Debt overhang threatens SDGs and sustainable recovery

Bernhard Obenhuber

Sep 08, 2020

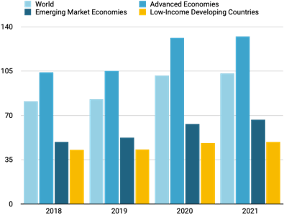

Emerging market sovereigns and international bond holders have conspired in a borrowing spree that, as the global economy struggles under the weight of the Covid pandemic, risks reversing progress towards economic recovery and sustainable development objectives. Based on data and projections from the International Monetary Fund (IMF), government debt ratios will increase substantially in 2020 and 2021; even more than during the Great Financial Crisis of 2008.

While the increase is greatest in advanced economies (see figure above for government debt to GDP ratios for various country groups), which tend to carry higher debt ratios than poorer countries, some low-income countries are facing unsustainable debt burdens. Countries like Sudan, Eritrea or Lebanon will get close to 200% government debt to GDP by the end of 2021. For many countries, debt service payments account for a large share of government revenues. Pressure is building for sovereign debt forgiveness to enable low-income countries to direct their resources to recovery, rather than paying back international investors.

At the start of this month, Pope Francis added his voice to this growing chorus, calling in a written message for “the cancellation of the debt of the most vulnerable countries, in recognition of the severe impacts of the medical, social and economic crises they face as a result of Covid-19”.

His call followed an exhortation in June by UN Secretary General Antonio Guterres for an extension to the six-month G20 debt moratorium for developing countries announced in April. He noted that the moratorium covered only least-developed countries and that it does not include private creditors.

“Unless we act now, economic recession could push millions of people across the continent into extreme poverty and hunger,” he said. “This cannot be allowed to happen.”

The IMF has warned that growth in low-income developing countries is likely to fall from 5% last year to zero in 2020. “Absent a sustained international effort to support them, permanent scars are likely to harm development prospects, exacerbate inequality, and threaten to wipe out a decade of progress reducing poverty.”

A protracted debt crisis

The Covid pandemic, and the effect it is having on government revenues around the world, risks becoming a protracted debt crisis for developing countries. It is making it more difficult for them to respond to the pandemic and is putting achievement of the UN Sustainable Development Goals (SDGs) further out of reach.

According to the UN Department of Economic and Social Affairs, the decade since the global financial crisis has seen levels of developing country debt rise dramatically from modest levels. Tempted by low interest rates and with strong appetite from international investors, median public debt in developing countries increased some 15 percentage points of GDP between 2012 and 2019, from 35% to 51% of GDP.

Time for bondholders to take a hit?

Moritz Kraemer, chief economic adviser at Acreditus and S&P’s former sovereign chief ratings officer, argues that heavily indebted nations should be prepared to default on this debt, and force bondholders to “accept reality”. The IMF is more measured, but it calls for “reprofiling and restructuring debt to restore sustainability where needed”.

Given the massive adverse shock to all countries from the Covid pandemic, we will see an uptick of government defaults in the coming quarters. However, this is easier said than done. No government default is quick and easy. Many of them will be protracted and lead to a deepening of their economic and social decline.

The IMF also notes the importance of the SDGs and calls for the international community to “keep sight of the United Nations’ SDGs, including by reassessing needs when the crisis subsides”. Without sustained international support, it is clear that a combination of the Covid pandemic and crippling debt levels will retard many low-income countries’ economic, social and environmental development.

Unconditional help for people; conditional help for governments

At CountryRisk.io we believe that advanced economies and multilateral organisations need to support the poorest groups who bear the brunt of previous poor economic policies and the current health crisis. In order to be effective, government loans should be tied to strict criteria and transparency to limit the risk of corruption and the risk of supporting environmentally unfriendly industries. Foreign support should be used to advance SDGs in a meaningful and long-term manner.