Money laundering, and its associated illicit activities in both public and private sectors, is a significant challenge for both national and international markets. It undermines the rule of law, damaging state institutions, law enforcement bodies and decision-making processes through corruption and reduced transparency. According to the United Nations Office on Drugs and Crime (UNODC), money laundering operations cost the global economy USD 2 tn annually.

Money laundering activities also negatively affect the perceived stature of nations and markets, making them less attractive to international investors who may foresee corporate reputational damages, or even legal actions, against their interests should they get involved with such economies.

Moreover, the functioning of liberal democracies could be subverted through money laundering activities. For instance, it’s thought that some of the recent rise in right-wing populism could, in part, have been funded with laundered money.

Money laundering is especially devastating to poor countries. As this piece by Transparency International says, “When money goes into the pockets of government officials rather than into public services, it is the people who suffer. Countries cannot tackle poverty when their resources are stolen.”

AML Legal Frameworks in South East Europe

While it’s difficult to quantify the scale of money laundering in SEE, there’s little doubt that it’s significant. It is therefore considered to be one of the most challenging criminal activities in the region.

As part of its membership requirements, the EU demands that candidate countries carry out significant judiciary system reforms and step up their fight against corruption so as to establish greater political and economic stability in the region.

A principal EU AML lever is the EU Anti Money Laundering Directive. The European Parliament approved the fifth version of the Directive in June 2018 to further reduce money laundering in the EU and its neighbouring countries.

South East Europe Country Approach

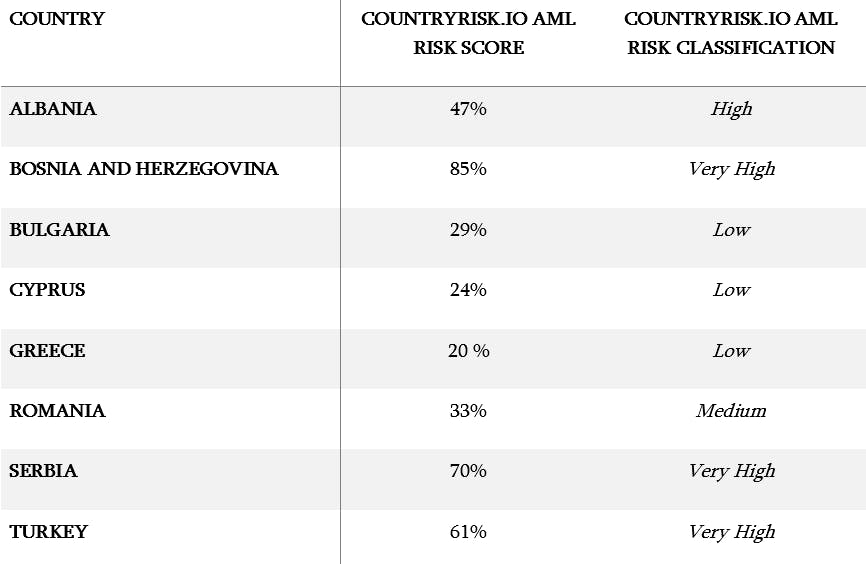

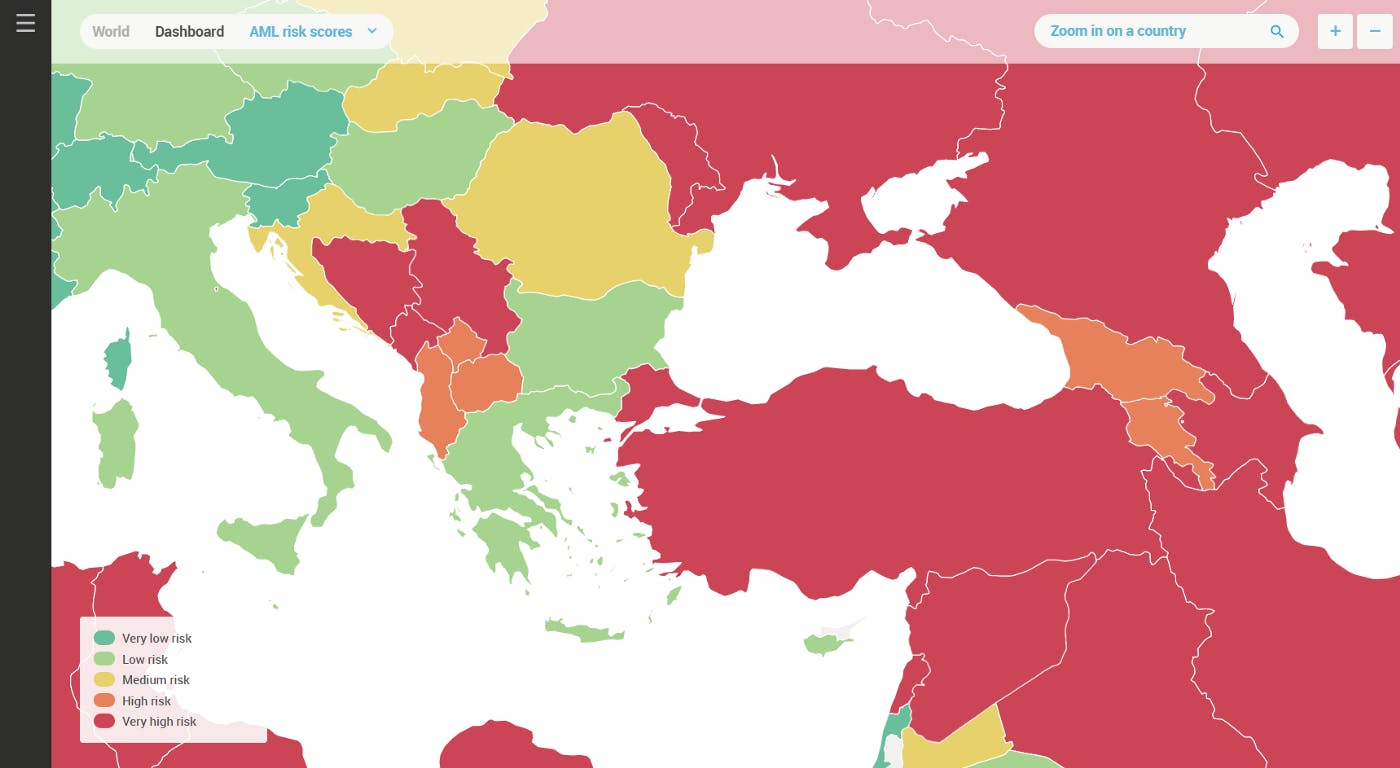

This section summarises each SEE country’s anti-money laundering efforts based on recent policy directives. CountryRisk.io’s AML Risk Score complements the narrative.

Greece

CountryRisk.io AML Risk Score 21% — Low

Greece remains one of the leading SEE countries in AML, earning a Low CountryRisk.io AML Risk Score. According to the latest FATF 2019 AML report, Greece and its authorities are considered to understand the risks of money laundering to its economy and governability. The country adopted a new National Risk Assessment (NRA) in 2018, and this document has proved vital to Hellenic authorities in designing their AML policies.The NRAs are official reports prepared by government agencies, such as Financial Intelligence Units (FIU), relevant Ministries/Departments, and central banks as well as private sector actors, to identify money laundering and terrorist financing threats and vulnerabilities in the country.The report also stated that Greece has created a strong AML legal framework, with only few changes required to fully satisfy FATF requirements. The FATF highlights drug trade, migrant smuggling and corruption as the most challenging AML-linked activities in Greece.In spite of this overall AML legal improvement, a recent Financial Times article stated that a penal code amendment in November 2019 “provides facilities for people suspected of criminal fraud and money laundering to recover assets frozen by the court, if they are not brought to trial within 18 months.” The Greek real estate and shipping industries also remain sources of high AML risk.

Cyprus

CountryRisk.io AML Risk Score 25% — Low

The Republic of Cyprus significantly improved its AML legal capabilities following the publication of its first NRA in October 2018, a document that has been recognised by several international AML organisations. Cyprus’s current CountryRisk.io AMO Risk Score is Low.A December 2019 MONEYVAL (the Council of Europe’s expert body on AML/FT) report on Cyprus recognises this legal improvement, highlighting enhanced coordination between AML agencies and a more efficient AML supervisory role for the Central Bank of Cyprus.But despite this improvement, Cyprus remains heavily exposed to money laundering activities and is still believed to be an EU money laundering hub. As a consequence, a recent MONEYVAL report warned Cypriot authorities to establish stronger due diligence mechanisms and pursue more aggressive AML policies. The IMF IV Report on Cyprus (December 2019) underscored the fight against Money Laundering activities as one of the cornerstone in regaining the country’s credibility and improving upon its foreign investment. Furthermore, this report expects further implementation of AML compliance mechanisms in Cyprus such as “preventive measures, transparency and beneficial ownership of companies and trusts, international cooperation, financial intelligence and investigations”Money laundering activities may have reached the highest levels of politics, including the current president of Cyprus, Nicos Anastasiades. An OCCRP investigation published in August 2019 accused Anastasiades and an intermediary company of attempting to facilitate Cypriot citizenship for alleged Russian criminals, activities which involved money laundering. Cyprus FIU and the government are currently investigating the case.

Bulgaria

CountryRisk.io AML Risk Score 29% — Low

Bulgaria shows positive momentum in the fight against money laundering and currently holds a Low Risk Score. The country has effectively implemented new AML legislation and is following the EU’s AML directives. Moreover, Bulgaria has recently published its first NRA (January 2020), imposing a new deadline for all entities obliged by Bulgarian AML legislation to adopt internal rules and create more transparency, which they must meet to avoid further money laundering cases. Ultimate Beneficiary Owner (UBO) registration in the Commercial Register is already mandatory in Bulgaria.This legal progress on AML is much needed in the country, which, notwithstanding recent developments, still has several AML deficiencies. Following FATF and EU AML recommendations, Bulgaria published its first NRA this past February. In this document, the Bulgarian State Agency for National Security listed the economic areas that are highly exposed to AML activities, such as human trafficking, corruption linked to Politically Exposed Persons (PEPs), construction industry or EU funds abuse, among others.In the last six months, several money laundering cases have appeared in the Bulgarian media, including the accusation that Credit Suisse was involved in money laundering linked to a Bulgarian drug trafficker. Another recent case involved money transfers to a small Bulgarian bank from the Venezuelan national oil giant PDVSA, allegedly to avoid international economic sanctions and engage in money laundering.In January this year, the U.S. appointed a new Resident Legal Advisor for Romania and Bulgaria to provide further assistance in combating money laundering.

Romania

CountryRisk.io AML Risk Score 33% — Medium

Romania’s CountryRisk.io AML Risk Score is Medium, ranking it in the middle of SSE countries. The latest public MONEYVAL analysis report on Romania (July 2019) highlights the country’s progress on adopting AML law: “Romania has made tangible progress since the last compliance adopted by MONEYVAL (December 2018)”. Despite accepting the EU’s fourth and fifth AML Directives, Romania has, nevertheless, undergone some legal regression. The former Romanian judge and scholar Camelia Bogdan, whom we interviewed for this article, highlights Romania’s Constitutional Court amendment of AML regulatory law 129, which has ultimately limited its influence. Bogdan says that this amendment limits the fight against the “most common typology of money laundering taking place in Romania.” According to Bogdan, “In Romania, now it is not possible to hold defendants liable for money laundering accusations.”In February this year, the European Commission warned Romania for not implementing measures to comply with the last EU AML directive. Should Romania fail to act on this warning, the Commission could follow infringement procedures by first sending a “Reasoned Opinion” and, ultimately, referring Romania to the Court of Justice or imposing financial penalties.

Albania

CountryRisk.io AML Risk Score 47% — High

During these last three years, Albania has witnessed several corruption scandals involving money laundering accusations against top politicians. During the 2019 popular demonstrations that took place against government corruption, the opposition leader Lulzim Basha was accused in June 2019 of engaging in money laundering activities. This case, which was recently suspended by the Prosecution of Tirana, was seen as part of the political use of the justice system in Albania.That being said, improvement in Albania’s AML legislation have taken hold between 2016 and 2017, “including reforms of the justice system, vetting of judges and prosecutors for unexplained wealth, and a revamped law governing asset forfeiture.” These reforms have also improved transparency around UBO records. CountryRisk.io still attributes a High AML Risk Score to Albania, owing to deep-seated corruption and overall weak institutional quality.According to the December 2019 MONEYVAL follow-up report on Albania, the country has improved upon six recommendation points with only one recommendation remaining under-addressed (FATF Recommendation 7). This came on the back of the parliament’s adoption of stronger AML package and borne by Albania’s EU candidacy. But despite these positive developments, Albania was again placed on the FATF’s “grey list” during February 2020, suggesting further AML monitoring by this supranational organisation and the need for additional AML measures. This negative assessment also weighed on CountryRisk.io’s assessment of Albania.According to Anila Denaj, Albania’s Minister of Finance, this FATF “increased monitoring” is due to “fundamental gaps found in the justice system, the Prosecutor and the Court.” As a result, Albania this year is expected to “conduct an in-depth analysis of the risks of money laundering and to enable the strengthening of institutional coordination and cooperation,” among other AML-related policy making.

Turkey

CountryRisk.io AML Risk Score 61% — Very High

Turkey’s AML fight has been hampered by its decade of political turmoil, which saw a change of political system that has diminished overall government and state accountability. Poor institutional quality and sanctions are the principle drivers of our Very High AML Risk Score for Turkey.The FATF 2019 report on Turkey highlights certain improvements regarding AML state mechanisms, such as the publication in 2018 of its NRA as well as an improved understanding of money laundering-linked ideas. However, it also takes into account the damage done by massive purges within the Turkish security apparatus since 2013, a trend reinforced by the post-2016 coup attempt. With the government’s attention elsewhere, this repressive context “has caused strains on the capacity of AML/CFT authorities.”AML-linked legislation has also been affected. For example, in May 2018, a Tax Amnesty Law (active until November 2018) has allowed the “repatriation of foreign assets, such as money, gold, foreign exchange, securities, and other capital market instruments,” enabling repatriated goods to be declared “without being subject to any inspections, enquiry, or tax assessment.”An ongoing money laundering case of particular relevance to future economic and political developments in Turkey is that of Reza Zarrab. Zarrab, an Iranian businessman with Turkish citizenship, allegedly intended to create illegal scheme for Iran to avoid international sanctions regarding oil and gas commercialisation through Turkey. This scheme would have used Turkish government-owned banks and companies, bribing ministers and even the then Prime Minister, Recep Tayyip Erdogan, all of which would likely have entailed money laundering. While Zarrab has been in U.S. custody since 2016, he is still believed to play a key role in U.S.-Turkey relations, throwing the judiciary outcome of the money laundering accusations against the Turkish government into doubt.

Serbia

CountryRisk.io AML Risk Score 70% — Very High

While CountryRisk.io has maintained its Very High AML Risk Score, Serbia has made considerable strides in the right direction. In June 2019, FATF removed Serbia from its list of jurisdictions with strategic deficiencies.According to the March 2019 U.S. Department of State’s International Narcotics Control Strategy Report and several FATF-GAFI reports, Serbia has been committed to carrying out extensive AML reforms and aligning its AML legal framework with EU standards since 2018.These reforms have included updating its NRA, subjecting intermediary AML actors (e.g. lawyers, notaries, casinos) to tighter control and strengthening customer due diligence processes. According to the latest MONEYVAL follow-up report on Serbia, the country has improved in the areas of “targeted financial sectors”, “non-profit organisations” and “internal controls and foreign branches and subsidiaries”.However, Serbian political elites are still lukewarm toward accountability, as suggested by the December 2018 detention of Serbian journalist Stevan Dojčinović before his participation at a UN-hosted conference on corruption. Dojčinović was set to discuss money laundering in Serbia, thought to have been the main reason for his detention. There are also concerns about the so-called “Belgrade Project”, a construction project in the Serbian capital believed to have been used for money laundering.

Bosnia and Herzegovina

CountryRisk.io AML Risk Score 85% — Very High

CountryRisk.io has assigned Bosnia and Herzegovina a Very High AML Risk Score, as the country is sanctioned by the EU. In March 2019, the U.S. Department of State International Narcotics Control Strategy Report (INCSR) classified Bosnia and Herzegovina as a major money laundering jurisdiction, and corruption is still high. However, since there are no FATF country assessments or OECD tax transparency reports, detailed information on the country is relatively weak. Bosnia and Herzegovina is currently under the jurisdiction of MONEYVAL. Bosnia and Herzegovina, and its associated entities (Republika Srpska, Brčko District), have also been reported to suffer from AML investigative fragmentation, as well as from disproportionate empowerment of its intelligence services during the investigation of AML cases.The INCSR highlights the scheduling of a NRA in Bosnia and Herzegovina as a positive development for AML in the country. Besides improving against NRA standards, the report also acknowledged that Bosnia and Herzegovina has improved its AML legal framework such that it’s no longer subject to the FATF’s monitoring process.This legal improvement in Bosnia and Herzegovina has triggered several significant police operations against politicians and private actors involved in money laundering activities. These include the 2018 case against the former Agriculture Minister, Jerko Ivankovic Lijanovic, which resulted in a 12-year prison sentence. More recently, in September 2019, three former officers of the Russian bank Sberbank were detained by authorities under accusations of money laundering through its Bosnian branches.