Country risk modelling: DIY or off-the-shelf?

Jenny Asuncion

Nov 09, 2020

Build or buy? It’s a question that a growing number of organisations are contemplating as they begin to think about their sovereign risk modelling capabilities. The reason is a growing recognition among asset managers, industrial companies and public entities such as central banks of the need to better integrate ESG risk factors into their sovereign risk analysis.

As experienced sovereign risk analysts, my co-founder and I know how painstakingly difficult it is to build a comprehensive model from scratch in Excel, and how costly it can be to build dedicated applications in-house — not to mention the challenges and costs of maintaining them and managing data feeds.

It’s a challenge that many of our CountryRisk.io community members and prospective clients recognise. As a consequence, one of the questions we are often asked by them is whether they have the ability, when using the platform, to change the risk sections or indicator weights, or to add or delete certain indicators. The answer is two-fold: yes and no.

Let’s start with ‘no’. The publicly available CountryRisk.io ESG Sovereign Risk and Country Risk rating models cannot be modified in any way. The reason behind this is that we want to ensure that everyone works with the same model that we use to calculate the average rating for each country: those average ratings need to be calculated from a model that is uniform across the board.

But here’s the ‘yes’: We understand that some of our users who need to conduct their own in-house ESG country risk analysis (or standard country risk assessment), have their own desired weights or set of parameters or indicators from which to base their ratings. To allow for this flexibility, a key service that CountryRisk.io offers is to provide a ‘white label’ version of our platform.

A tailored solution from CountryRisk.io

The white label service essentially provides a bespoke version of our platform. This allows users to adjust the following elements:

- The objective of the model: While the publicly available platform model is calibrated towards sovereign credit risk, clients might have a different need such as a stand-alone ESG country risk rating or to focus more on a country’s future growth prospects instead of default probability.

- Risk factors and indicators: The risk factors included, and their respective weights, can be easily adjusted depending on the objective of the model.

- Data feeds: The raw data used for the indicators and the explanatory guidance texts can be changed.

This latter feature enables the client to integrate their own data sources and forecasts — instead of, or in addition to, CountryRisk.io’s default data sources such as the IMF, the World Bank and the UN, to name a few. In addition, these sources would be specific to the client and inaccessible to others. This is important to ensure that each client’s paid data subscription is respected. As with the web-based platforms, the client could easily conduct scenario analysis to assess the range of potential outcomes for any given country.

The advantages of this approach are not only in shorter model development but also easier model maintenance. With a click of a button, we can create a new version of a model that ensures clean and documented model governance (i.e. version control).

In addition to the customisation aspects of the rating model, there are numerous other elements of the white label platform that can be adjusted, such as adding the user’s own in-house quantitative risks scores or reports.

Country dashboard

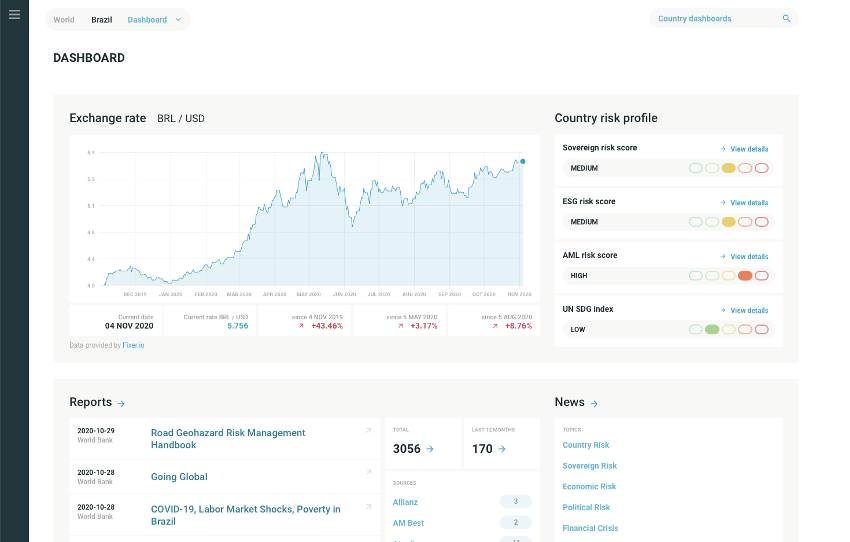

Each country in CountryRisk.io’s universe has a dedicated page (see image) that shows financial market information, the latest curated country-specific reports and news as well as CountryRisk.io’s various sovereign risk scores. In a bespoke version, clients have the flexibility to define its contents.

A better user experience

White labelling also offers an advantage that is becoming increasingly important: usability and engagement with stakeholders. Many organisations continue to use static PDFs to distribute their country analysis. With our white label platform, organisations can invite their stakeholders — whether internal or external — to their bespoke platform and engage and communicate with them around country risk assessments and related topics.

CountryRisk.io can deliver a state-of-the art web application and APIs for ESG country and sovereign risk assessments at a fraction of the cost of similar platforms or in-house development. Depending on the complexity of the client’s needs, the lead time to deliver is roughly two weeks, if not less, as a result of the platform’s flexible backend.

We have done the hard work in building a platform that facilitates fast and efficient sovereign risk analysis. If your organisation is looking for a modern, cost-effective solution, reach out to us at [email protected] and put us to a test.