factors can be quantified. Therefore, the knowledge and nuanced expertise of an experienced analyst around country-specific contexts and non-linear relationships is a vital element of a comprehensive country risk assessment.

CountryRisk.io’s platform enables community members to conduct their own due diligence, as well as to compare and exchange views among the community.

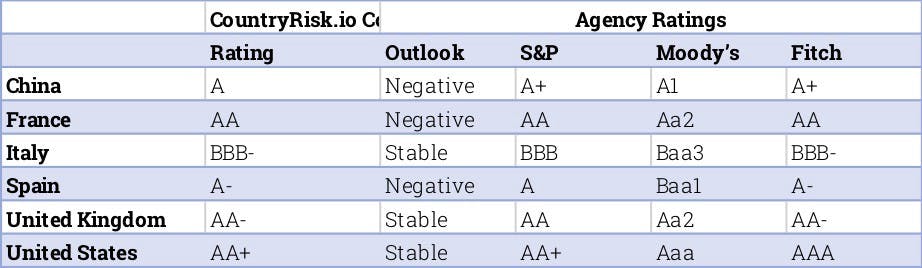

Some recent CountryRisk.io community ratings are included in the table below.

Become part of the CountryRisk.io community

No one analyst has a monopoly on wisdom. Join the debate and help shape the community view. Come to CountryRisk.io, do your own ratings on the platform and see how they compare to those in this report. Or, why not begin a rating on other countries for the community? To get started, visit CountryRisk.io and join the community.

About CountryRisk.io

Developed by a team of experienced country risk analysts, data scientists and developers, the CountryRisk.io Insights Platform helps organisations make better country risk decisions. The platform offers a comprehensive and transparent country risk assessment framework; quantitative models that integrate Environmental, Social and Governance factors; and a wide range of ESG and macro-economic data, reports and newsfeeds. CountryRisk.io also provides quantitative risk scores for ESG sovereign credit risk and anti-money laundering country risks via an API, as well as bespoke country risk solutions.

Our platform encourages a constructive exchange of analyses and ideas among those who use it. As members of the community ourselves, we collectively generate multiple rating views for a given country based on each individual’s fundamental analysis.