Taking nature into account: CountryRisk.io goes ESG

Bernhard Obenhuber

Aug 24, 2018

When I was 16 years old, I found the book “Limits to growth” in my father’s library and I was hooked by the topic, not least for the potential element of doom and gloom. This reading then led me to “Taking nature into account” by Wouter van Dieren, which highlights the necessary adjustments to the calculation of GDP in order to use it as a welfare measurement.

Many moons later I decided to study economics, during which time I took some classes in environmental economics. As my LinkedIn career profile shows, though, I got a bit side tracked, but the topic itself and related areas, such as sustainable investing, have remained a deep, personal interest. While sustainability has experienced peaks and troughs in the hype cycle, it looks to have gained some traction and breadth of late, capturing the attention of international organisations (UNEP Finance: www.unepfi.org), and private sector corporations and financial institutions.

So, it was with considerable pleasure when we started working on a version of the CountryRisk.io risk rating platform, which explicitly takes Environmental Social Governance factors into account to derive a sovereign and country risk rating. In this update, I want to share the current development and invite everyone to join and contribute to the ESG CountryRisk.io community (sign up here: esg.countryrisk.io/registration).

ESG meets sovereign and country risk ratings

CountryRisk.io provides an independent, transparent and comprehensive sovereign and country risk-rating platform to the public. The outcome of the platform framework is a standard letter rating that summarizes the ability and willingness of the sovereign borrower to repay its foreign and local debt obligations. And in the case of country risk, it is an assessment of transfer risk (i.e. introduction of capital controls, moratorium,…).

The ESG version of CountryRisk.io shares the same objective and variables will be selected and calibrated towards this goal. One could develop alternative versions with a different focus, such as a rating of the quality of life (www.oecdbetterlifeindex.org) or economic growth potential, which looks at a country from the perspective of an equity investor rather than the downside risk-centred approach of a credit investor. Our focus is the sovereign credit risk.

Fundamental factors why countries succeed or fail

When we started designing the ESG CountryRisk.io platform, we took a step back and asked ourselves: What are the most fundamental factors that influence credit risk? Or to put it more broadly: why do some countries succeed while others fail? Daron Acemoglu (en.wikipedia.org/wiki/Daron_Acemoğlu) wrote about this in his book “Why nations fail”, and also discussed it in this interesting panel (cgeg.sipa.columbia.edu/events-calendar/why-nations-succeed-social-economic-and-legal-building-blocks-success).

“Economic institutions matter for economic growth because they shape incentives. They do not only determine the aggregate economic growth potential of the economy, but also the distribution of resources. Similarly, political institutions determine the constraints on and the incentives of key actors, but this time in the political sphere.” Daron Acemoglu

We will focus on five major building blocs:

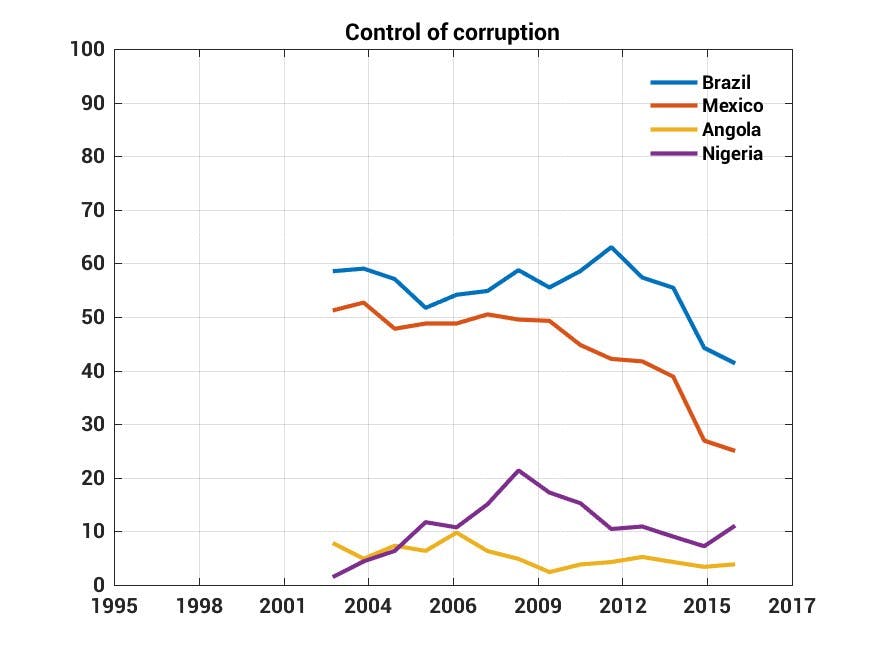

- Economic and political institutions: Development economics 101 proposes that a fully-functioning economy and society need to have a set of rules that are known, understood and enforced. On the most basic level this includes the legal framework, rule of law and property rights. But it also encompasses the quality of social safety nets that allow individuals to take advantage of opportunities and spread risks across society. Checks and balances also need to be in place to measure government effectiveness and create accountability. The chart below shows the control of corruption in various countries where higher values indicate lower corruption.

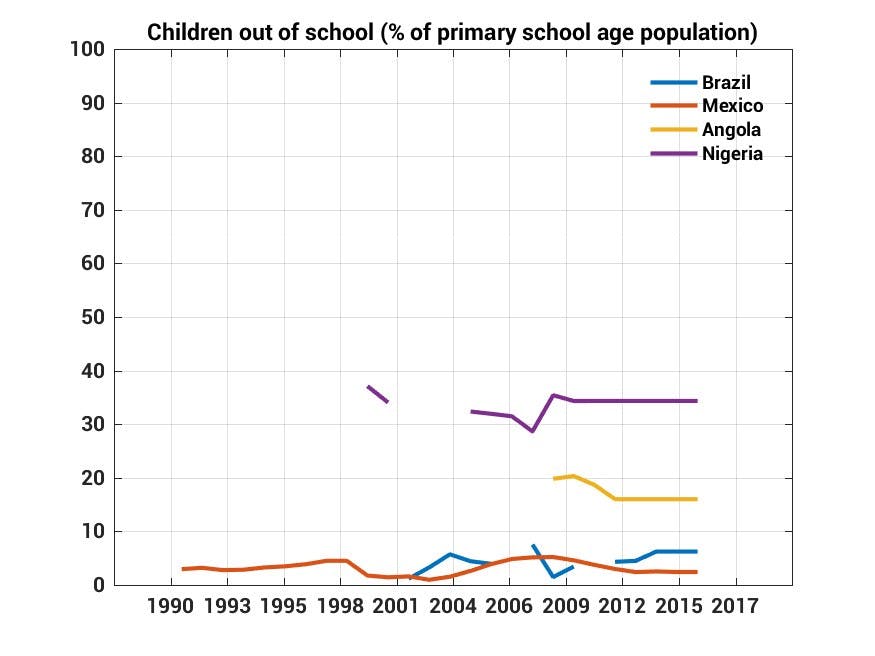

- Education system: A key task of the government is to provide education to its citizens; ranging from schools and universities, apprenticeship programs, basic research and development. Education spurs the level of human capital available, but the quality of education is equally critical to allow citizens to switch between professions, as structural changes require. Education also tends to be an important factor for social cohesion. Learning is a life-long activity that will be facilitated by new technologies and has the huge potential to reduce the risk that parts of society are left behind. One indicator to measure the quality of the education system is the share of children not attending school that is shown below.

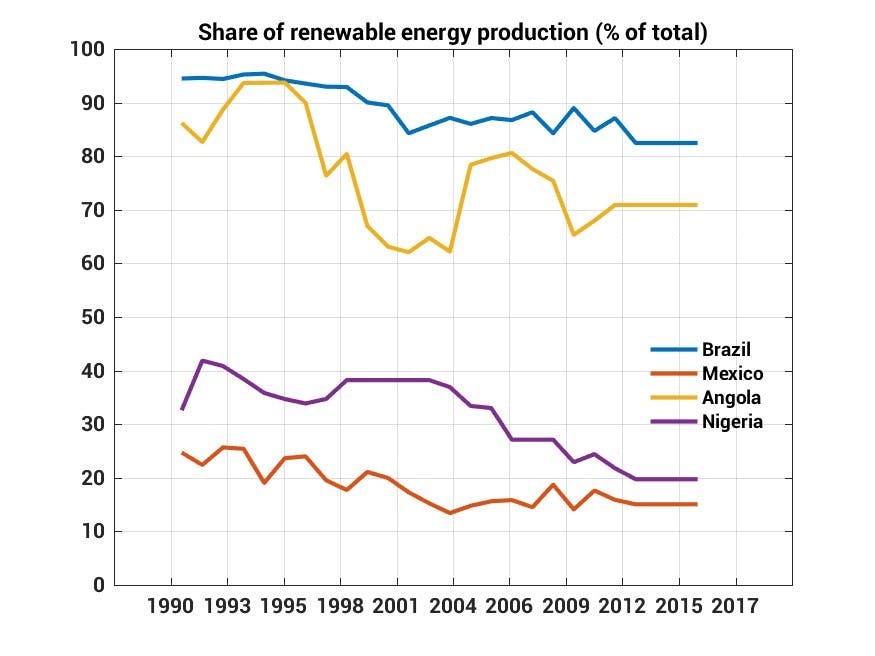

- Environment: Within the context of sovereign credit risk, environment is typically considered as an input factor for production or as asset of the sovereign that could be (implicitly) used as collateral for debt obligations. While it is important to capture a country’s endowment of natural resources and assess whether there is governance process around it, the costs of environmental degradation (e.g. air quality in cities, overfishing,…) and disasters (droughts, flooding, nuclear accidents,…) should also be incorporated explicitly in the risk assessment.

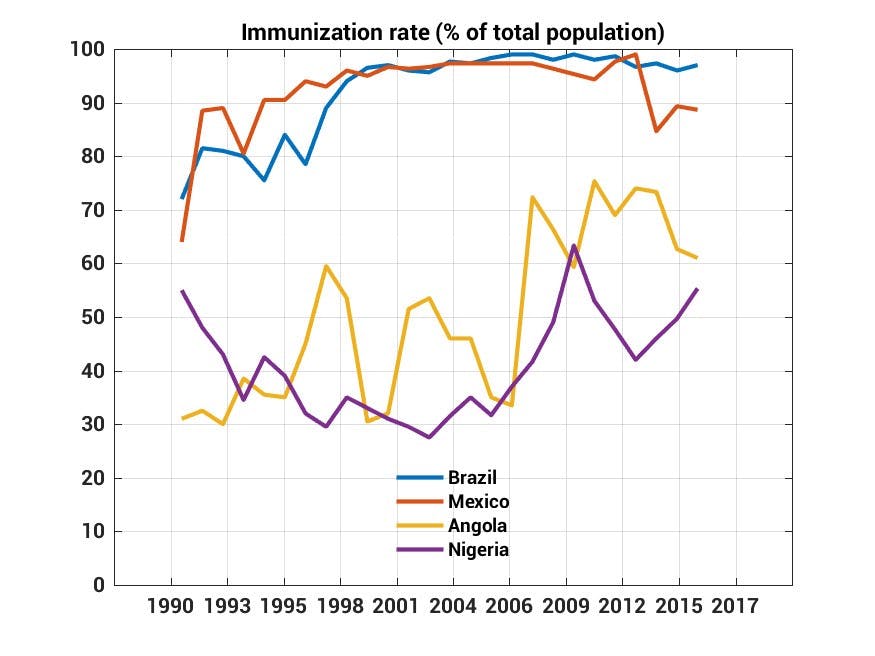

- Health: Ultimately, the factors listed above will have an influence on the quality of health of the population, duly reflected in an increasing life expectancy. Relevant indicators for calculating the health risk score include among others the immunization rate (see illustration below), access to clean water and sanitation, or the impact of air pollution on health.

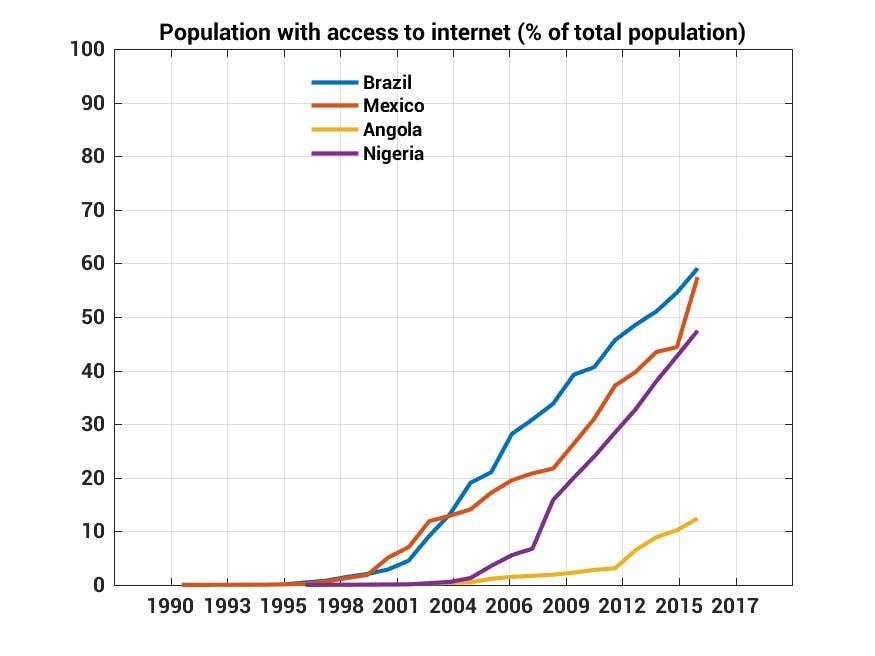

- Inclusion and equality: An economy can only thrive if each citizen has the ability to take part in society and economic process in a fair and equal manner. This is clearly a fuzzy statement that needs to be broken down further. Firstly, inclusion means to us the ability to access not only education and health care, but also the banking system, formal labour market and the democratic processes such as elections. Secondly, equality means to us creating a level playing field for everyone and removing any discrimination. The illustration below shows the share of population with access to internet.

United Nations Sustainability Goals

The five sections above can be mapped into the 17 Sustainable Development Goals defined by the United Nations. The growing focus of international organisations in sustainable development also implies improving access to statistical data, which has progressed markedly in recent years. While there are still many gaps, such as data quality and timing of release, the progress in recent years is nonetheless encouraging. For example, the statistics division of the United Nations (unstats.un.org/sdgs/) provides the data that can be conveniently accessed through an API (www.sdmx.org/?page_id=4643).

The 169 sub-targets of the UN SDG and their related indicators guided us when constructing the ESG CountryRisk.io rating model. The UN list of indicators can be found here: unstats.un.org/sdgs/indicators/indicators-list/

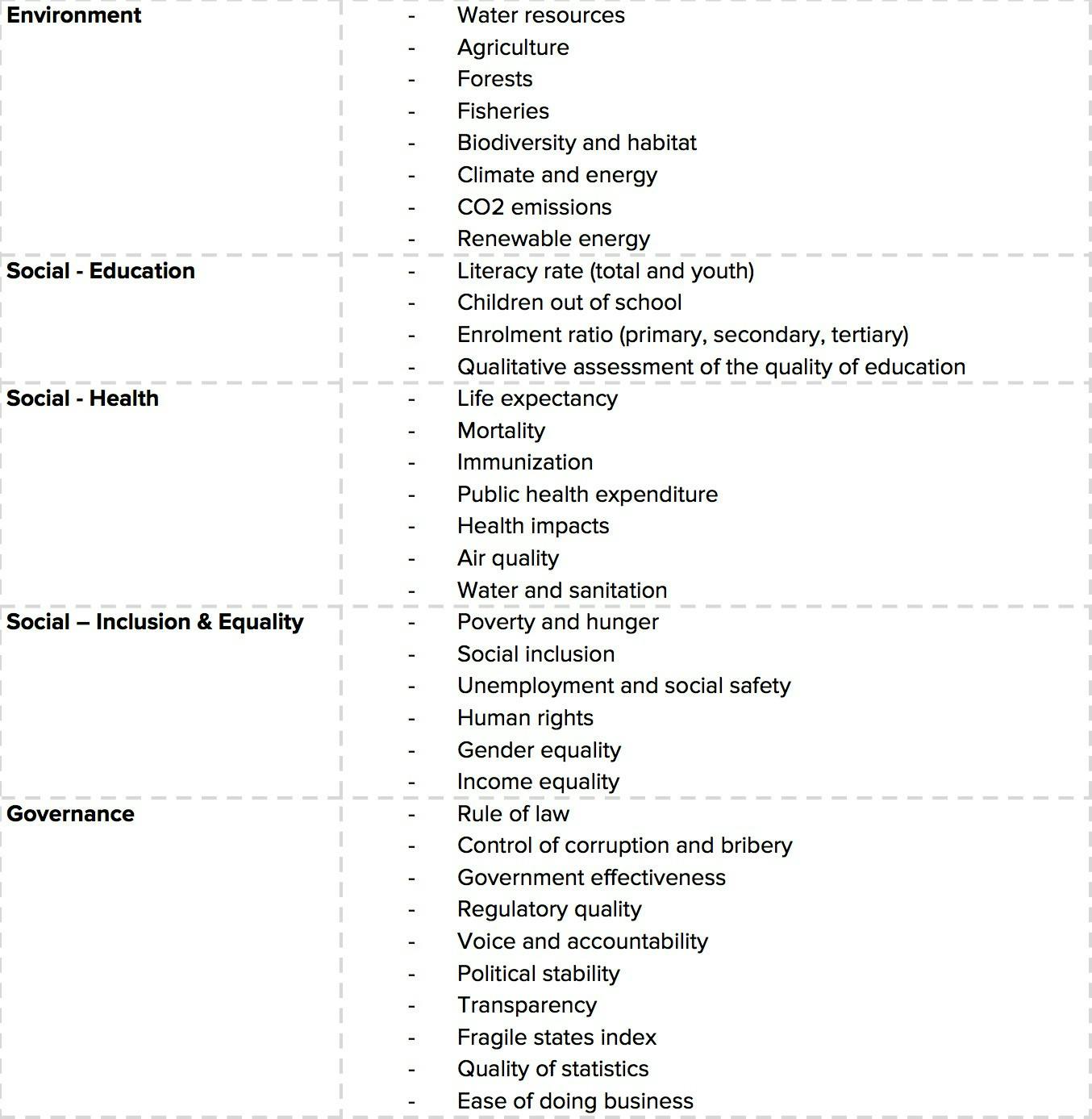

The following indicators are included in the ESG CountryRisk.io rating model.

One can surely imagine many additional aspects for a complete ESG assessment. However, data quality and availability limits the use of many indicators. We plan to regularly update the ESG model and potentially add new indicators if and when data availability improves.

The ESG CountryRisk.io platform hosts datasets for more than 150 countries, each covering over 300 indicators dating back to many years. The datasets for all countries can be downloaded here: www.bit.ly/ESG_CountryRisk_datasets

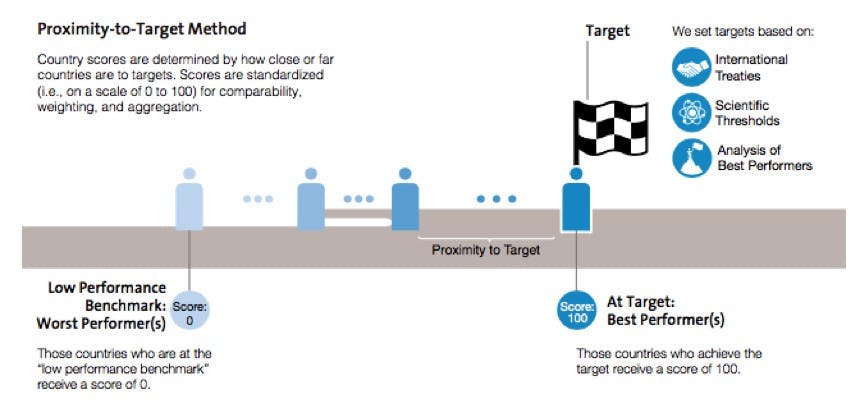

The traditional risk sections of the CountryRisk.io, which ranges from economic growth prospects, monetary stability, and banking sector to fiscal and public debt sustainability, complement the ESG-sections. In terms of methodology, we follow our standard scoring-based approach, which incorporates quantitative and qualitative factors. Each indicator is assessed on a stand-alone basis and receives a risk score similar to the “proximity-to-target” method that is neatly illustrated by Yale Center for Environmental Law & Policy (http://epi.yale.edu/) for calculating the Environmental Performance Index.

ESG risk factors in the context of debt sustainability factors

As the objective of the rating model is to derive an assessment of the sovereign credit risk, we can also look at the ESG indicators in the context of debt sustainability model. The key determinants of debt sustainability are: net wealth (i.e. debt minus public assets), new debt creation or primary deficit, nominal economic growth, inflation and the cost of servicing debt.

- Net wealth: Environmental resources are an enviable source of wealth.

- Primary deficit: Environmental disasters can lead to substantial costs for the government (e.g. Fukushima) that will weigh on the fiscal account and lead to higher debt levels. At the same time, environmental pollution leads to higher health care costs and lower government revenues.

- Economic growth: Capital growth and productivity are the key drivers of economic growth. Many of the ESG factors capture human capital and productivity (e.g. education).

- Debt servicing cost: The cost of debt is a function of the factors listed above. Nevertheless, governance indicators (e.g. rule of law) are important determinants of the risk premium. Investors will demand a higher compensation for extending money to a country if the institutional framework is weak, ceteris paribus of the factors mentioned above.

Let’s bring it all together: results

Let’s take a look at the results and see which countries rank highest and lowest when traditional and ESG risk factors are considered.

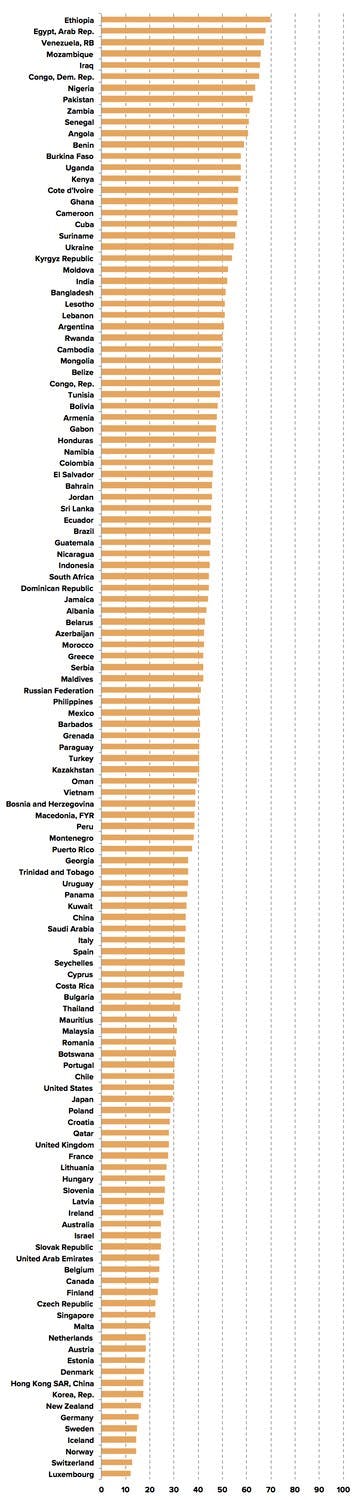

The chart below shows the ranking of 129 countries. Lower values indicate lower risk to default on foreign-currency sovereign bond obligations. The ranking is based on the combination of standard economic and financial country risk factors and ESG factors. The combined weight of ESG factors is 20%. It is important to note here that the presented results are based on quantitative factors only and do not take into account qualitative factors or adjustment factors that are equally important elements of the ESG CountryRisk.io model.

The top ranked country with the lowest risk is Luxembourg, closely followed by Switzerland. On the other end of the spectrum is Ethiopia, followed by Egypt. Looking at the results more closely, there is some variation among the top/worst ranked countries when only economic & financial factors — the traditional country risk indicators — are considered in contrast to the ranking based on ESG factors only and the overall ranking.

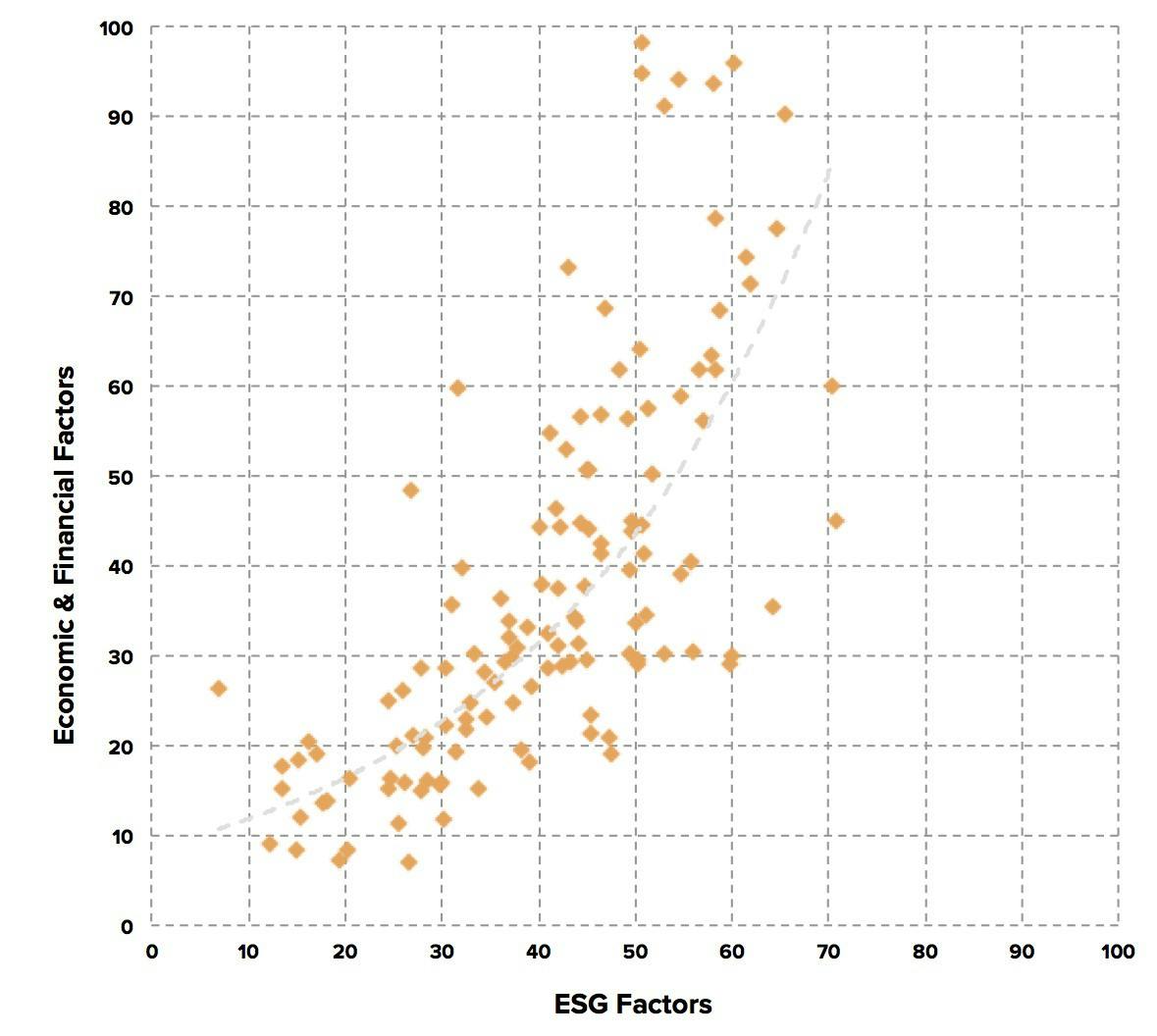

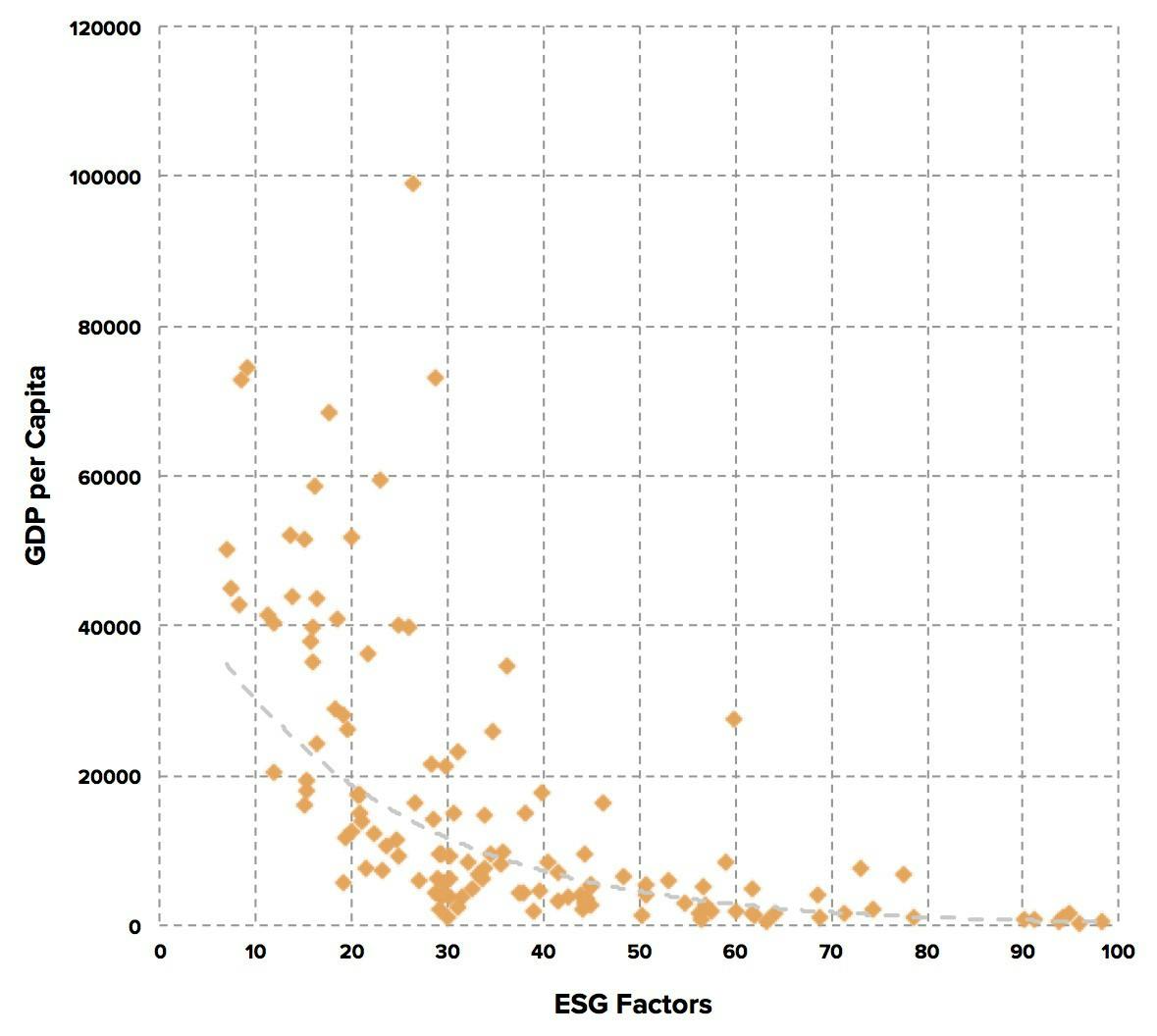

Nevertheless, there is a strong correlation between traditional and ESG factors as illustrated in the chart below. The chart is based on the 2017 ranking data as used in the previous charts. Countries with lower ESG risks (i.e. healthier environment, stronger social system, education and governance) on average also have lower economic and financial risks. This should not come as a big surprise. The same also holds when ESG risk factor is compared to a measure of wealth such as GDP per capita.

For a given level of economic & financial risk, there can be dispersion among countries regarding ESG risk. Hence the ESG factors bring better granularity than only looking at the standard factors. We find this especially valuable in the case of higher risk countries where ESG factors give a more comprehensive picture of risk drivers. In addition, for countries that are typically referred to as “least developed countries”, the role of ESG factors such as health, education and governance becomes even more essential for future economic development.

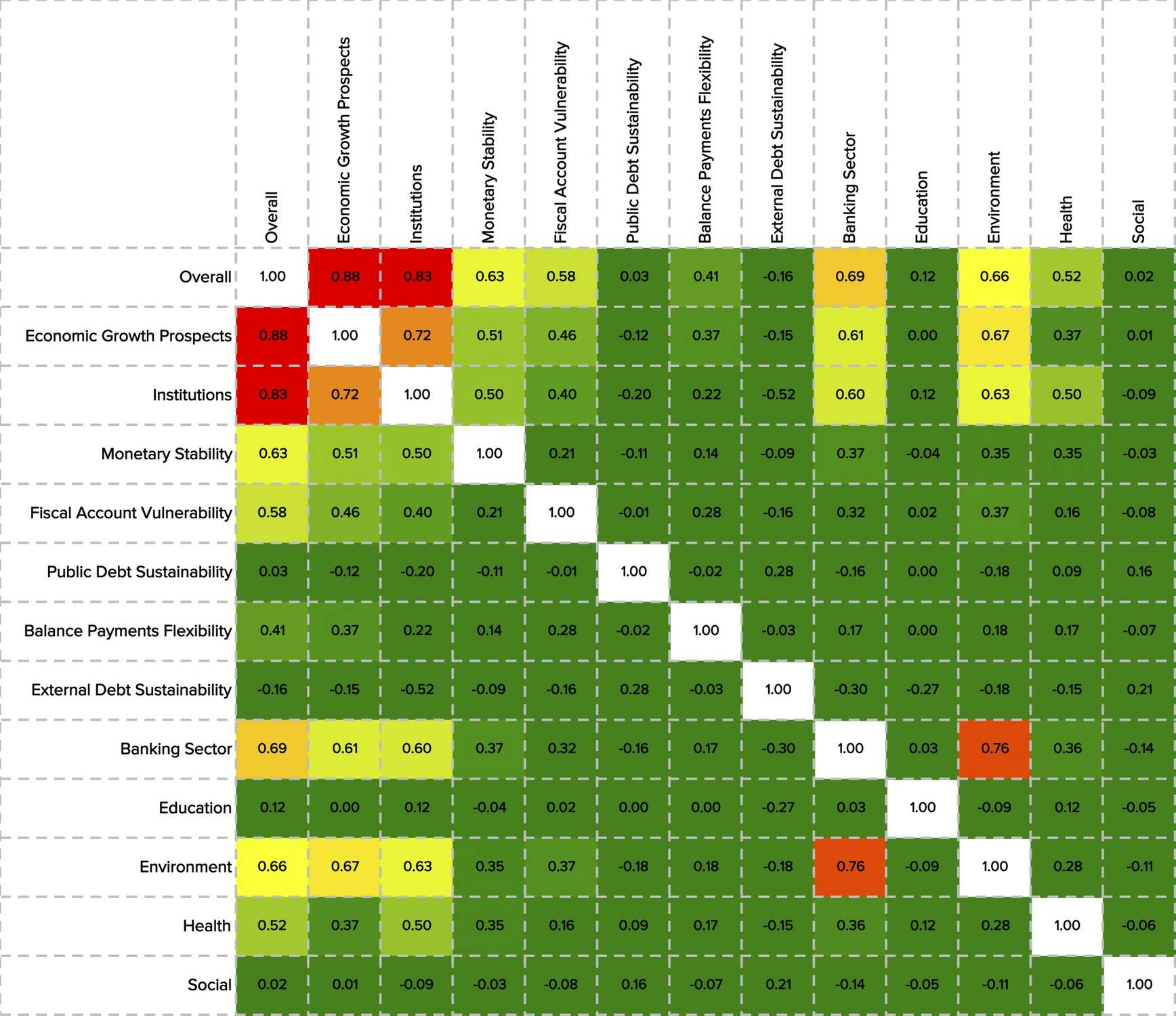

Let’s take a look at how strongly the individual risk sections across economic, financial and ESG factors behave. The matrix above shows the cross-correlation of the 12 risk sections. Areas that are shaded green indicate low or negative correlation while yellow and red shows risk sections that are stronger correlated with each other. In general, ESG risk sections (e.g. education, health) show a low correlation with more traditional country risk sections such as financial vulnerability or public debt sustainability, hence add information to the overall rating.

It is clear to us that a scoring based approach with many indicators will have some degree of correlation and redundancies. We accept this, as we still find that it generally improves the understanding of any country when viewed from different dimensions. Secondly, in many cases, the lack of data also reduces the problem of overlapping indicators. A certain indicator may not be available for a specific country and at a point in time, but a slightly different one, serving as a proxy, might be.

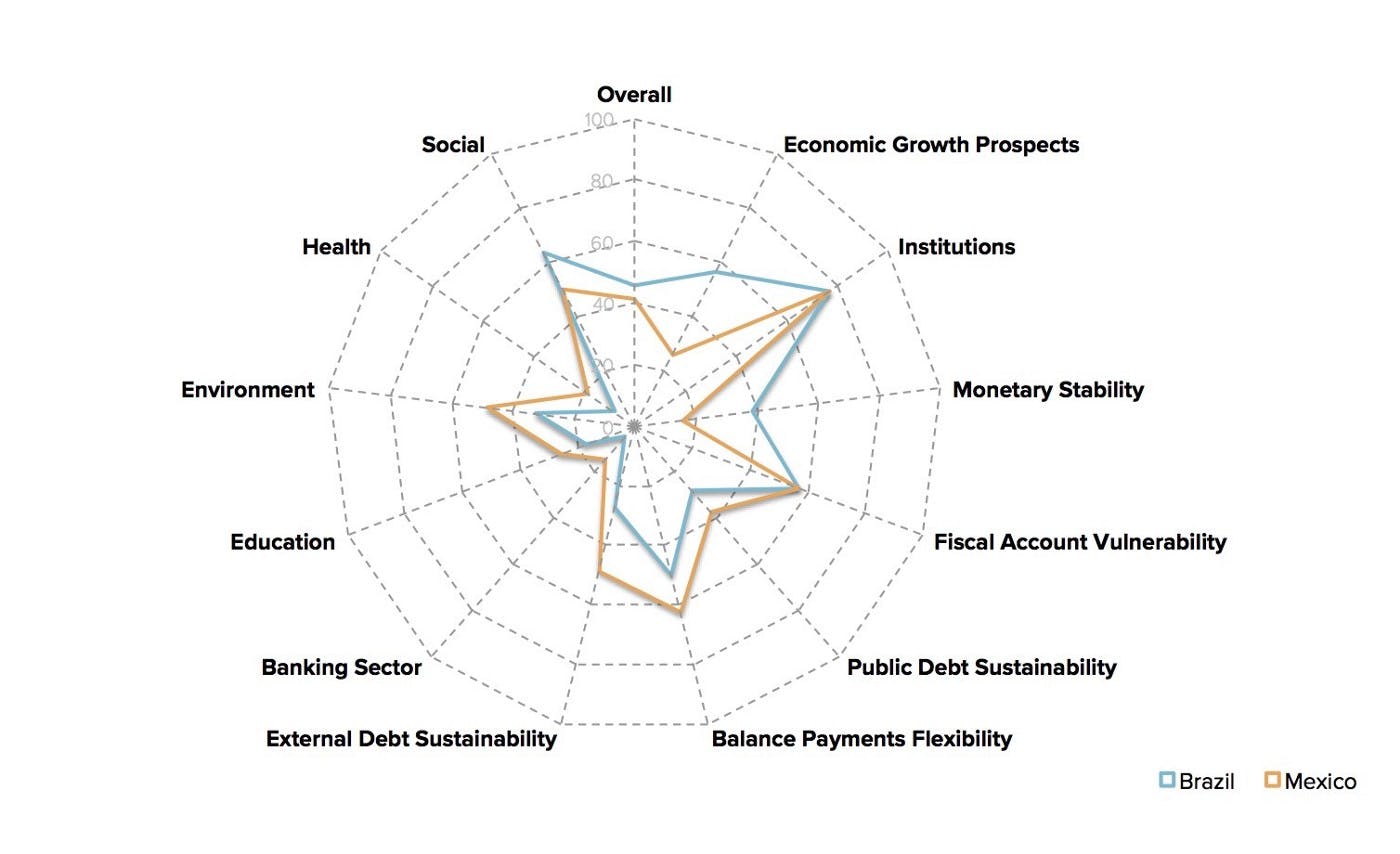

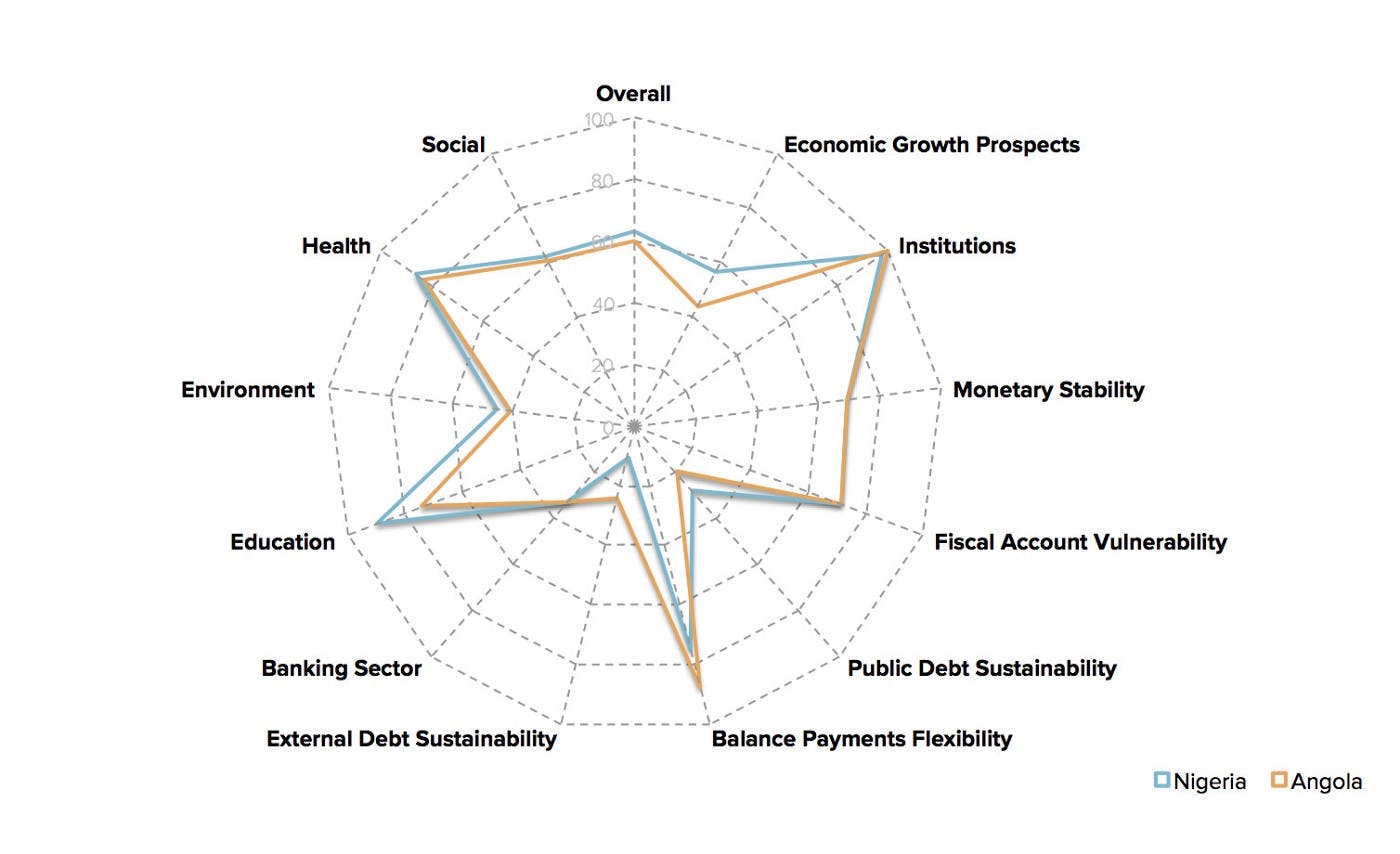

Cross-country comparisons are best shown with some spider-charts. Below, you find the chart comparing Mexico with Brazil and Nigeria with Angola. Brazil fares better in environment, education and health than Mexico. However, it clearly lags in economic growth prospects, monetary stability and in the various social metrics.

Nigeria and Angola both rank among the weakest countries in our universe. Both share very similar risk profiles, perform very poorly in governance (e.g. quality of institutions, corruption, rule of law), health and education.

Please drop us a message if you want to receive the full set of results.

ESG country ratings have many applications

We find that ESG factors are not only relevant in deriving sovereign credit risk ratings, but combining ESG factors with more traditional economic and financial factors can also be useful in gaining long-term capital market assumptions for strategic asset allocation decisions. Certainly, ESG ratings can be a valuable source of information for companies when making foreign direct investment decisions.

Guided approach to country risk assessments

The beauty of country risk ratings is that it gives a comprehensive picture of the country’s ability and willingness to repay debt in a single number or letter-rating. One can track its change over time and compare with peers or regional averages, or use as quantitative inputs for other models to determine country risk premia or valuation signals. I personally know how tempting such numbers can be.

Nevertheless, I also have to remind myself from time to time that each country is unique in its economic structure and model, political and socio-economic heritage and culture. Pressing all this into a single number (i.e. probability of default) or rating is possible but flawed. In my view, country risk analysis is about understanding the many facets, intricacies, inter-dependencies and non-linearity of a country. This was precisely the reason why we follow a scoring-based approach and put a lot of emphasis on supporting the analyst in looking at each country from different angles.

We do not claim to have a perfect model. While a comprehensive framework goes a long way in highlighting the various strengths and weaknesses of a country, we regard it as only the first step. The second step is fostering a constructive discussion among analysts concerning country risks. We find it more meaningful to have the discussion shift from “I think Austria is a AAA country” to encouraging qualified statements that give transparency on the result, the key risk drivers and mitigants, and the model that was used.

Community approach

CountryRisk.io was started on the basic premise that we can improve the quality of sovereign risk ratings by making the analysis framework publicly available, and by aggregating the ratings for a specific country across many users. We are convinced that a crowd-sourced approach provides the community with a lot more valuable information, which is virtually lacking today.

In addition, the crowd-sourcing approach is also useful in the case of poor data quality as it serves as it provides survey information for the qualitative factors. We also see that new technologies can bring innovation in the area of data and aggregation.

Join the discussion and community

We want to invite everyone to join the ESG sovereign risk discussion and community. Together we can develop the best ESG sovereign risk rating framework and provide ESG ratings to the public.

Join us here: esg.countryrisk.io/registration

Your CountryRisk.io team

Bernhard Obenhuber ([email protected]) and Jennifer Asuncion ([email protected])