Checklist for the path to a sovereign credit rating

Bernhard Obenhuber

Mar 28, 2024

Credit ratings are an institutional feature of capital markets, and the probability that a country would default on its obligations is distilled into a few letters. The requirements to follow the assessment of rating agencies is prescribed in many regulations like capital requirements for banks or defined in investment policy statements. For any issuer – sovereign or corporate – being assessed and having a rating is like the entry requirement to play at the big table and becomes a factor for consideration by investors with very large pools of assets. Given their influence to move capital in and out of countries, it is thus not very surprising that rating agencies are abundantly criticised and scrutinized for their rating reviews. But this is not the topic of today’s post.

In a series of blog posts, we want to share some insights on what we observe is needed to obtain a sovereign rating for access to larger and wider sources of financing. In this first post, we focus on the macro-fundamentals that ought to be in place. In future posts, we will touch on other topics like quality and accessibility of statistics and information and modern ways to engage with international investors and analysts. Please reach out if the topic is of interest to you and you would like to share some views and insights.

Long history and relevance

Sovereign ratings have been around for around 100 years pioneered by the two companies Moody’s and Standard & Poors (and its predecessors Poor’s Publishing and Standard Statistics). If you are interested in the history of sovereign ratings, please take a look at the IMF paper “Sovereign Credit Ratings Methodology” by Ashok Vir Bhatia (Link). Fun sovereign rating facts: The top rating category was once ‘AAAAA’. This was also new to me – but also comes with the painful, if not embarrassing, reminder that the only way from the highest rating is down – as illustrated by Venezuela that once held the coveted AAA rating assigned by S&P in 1977 (Link).

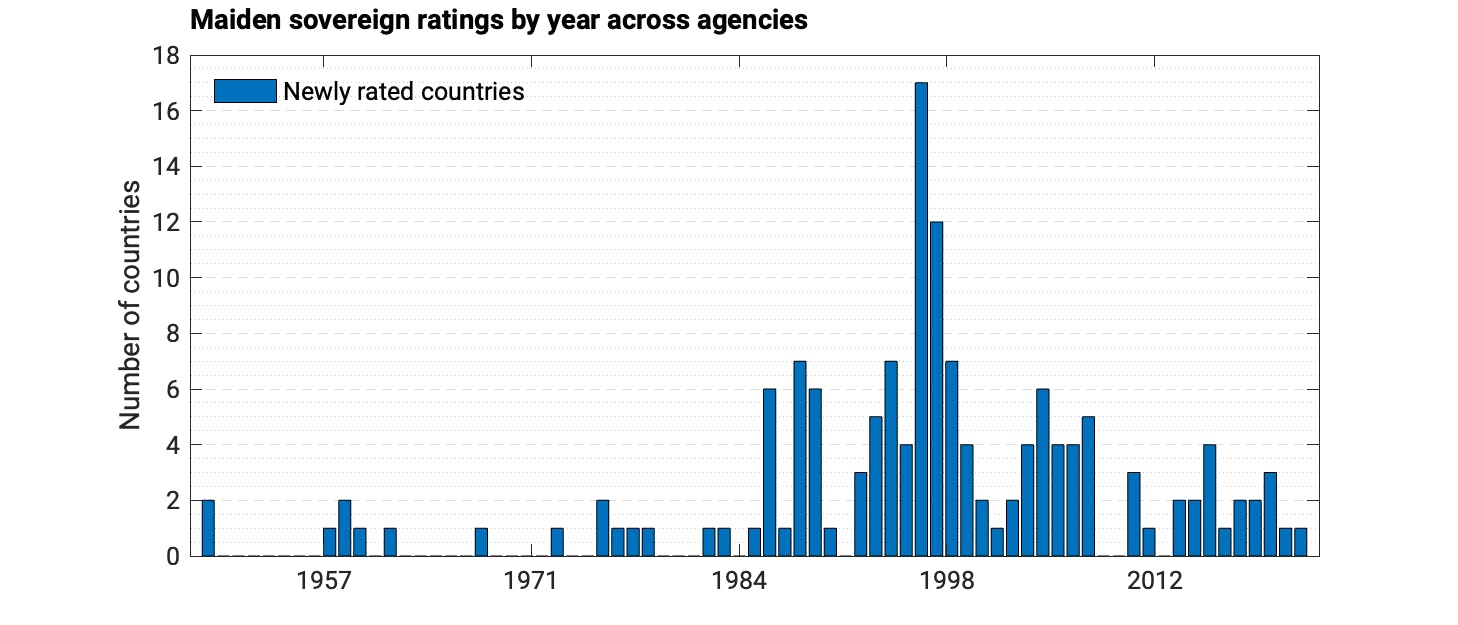

The chart below shows the number of newly rated – also referred to as maiden ratings – sovereigns by year. It was a rather quiet period until the 1980s and picked up in the 1990s and the demand for getting rated took a bit of a hit after the Asian and Russia crises that also challenged the rating methodologies. Nevertheless, there has been a steady stream of sovereigns getting rated.

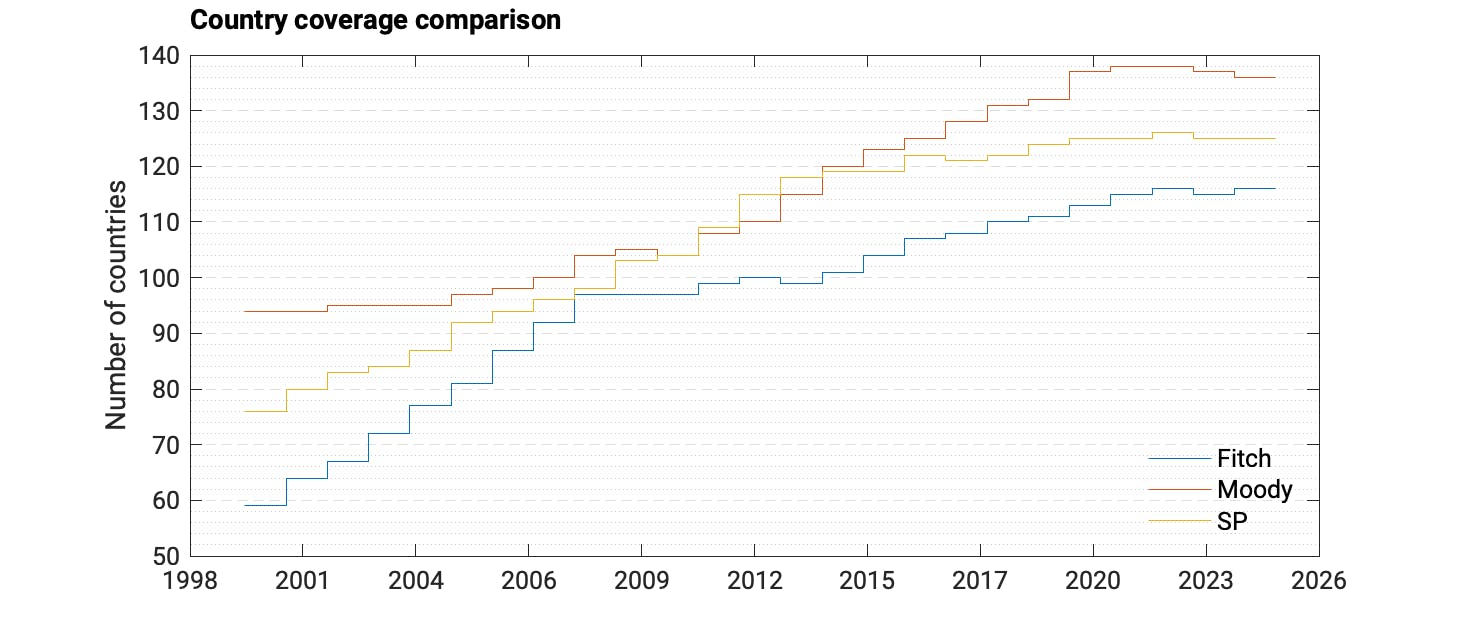

Some of the most recent ones were Turkmenistan in 2021 with an inaugural rating of B+, Laos by Moody’s in 2020 with B3, or Togo by S&P in 2019 with a B. Currently, around 120-130 sovereigns are rated by the big three agencies Moody’s, Fitch and S&P.

Who wants to go next

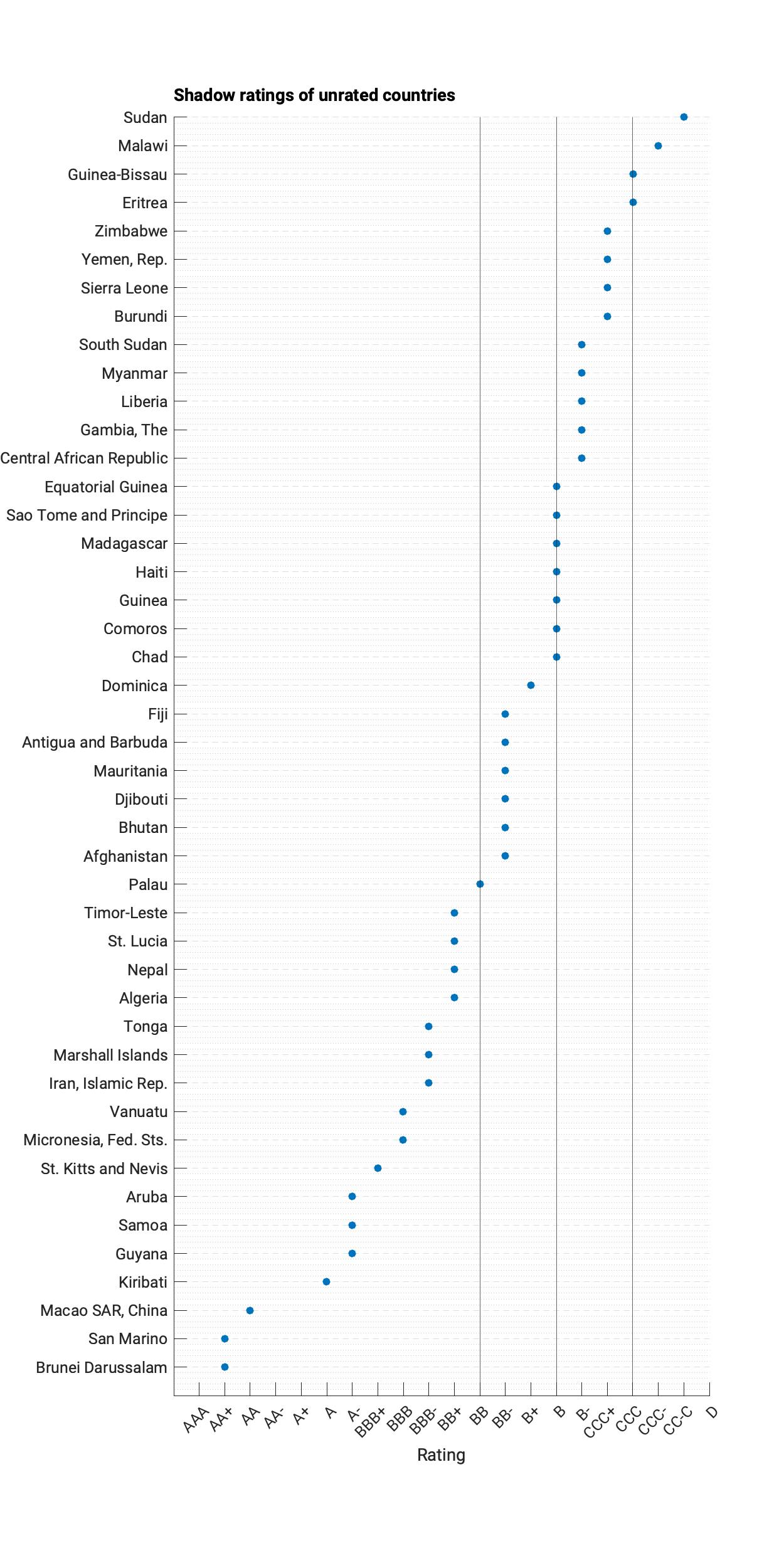

As the country coverages of the three agencies do not completely overlap, there are around 50 sovereigns that are currently unrated. Among these are many small islands nations, or countries that are “off limits” like Iran due to sanctions; Afghanistan due to the political regime, or ongoing wars like in Yemen. Nevertheless, there are countries that may have ambitions to move from solely printing money or concessional financing from multilateral development banks, or official development assistance, to issuing bonds on the international debt capital markets. But this would require obtaining a sovereign credit rating first. So, the obvious question for governments is: Am I ready to get rated? Are our economic and financial fundamentals strong enough to get an acceptable rating and consequently a bearable funding cost?

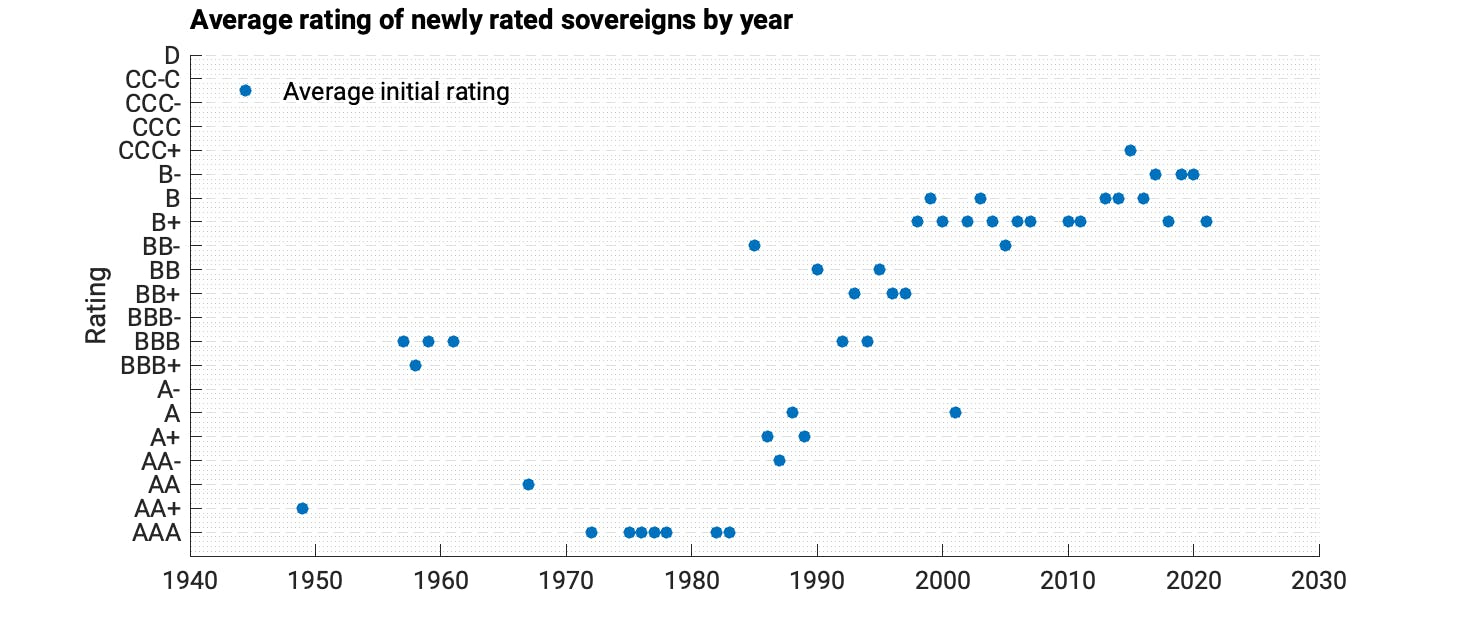

It is instructive to look at peers. The chart below shows the average rating of newly rated sovereigns by year. For instance, in the 1970s and 1980s countries that entered the rating arena received on average the highest rating. These included the AAA ratings of Austria (1975), Finland (1977), Denmark (1981) and Germany (1983).

As there are not so many Switzerlands and Norways in the world, the average maiden rating deteriorated significantly over the decades towards the B rating segment. The average rating shown in the chart of course hides the dispersion that some countries received better, and others weaker, initial rating.

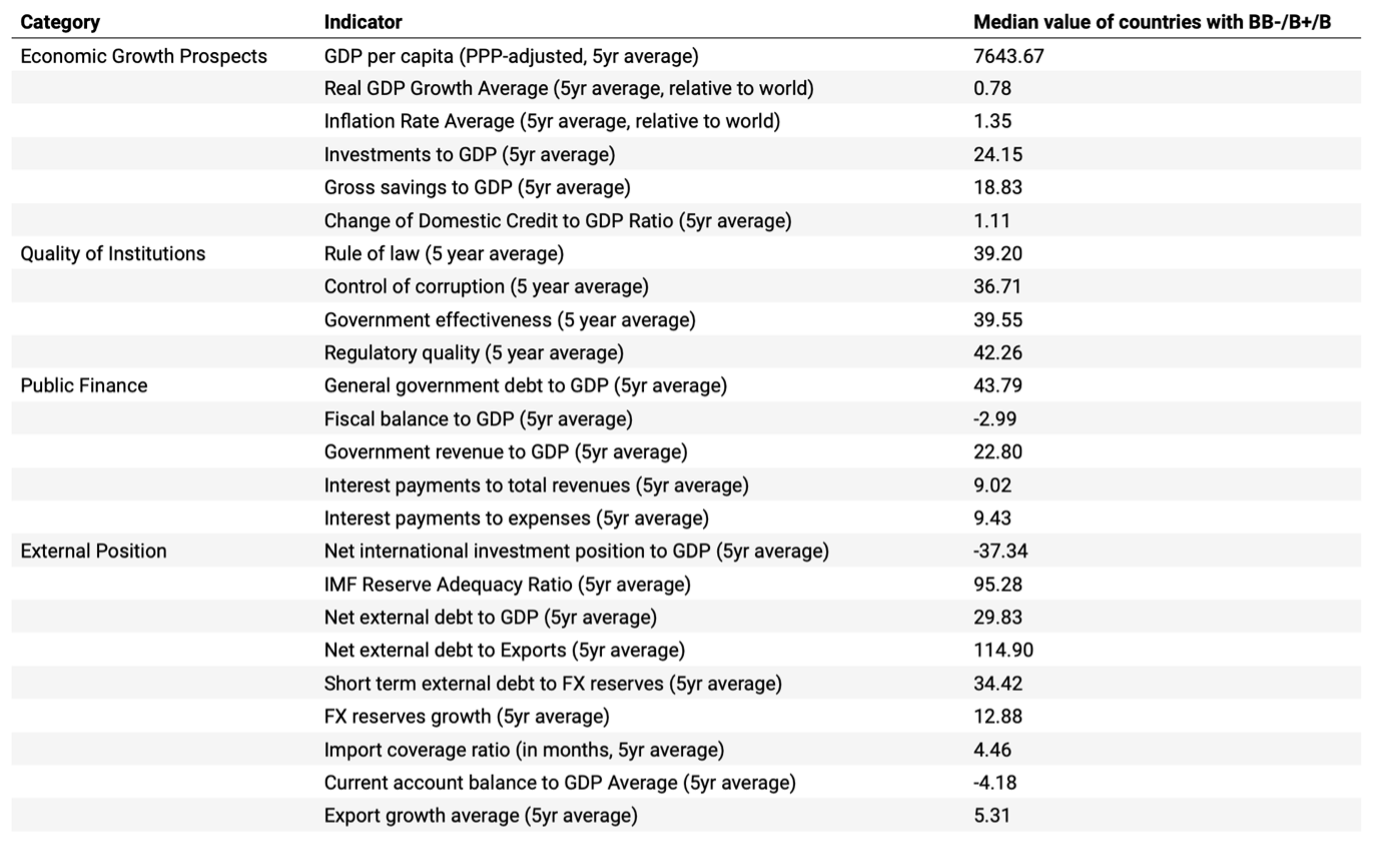

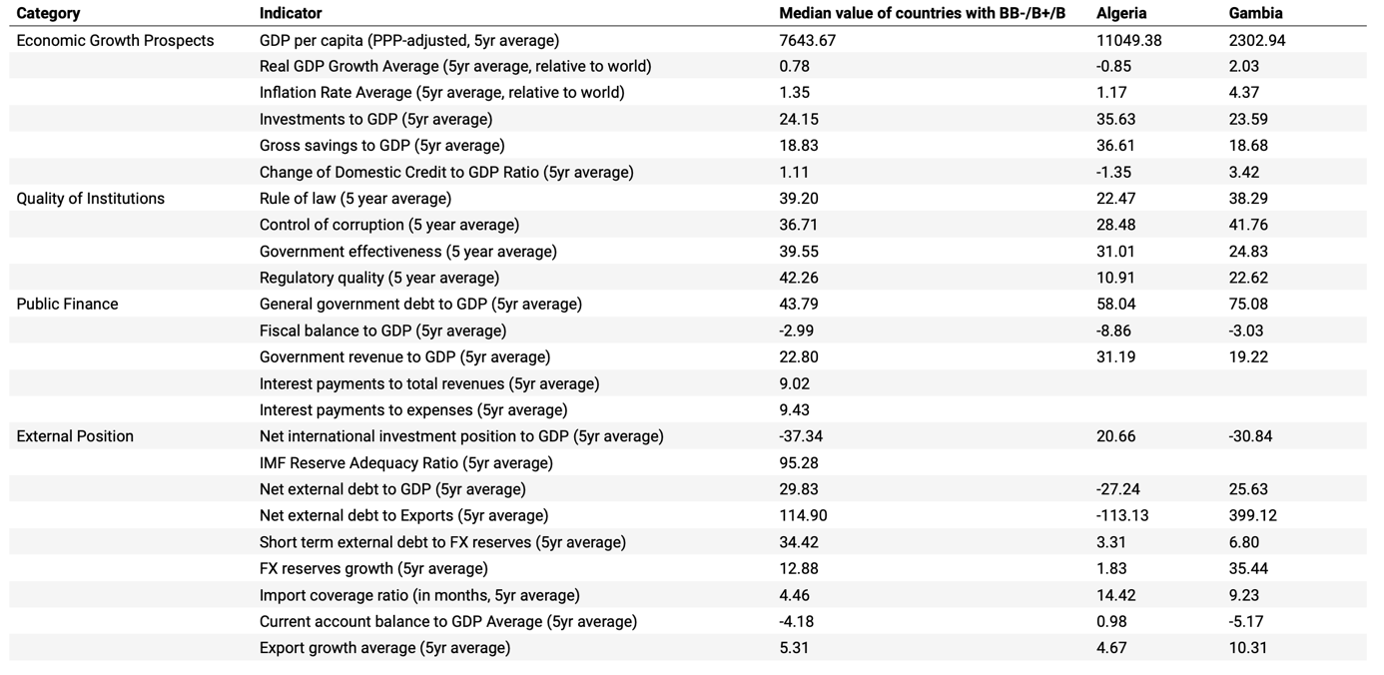

As mentioned at the outset, the appeal of a sovereign rating is that it distills relevant macroeconomic data into a single metric. Differences in rating methodologies aside across the three largest credit rating agencies, by and large they all consider similar indicators. The table below shows a selection of common fundamental indicators and the median values of countries rated between BB- and B. For instance, the median value for this rating group for general government debt to GDP (5yr average) is around 44% or GDP per capita (PPP adjusted) is around USD 7600.

The table allows to benchmark unrated countries and to see the distance a country is from such median values. As an illustration, we pick Algeria and Gambia out of the approximately 50 unrated countries. Algeria compares favourably on many metrics: economic wealth of USD 11,049 is way above the median value. Government revenues as a share of GDP – also one of the more important indicators – is also strong. Public finance indicators, by contrast, are weaker while external position is stronger; not so surprising given the lack of external capital market funding. Another key weakness can be found in the governance metrics where Algeria underperforms the benchmark. All in all, Algeria could be a contender to get rated but would need a strong public commitment to strengthen governance.

Looking at Gambia, the metrics suggest that a (helpful) rating is unlikely to be within reach. That being said, Gambia was once rated by Fitch but the rating coverage was withdrawn in 2007. That is why we list it here as unrated. Reach out if you are interested in the table for all the other countries.

Shadow ratings

The list of indicators from above is taken from our CountryRisk.io Shadow Rating model that is a purely quantitative approach to measure sovereign credit risk. The output is a score between 0 and 100 where higher values indicate higher credit risk. For comparison purposes, we also map the score to the letter-grade scale that is shown in the chart below. Going back to our two showcase examples, Algeria’s shadow rating would be BB+ and confirms that a rating might be within reach. In contrast, Gambia’s rating would be B- that is also in line with a recent statement in the IMF Article IV report “The Gambia’s overall and external debt distress risk ratings remain high and public debt continues to be deemed sustainable, similar to the previous DSA.” (Link).

Data quality challenges

As part of the shadow ratings, we also calculate a data quality metric to give an indication of the result is based on broad number of key indicators. And in this area, many of the unrated countries still have some work ahead as in several cases 20% or 30% of indicator data is missing. We will touch on this important topic in an upcoming post.

Outlook

In this first post, we gave a bit of historical context of maiden ratings and macro-fundamentals that we feel ought to be in place. It is obvious that getting ready for a sovereign rating involves a lot of preparation work from the government, and indicators like governance or GDP per capita do not improve overnight. Besides the economic environment, there are several other aspects that are relevant, ranging from the quality and accessibility of investor relations and overall management of public finances, and more importantly, the long-term development prospects of the country. More on that in the future posts. Let us know what you think.