The Challenge of Our Time

CO2 emissions and how to reflect in country risk analysis?

Bernhard Obenhuber

Sep 13, 2018

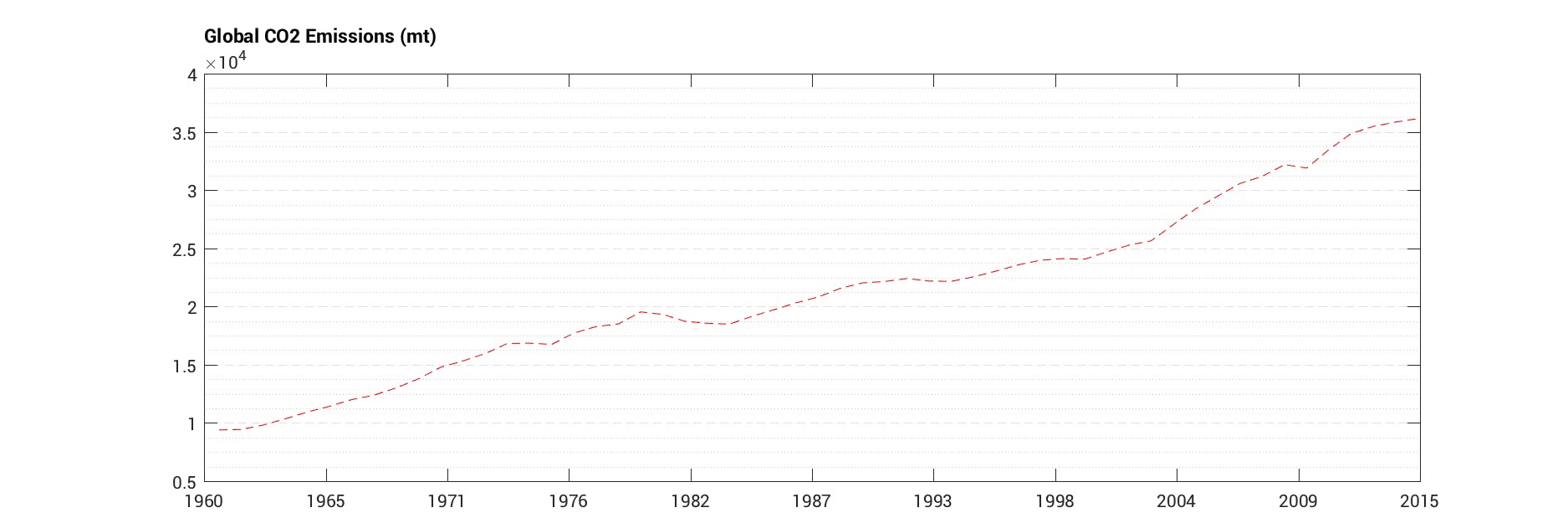

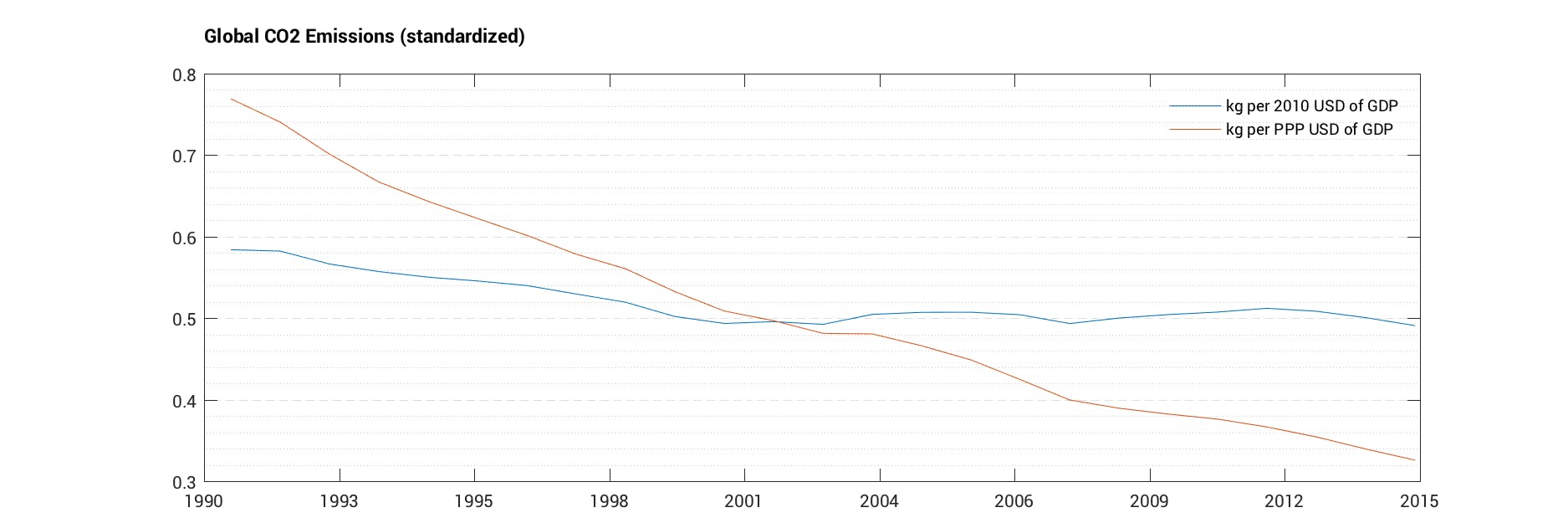

CO2 emissions and its consequences for our climate are one of the key challenges of our society today and in many years to come. Based on the latest data point, we have collectively emitted more than 36m kilotons. And the global CO2 emissions continue to increase. The only recent small dent in the chart occurred during the financial crisis of 2008. Do we need a recession or depression to contain emissions? Admittedly, the chart does not tell if we have become at least a bit more efficient when it comes to the use of energy. When we put emissions in relation to economic output (measured as GDP in USD), we might say all good as we have become massively more efficient (according to this measure) over the past decades. We can even go a step further and look at it from a purchasing power adjusted perspective that shows an even stronger improvement. So, all is good and let’s hope that technological progress will come to the rescue.

… But not so fast, since the last two ways to standardize have some limitations. Is economic output measured as GDP really the relevant denominator here? If we have to spend more money going forward on fixing the devastating consequences of climate change such as flooding or droughts, GDP would increase without much added welfare to the society. In addition, our planet’s bio capacity does not really care whether we are becoming more efficient. At one point, enough is enough. So, reducing CO2 emissions directly is the only way to go about it. Nevertheless, for a cross-country comparison and ranking we need some form of standardization.

SDG Goal 13: Climate Action

The importance of climate change is also reflected in the Sustainable Development Goal #13: Climate Action and the related targets and indicators that measure progress towards a sustainable future.

“Climate change presents the single biggest threat to development, and its widespread, unprecedented impacts disproportionately burden the poorest and most vulnerable. Urgent action to combat climate change and minimize its disruptions is integral to the successful implementation of the Sustainable Development Goals.”

Source: Report of the Secretary-General, “Progress towards the Sustainable Development Goals”, E/2016/75

Mobilizing public and private capital through the “Green Climate Fund” is considered key to address the challenges. As part of the SDG #13, USD 100bn annually should be invested into the fund that supports projects to limit greenhouse gas emissions and improve the adaptive capacity of countries.

Besides directly supporting specific projects, capital markets can also have a strong indirect impact. At CountryRisk.io, we focus on sovereign debt which, with roughly USD 60tn, is one of the largest asset classes. Hence, portfolio managers make daily judgements about countries that should receive capital and for which cost. By integrating how a country performs in achieving the SDG #13 and rewarding it for good performance, more capital at lower cost can be the result. The large lever provides strong incentive to implement government policies towards achieving SDG 13 and lowering CO2 emissions. The CountryRisk.io ESG sovereign ratings provide a way to integrate ESG risk factors — including CO2 emissions — into sovereign credit ratings.

How and what to measure

Conceptually, it is not so clear what CO2 emissions mean in the context of sovereign ratings and how we make should CO2 emissions comparable across countries. There are three broad approaches:

- Emissions caused by government entities(e.g. public administration, military, etc.) only. The first approach is the most immediate measure of a government’s emissions and allows the best comparison with the private sector. However, it is very difficult to define its scope, is difficult to compare across countries, and it ignores a government’s responsibility and ability to shape legislation. Nevertheless, the Dutch initiative “Platform Carbon Accounting Financials” gave it a try and released data for The Netherlands that can be found in the report here. http://carbonaccountingfinancials.com

- Production-based approach: All emissions produced within the national borders regardless of where the final products or services are consumed. This is also described as a territorial scope and is widely followed as it is defined by the Intergovernmental Panel on Climate Change (IPCC). However, the problem with this approach is obvious: countries can improve the emission performance by moving economic activities with high emissions to other countries with typically weaker environmental standards. This is called “carbon leakage”, and has been a common practice in the last decades of “wealthier” countries to developing and emerging countries.

- Consumption-based approach: All emissions that are consumed within the countries. This excludes emissions that are exported to other countries but include emissions that are imported. This approach is widely considered as the best and “fair” approach as it follows the “polluter-pays-principle”. However, it is also easy to see the complexities of the approach. One does not only need good data where the emissions occur but whole detailed information about global trade flows and value chains to pinpoint where the final consumption takes place.

At CountryRisk.io, we focus on the last two approaches because of relatively better data availability and better cross-country comparisons. Our preferred source for production- and consumption-based emission data on a country level is the Eora global supply chain database which can be found here (http://worldmrio.com), or the Environmental Footprint Explorers by the Norwegian NTNU (https://environmentalfootprints.org).

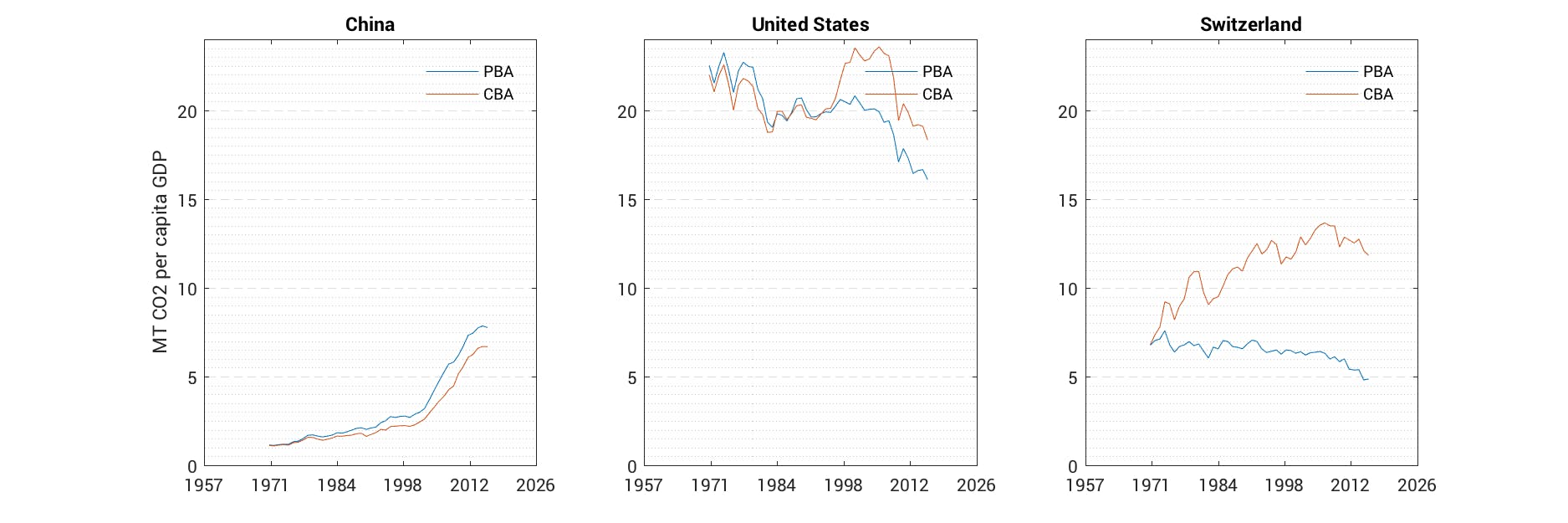

The charts above depict the developments of CO2 emissions in Switzerland, United States and China. It shows emissions in metric tons per capita GDP from 1970 to 2015.

- The dramatic increase of CO2 emissions in China is obvious but the level — on a consumption basis — is still well below in comparison to the US or Switzerland.

- Switzerland and the US are outsourcing emissions to other countries as the production-based numbers are below the consumption-based numbers. The contrary holds for China.

- The US has become less emission-intense in the last decades but the overall level remains high.

- Switzerland has significantly lowered its territorial emissions but has caused emissions more substantially when viewed from a consumption-based approach. This can be explained as Switzerland exports higher-valued products to the world and imports resource- or emission-intense products. The same is true for many other developed countries such as Sweden.

An ideal country would show following developments:

- Declining CO2 emissions based on the territorial and consumption-based approach, and ultimately converging to zero emissions when considered on a net basis taking into account the country’s ability to absorb CO2. This is the most important factor.

- Narrow gap between production- and consumption-based approaches as a gap indicates that either countries are outsourcing emissions or countries are using weaker environmental standards as a competitive advantage.

- Government policies can effectively only steer the territorial emissions through taxes or technical requirements (e.g. filters). If the gap between consumption-based and production-based approaches is widening, it might also indicate that companies are looking to circumvent strict domestic regulation through lax foreign regulation.

Data challenges

Data availability and quality are as always key issues in the area of ESG risk factors. While huge improvements have been made in recent years, thanks to the push of the Sustainable Development Goals and their statistical targets, significant gaps in terms of relevant data exists. This is especially the case for data on the consumption-based emissions approach that requires complex calculations and assumptions.

CO2 emissions in the CountryRisk.io ESG rating model

In the CountryRisk.io ESG Rating Platform, a country’s performance in terms of emission is an important factor within the “Environmental” risk section. We approach the challenge described above in following way. We have quantitative indicators that cover the:

- CO2 emissions on a production and consumption basis (relative to economic production and per capita GDP)

- Country’s natural ability to absorb CO2. While there is a lack of incentives in many countries to maintain or grow standing forests as a way to absorb CO2, this is likely to be seen as an asset in the future.

- Land use emissions

In addition, we guide the user through various qualitative assessments that give a more nuanced view on the topic of CO2 emissions:

- Government policies and willingness to reduce CO2 emissions

- Ratified treaties in the area of CO2 emissions

- Dependency of a country’s economy on emission-intense sectors to assess the transition risks to a low carbon economy

- Quality of national emission data and requirements of private sector to report emissions

As part of the “Environmental” risk score, several other aspects are covered in the CountryRisk.io ESG rating platform that we will discuss in future articles.

- General health of the environment

- Dependency of the economy on natural resources

- Material footprint

- Renewable energy

- Exposure to natural disasters

Community and crowd intelligence approach

The community approach of CountryRisk.io also allows a constructive exchange of opinions on the topic of emissions and climate change in more general. Collectively, the CountryRisk.io community generates intelligence by pooling different views. We also take the position that the topic is too complex and manifold to say with certainty that there is only one approach to address it.

Secondly, the complexity must not prevent the financial community from ignoring the subject completely. With CountryRisk.io we offer a readily available platform and statistics to get started with solid ESG sovereign and country risk ratings.

To access the ESG sovereign risk platform and conduct your own analysis, please sign up on (esg.countryrisk.io).

Written by the co-founders of CountryRisk.io Bernhard Obenhuber and Jenny Asuncion

About CountryRisk.io

CountryRisk.io was started on the basic premise that we can improve the quality of sovereign risk ratings by making the analysis framework publicly available, and by aggregating the ratings for a specific country across many users. We are convinced that a crowd-sourced approach provides the community with a lot more valuable information, which is virtually lacking today.