ESG Index Builder — index customisation from CountryRisk.io

Bernhard Obenhuber

Sep 14, 2020

Scores, rankings and ratings of many kinds are widely used in our daily lives. We quickly dismiss a movie with just two stars and we decide on restaurants based on various rankings and lists. Some of these scores have become institutionalised, such as Michelin stars or the sovereign credit ratings that measure the ability of governments to honour their debt obligations.

John Moody started his eponymous company by publishing the Moody’s Manual of Industrial and Miscellaneous Securities in 1900 that contained information and statistics on a wide variety of securities. A few years later, in 1909, he introduced the rating system that is still used today. It is difficult to imagine fixed income markets without the omnipresent letter ratings ranging from Aaa for the best credit risk to D for countries that have defaulted on their debt.

Ingredients for acceptance

For a rating system to win widespread acceptance, it needs, among other things, to be:

- easy to understand;

- transparent;

- consistent over time;

- unbiased; and

- relevant for the user’s needs.

When it comes to sovereign credit ratings from the large rating agencies, one can debate which of the above factors hold. On the surface, they are easy to understand: AAA is better than BBB, but the meaning of a specific rating can be less clear. Does it measure the probability of default, or the magnitude of loss should a default occur?

Similarly, rating agencies need to be transparent for regulatory purposes. They are required to publish rating methodologies, produce a public rating calendar and submit their models and ratings to the regulator. But, again, if one scratches the surface, some questions emerge. How, for example, is the ultimate rating determined by the rating committee?

Consistency over time is also a challenge, as rating methodologies are often subject to change. However, they should be able to incorporate new findings, data and approaches, as long as the changes are communicated transparently. Ratings bias has been hotly debated in academic literature and, following the subprime crisis, in court. Finally, the relevance of credit ratings can be very high if the investor mandate dictates a minimum credit rating. An unconstrained investor will put much less weight on them.

ESG ratings

Ratings and indices that integrate environmental, social and governance (ESG) factors into the analysis have also been around for some time but are only more recently garnering widespread attention. The development by the United Nations of the Sustainable Development Goals and increasing public awareness of the dire consequences of climate change and biodiversity loss have encouraged the financial sector to embrace ESG integration — although cynics might also add that sustainable finance offers new products for banks and asset managers to sell…

However, if one applies the criteria for acceptance listed above to ESG ratings, it is clear that there is a long road ahead before we reach widespread adoption. Key issues include: the lack of standardisation of ESG factors; differing definitions of ESG across the various asset classes; conflicting evidence of the financial materiality of ESG factors; and whether the ESG performance of an asset should be assessed as a standalone metric, or integrated with traditional factors.

CountryRisk.io approach

Our objective at CountryRisk.io is to make sovereign risk assessments a public good. This means empowering our users to undertake their own risk assessments and encouraging them to share these with the community. In so doing, this reduces their dependency on rating agencies. This is desirable — not because we hold any grudge against rating agencies — but because we believe that undertaking analysis and data exploration fosters the user’s understanding. In addition, there is value in the diversity of opinions.

As far as ESG analysis is involved, the market is moving in our direction. A recent article published in IR Magazine suggests that a rethinking is underway among financial market participants; rather than relying on third-party ESG risk scores, investors are increasingly working with the raw data and doing the analysis, ranking and rating themselves, the article found.

On the CountryRisk.io Insights Platform we provide free access to a comprehensive rating model which incorporates statistical data tracking 500 indicators — including ESG metrics — for 190 countries. The rating methodology is publicly available and community members can exchange opinions and views on their analyses, as well as benefiting from numerous other features.

ESG Index Builder

With the latest platform update, we are adding another tool for our users. The CountryRisk.io ESG Index Builder allows users to create their own custom ESG Index by selecting from a large range of environmental and social factors. The platform then automatically crunches the data to generate an index of ESG performance ranges from 0 to 100.

Users can test the ESG Index builder here at the CountryRisk.io Lab, the part of our platform where we test new ideas. Before we fully integrate the new feature into the CountryRisk.io Insights Platform, we want to share the tool with a wider audience for feedback and comment.

How it works

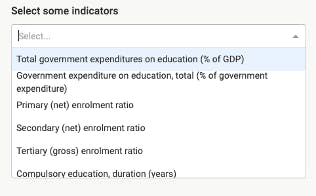

1) Users first select indicators from the dropdown menu. We have included a wide range of environmental and social metrics covering topics such as education, water resources, biodiversity, carbon emissions and equality and inclusion. The data, which is mainly sourced from the World Bank, is cleaned and normalised to ensure that the various indicators are aligned and standardised. More technical details can be found in the legend section of the ESG Index Builder page. If there are additional indicators you want to see, please drop us an email and we will do our best to add them to the list.

2) Secondly, users select countries of interest that they wish to compare. The selected countries will appear in blue.

After selecting the indicators and countries, the charts will automatically update and reflect the choices selected. The output includes three elements:

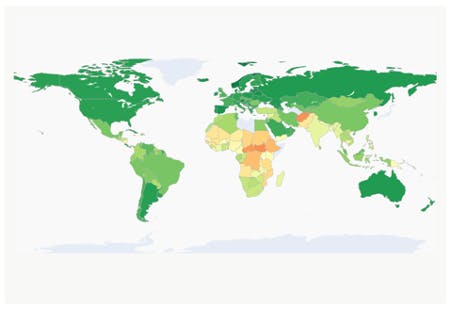

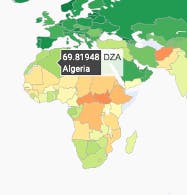

1) The world map shows the performance of the ESG index for all available countries. Dark green indicates strong performance while countries in dark red exhibit poor performance based on the selected indicators. Currently, the map shows index performance for end of 2019. Hovering the mouse pointer over a country shows its exact index performance.

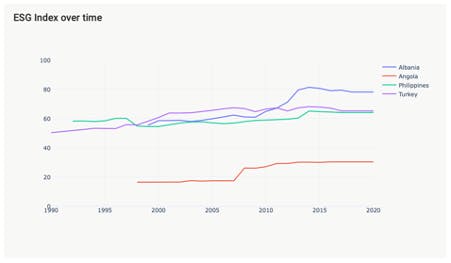

2) The output also includes ESG indexes over time. While the world map is an easy way to compare regions and countries, it is also of interest to see how certain countries have progressed over time. A rising index score indicates improvement. This illustration allows you to identify trends.

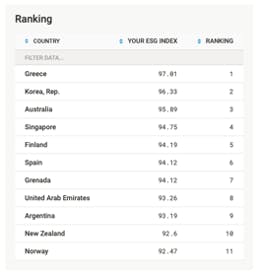

3) A ranking table shows all countries ranked by the ESG index. In addition, the table also allows you to sort the countries alphabetically or search for a specific country.

Users can download the various charts by clicking on the camera icon and saving the chart on their computer. The other icons allow you to, among other things, zoom in and out.

We hope that you find the ESG Index Builder useful for exploring ESG data for your own use cases. As always, your feedback is important to us, so please let us know what you think of this new feature and ways to improve it. Please email any comments to [email protected].

Link to CountryRisk.io ESG Index Builder: https://countryrisk-esg-index.herokuapp.com