Money Laundering: High-Risk Country Classifications

Bernhard Obenhuber

May 13, 2025

The primary objective of Anti-Money Laundering (AML) country risk ratings is to assess and quantify the level of money laundering and terrorist financing (ML/TF) risk associated with a particular country or jurisdiction. These ratings serve as a critical input for financial institutions and other regulated entities to calibrate their AML controls in line with the specific risks posed by different countries.

Effective assessments of AML country risk require a two-pronged approach: evaluating the inherent risks of ML/TF (such as corruption levels) and assessing the effectiveness of the control environment (which includes the quality of law enforcement and legal institutions). Although these factors are interconnected, it can be argued that the control environment is more critical. A country with a strong legal and regulatory framework provides fewer opportunities for illicit activity to thrive.

FATF and EU High-Risk Country Lists

The most commonly referenced lists of countries with significant AML deficiencies are those published by the Financial Action Task Force (FATF) and the European Commission.

The FATF publishes two public reports three times a year that identify countries with inadequate AML/CFT (Countering the Financing of Terrorism) and proliferation financing controls (Link):

- High-Risk Jurisdictions (the “black list”)

These countries exhibit significant strategic deficiencies. The FATF recommends that all jurisdictions implement enhanced due diligence, and in the most severe cases, countermeasures to safeguard the international financial system from related risks.

- Jurisdictions Under Increased Monitoring (the “grey list”)

These countries are actively working with the FATF to rectify the identified gaps. Countries on the grey list have committed to execute action plans within agreed timelines and are under heightened monitoring.

The European Commission’s rationale for its own list of high-risk third countries aligns with that of the FATF (Link):

“The identification of high-risk countries is required to protect the EU financial system and ensure the proper functioning of the internal market… These are countries with strategic deficiencies in their AML/CFT frameworks.”

In line with Directive (EU) 2018/843 (5th AML Directive), regulated entities such as banks must implement enhanced verification and oversight (Article 18a) when engaging with entities from these jurisdictions.

As of May 2025, the following countries are classified as high-risk:

FATF

- Black list: DPRK (North Korea), Iran, Myanmar

- Grey list: Algeria, Angola, Bulgaria, Burkina Faso, Cameroon, Côte d’Ivoire, Croatia, DRC, Haiti, Kenya, Laos, Lebanon, Mali, Monaco, Mozambique, Namibia, Nepal, Nigeria, South Africa, South Sudan, Syria, Tanzania, Venezuela, Vietnam, Yemen

European Union

- Afghanistan, Barbados, Burkina Faso, Cameroon, DRC, Gibraltar, Haiti, Iran, Jamaica, Mali, Mozambique, Myanmar, Nigeria, North Korea, Panama, Philippines, Senegal, South Africa, South Sudan, Syria, Tanzania, Trinidad and Tobago, Uganda, UAE, Vanuatu, Vietnam, Yemen

Identifying Common Themes

An analysis of FATF’s country assessments—particularly for grey-listed countries—reveals a recurring set of deficiencies, including:

- Beneficial ownership transparency

- Risk-based supervision (FIs & DNFBPs)

- ML investigations and prosecutions

- TF/PF controls, including targeted financial sanctions (TFS)

- Use of financial intelligence

- International cooperation

- Oversight of the non-profit sector

- National risk assessments and strategic planning

- Gaps in the legal and institutional frameworks

For blacklisted jurisdictions, the risk of proliferation financing—especially in the case of DPRK and Iran—is an additional and consistent concern.

Empirical Patterns in Risk Indicators

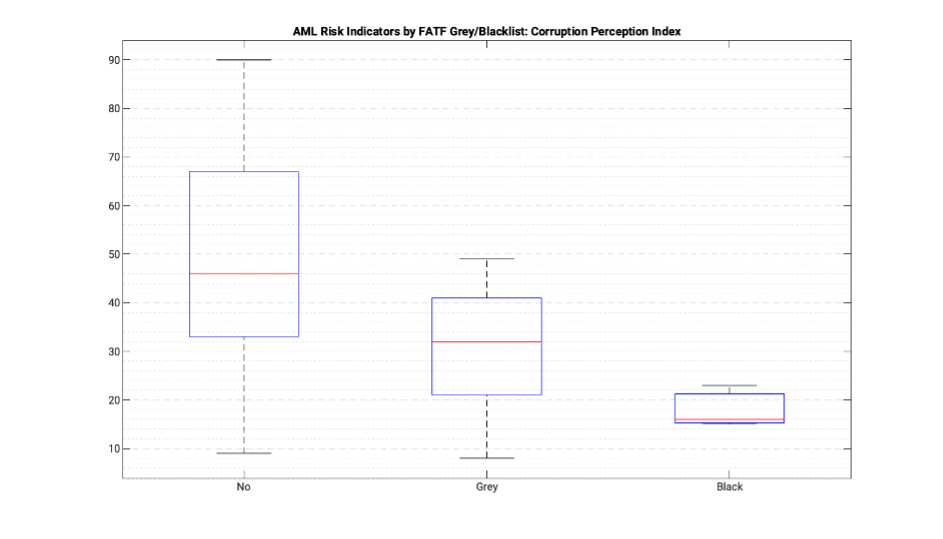

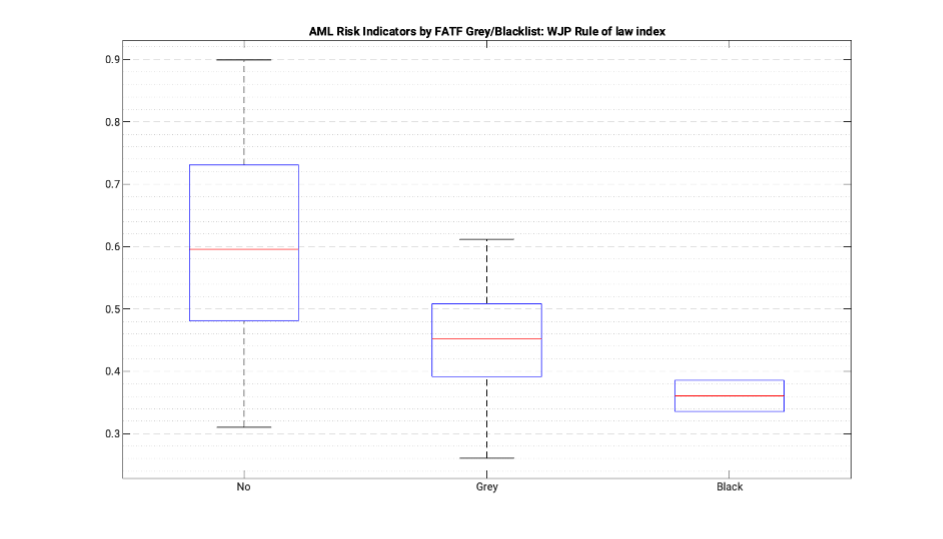

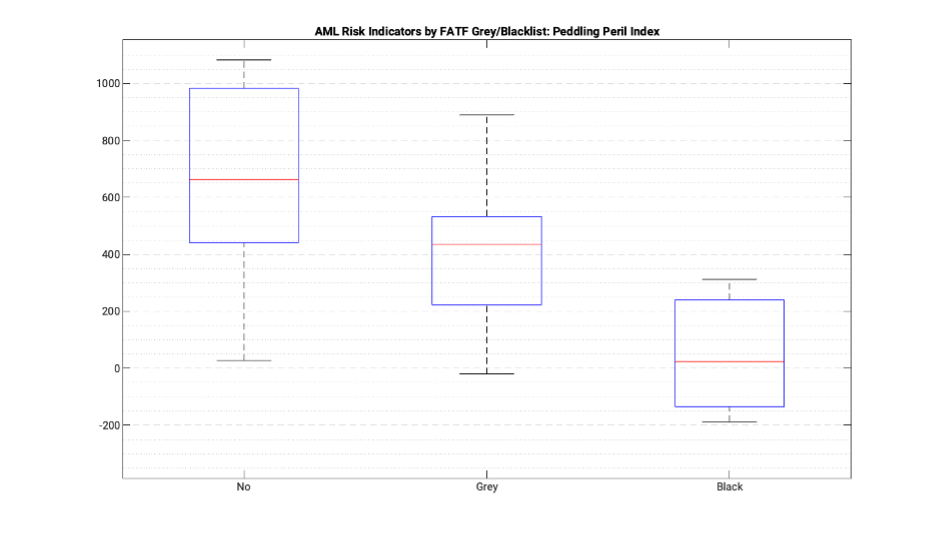

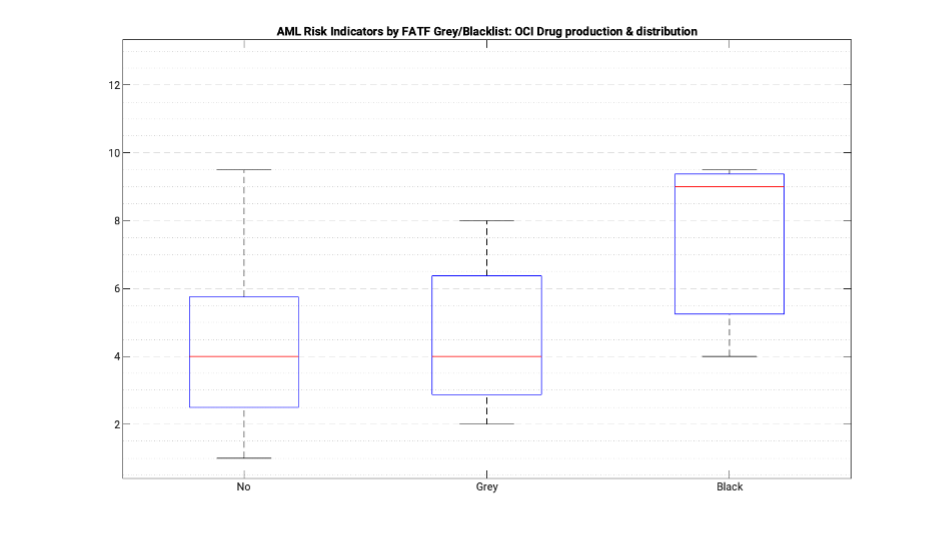

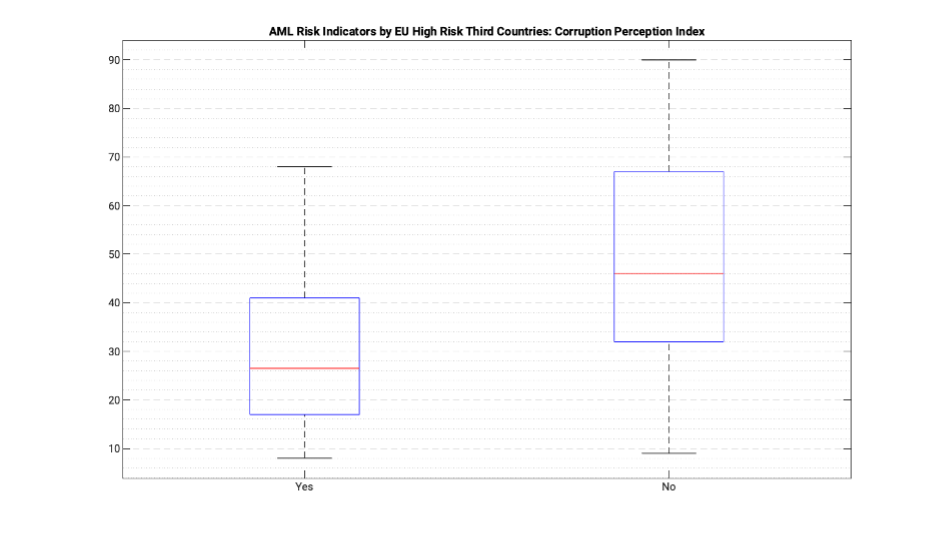

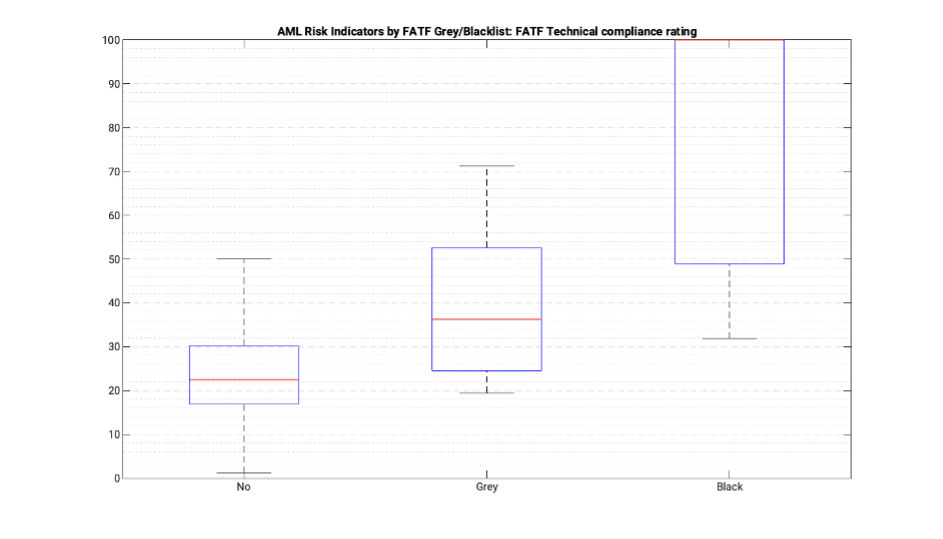

To substantiate these themes, we reviewed various country-level indicators related to ML/TF risk. The box plots below illustrate a sample of the data; please reach out for the complete analysis.

Countries on the grey and blacklists exhibit among other aspects:

- Higher levels of corruption

- Weaker rule of law

- Elevated proliferation risk, as measured by the Peddling Peril Index

When assessing inherent or predicate risks, the distinctions are less clear-cut. For example, the Organized Crime Index, particularly the sub-indicator for “Drug production & distribution”, shows no notable differences between grey-listed and non-listed countries. The contrast is more pronounced for blacklisted jurisdictions—but with only three countries currently on this list, drawing robust statistical conclusions are limited.

Comparable trends are observed when substituting the FATF list with the EU’s list of high-risk third country: countries with higher levels of corruption are consistently more prone to being included on these lists.

Assessing Consistency Between Listings and Evaluations

One of the strengths of the FATF’s methodology lies in its comprehensive mutual evaluation reports (MERs), which assess jurisdictions based on their technical compliance and effectiveness (Link). Not surprisingly, countries on the grey and black lists exhibit deficiencies in both areas.

However, many non-listed countries also demonstrate low effectiveness scores, indicating that while they may tick the box for legal and regulatory frameworks in theory, their actual implementation is lacking. This highlights a critical challenge: technical compliance alone is insufficient.

Modeling the Probability of Being Listed

We developed an econometric model using the FATF and EU high-risk lists as dependent variables, incorporating the following explanatory indicators:

- Corruption Perception Index

- Rule of Law

- Regulatory Quality

- OCI – Arms Trafficking

- World Justice Project – Order & Security

- Peddling Peril Index

The model estimates:

- A 92% likelihood of Afghanistan being listed as high risk third country by the EU

- 80% for Iran

- 3.4% for Sweden, 2.6% for Austria

The model fails to include specific countries from the current lists, including the United Arab Emirates (6.5%) and Barbados (22.5%), unless a significantly low probability threshold is applied. Consequently, we avoid making specific predictions prior to the next FATF plenary on 13 June 2025, when updates to the lists will be announced.