Digging into the data: Why crowdsourced ratings are replacing top-line ESG scores

Bernhard Obenhuber

Sep 22, 2020

At CountryRisk.io we have long believed that environmental, social, and governance (ESG) factors are an important part of a sovereign risk assessment. We believe that incorporating ESG factors creates better granularity and a more comprehensive view of country risk assessments.

But there’s an elephant in the room, and that is that we don’t take the ESG scores from third party providers for face value.

It is no secret that, as ESG has soared in popularity, investors have begun to turn their back on ESG ratings agencies. Marred with challenges like data bias and transparency, inflexible approaches, and varying definitions, investors and analysts are increasingly choosing to do their own ESG research and ratings, and with good reason.

A flawed system

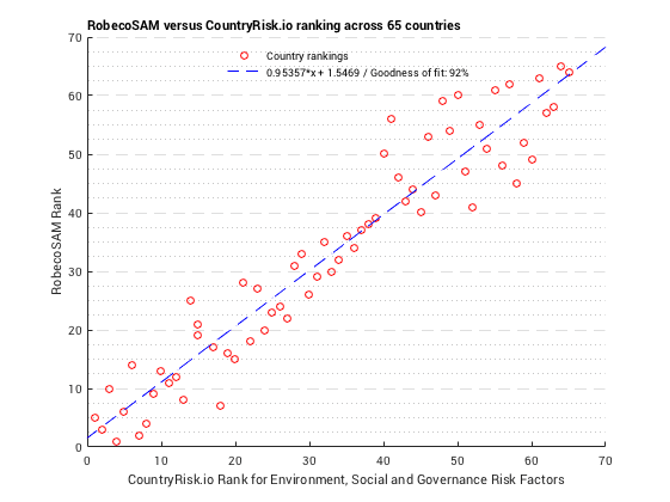

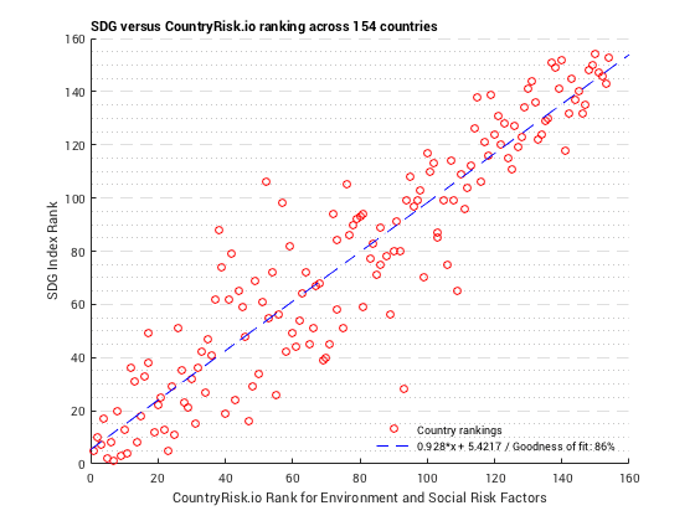

It is well known among ESG investors and analysts that agencies’ ESG ratings of the same issuer can vary drastically. Differences in methodology, subjective interpretation, or an individual agency’s focus can all tilt the scale of an ESG rating significantly. And the data backs this up, with the correlation between ESG ratings across different providers at around 0.3, or in other words, very divergent. While the figure refers to corporate ESG ratings, the issue can also be found with ESG sovereign ratings but to a much lesser degree. The charts below compares the CountryRisk.io ESG score with the ones from RobecoSAM and the SDG Index results. Interestingly, the divergence is especially noticeable for very low risk and very high risk countries.

It doesn’t help that there are no standardised rules for environmental and social disclosures, nor is there a disclosure auditing process to verify reported data. This lack of transparency and reliance on unaudited data leaves ratings agencies in a difficult place. As a result, they are forced to apply assumptions, further cementing the subjective nature of ESG ratings.

What this all means is that it would be careless for an investor to take one agency’s ESG rating off the shelf and apply it centrally to its decision making. A prudent investor will need to understand what the ESG data and rating is actually capturing, since different agencies define ESG in different ways.

Strength in numbers: The case for crowdsourcing

Given the murky process used by ratings agencies, investors and analysts are increasingly doing their own ESG research and ratings, as speakers at IR Magazine’s ESG Integration Forum testified this summer.

With investors wanting to know the real story and dig into the data themselves, this knowledge gap is being filled by platforms such as CountryRisk.io’s ESG Sovereign Rating model or ESG Index Builder. The crowdsourcing platform enables community members to conduct their own due diligence and thereby foster their understanding, while also comparing and exchanging views among the community. This approach allows ESG ratings to benefit from strength in numbers and diversity of thinking as users tap into the collective intelligence of ESG analysts.

On the CountryRisk.io Insights Platform, we provide free access to a comprehensive rating model which incorporates statistical data tracking 500 indicators for 190 countries. The platform guides the user through the analysis process to derive a comprehensive ESG sovereign rating. The platform itself can also be customised to the needs and ESG definitions of an organisation through a white-label offering.

The rating methodology is publicly available, because at CountryRisk.io we want to be as transparent as possible. The data, which is mainly sourced from the World Bank, is cleaned and normalised to ensure that the various indicators are aligned and standardised.

CountryRisk.io recently also launched the ESG Index Builder as a playful way for users to create their own custom ESG Index by selecting from a large range of environmental and social factors. The platform then automatically crunches the data to generate an index of ESG performance, ranging from 0 to 100.

Sovereign debt may be one of the oldest asset classes in the world, but relying on an outdated, subjective approach is risky business. Just as no one ratings agency should be relied on for ESG ratings, no one analyst has a monopoly on wisdom. By utilising our ESG Sovereign Rating Model and ESG Index Builder, users can not only foster their understanding, but they also benefit from a diverse range of thought, experience, and knowledge.

Visit our ESG Sovereign Rating model and ESG Index Builder here: www.countryrisk.io