Changing perspectives: Integrating ESG and SDG in sovereign ratings

Bernhard Obenhuber

Aug 24, 2018

Depending on where you live, you are more or less confronted with the impact of weather related disasters, the consequences of crumbling institutions or weakening of social cohesion. These are all factors that weigh on the government’s ability or willingness to honour its sovereign debt obligations. In this article, we take a look at how to integrate such factors into sovereign risk assessments and ratings. We also show how the CountryRisk.io ESG Sovereign Risk Scores compare to similar rankings and how to use them.

Rising environmental and social costs

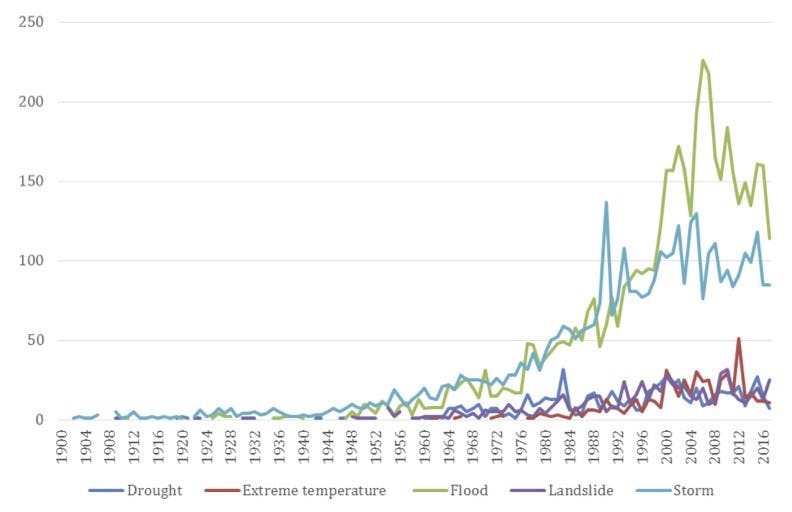

The chart below shows the number of weather-related disasters over the last 100+ years. It shows a strong increase across all categories, especially related to flooding and heavy storms during recent decades (You can find the full paper here). Certainly, such data is prone to challenges in collection. Nevertheless, the look into other academic studies or annual reports of re-insurance companies affirm the basic conclusion.

The associated direct (e.g. loss of capital or economic output) and indirect (e.g. migration) costs of environmental and social risk factors can be large enough to severely impact an economy and its ability to service its debt obligations. While such risks might have been implicitly considered by macro-economists or country risk analysts in the past, there is value in incorporating these costs explicitly in the analysis process.

Integrating environmental, social and governance ES(G) risk drivers into the country and sovereign assessment process is a good approach to do so. We put the (G) into parenthesis, as factors like rule of law, corruption or government effectiveness have been an integral part of country risk assessments for many years. The novelty of ESG sovereign risk ratings draws more from being explicit about environmental and social risk factors when rating a country and its sovereign debt obligations.

SDG gives ESG a push for better data

The exercise is not fraught without challenges. For one, poor data quality has been a key stumbling block in integrating environmental and social factors into risk assessments since its first big push with the Brundtland report (“Our common future”) in 1987. While patchy data are still prevalent in many areas, there is finally a strong international commitment and financial resources to improve statistics. The United Nations as the key driver of the Sustainable Development Goals operationalized the 17 goals by defining concrete targets and respective indicators. And important for research, the data access has become easier through API and bulk downloads (UN SDG Data or World Bank).

Given the SDG goals, targets and how to measure them, one can rank countries in terms of their distance to reaching them. The Sustainable Development Solutions Network (SDSN) Secretariat and the Bertelsmann Stiftung have recently published the 2018 edition of the SDG index that provides such a ranking. The report is very well done and with 460 pages, is very comprehensive. You can find it here.

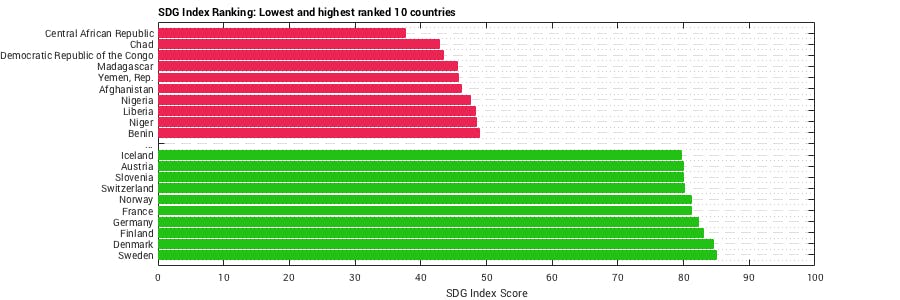

Only European countries out of 156 ranked among the top 10, and mainly the Nordic ones. Sweden bested the list with an overall SDG score of 85%, which means that Sweden has achieved on average 85% of the 17 SDGs. On the other side of the spectrum, you find mainly African countries, with the Central African Republic at the bottom of the SDG index with a score of just 37%.

In such rankings, one is always tempted to look for some surprises. Two such cases are the United States, ranking 35th, and China, 54th. Also surprising were Belarus and Ukraine, which ranked 23rd and 39th, respectively. Much better than expected. In addition, Middle Eastern countries such as Qatar (Rank 106) or Saudi Arabia (Rank 98) came behind Venezuela (Rank 93) or Iran (Rank 82).

As always, an overall ranking that aggregates 80+ indicators with widely different data availability and quality across countries needs to be taken with a grain of salt. But it would also be too easy to dismiss such initiatives and rankings as they have the potential to steer public awareness and public policies into the right direction.

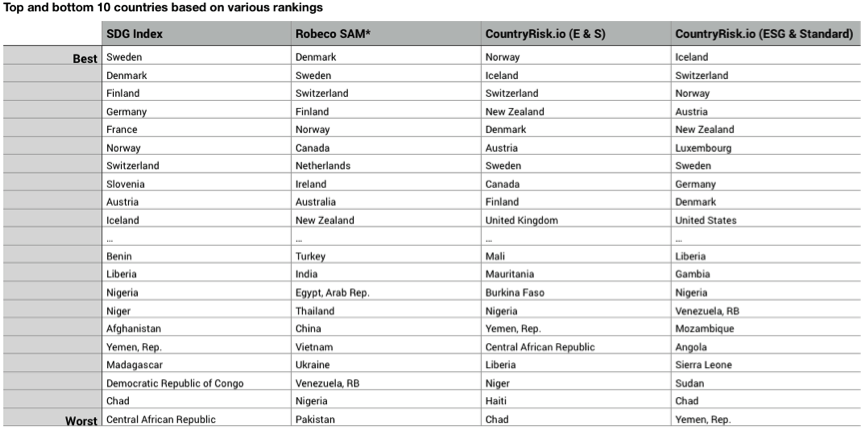

There are also other ESG country rankings available. In the table below, you find the top and bottom 10 countries of the SDG Index, RobecoSAM and the ranking of CountryRisk.io, once only based on the environmental and social risk factors and once together with standard economic and governance factors. For more details on the CountryRisk.io methodology, please take a look at this article and the standard rating methodology that can be found here.

In general, the different rankings show pretty similar results. Nordic and other European countries perform well. New Zealand and Canada also make it into the top section. Similarly, African countries still featured among the worst performing countries.

What’s your objective?

Despite the high level similarities in terms of rankings, one needs to ask what the objective is of the individual scoring system. As mentioned previously, the SDG Index measures the distance to meeting the 17 SDG goals. RobecoSAM states “By focusing on ESG factors such as aging, competitiveness and environmental risks — which are long term in nature — our country sustainability analysis offers a view into a country’s strengths and weaknesses that are not typically covered by rating agencies.“ (Source). Environmental factors have a 15% while social factors 25% and governance dominates the RobecoSAM score with 60%.

At CountryRisk.io, we focus on measures of the government’s ability and willingness to repay foreign currency bond obligations. In that sense, it is a classic sovereign credit rating. The CountryRisk.io score for Environment and Social puts equal weight on both areas. And it explicitly excludes governance factors (e.g. corruption, rule of law, stability,…) as such factors are already part of the standard country risk model.

CountryRisk.io E & S score for tracking SDG performance

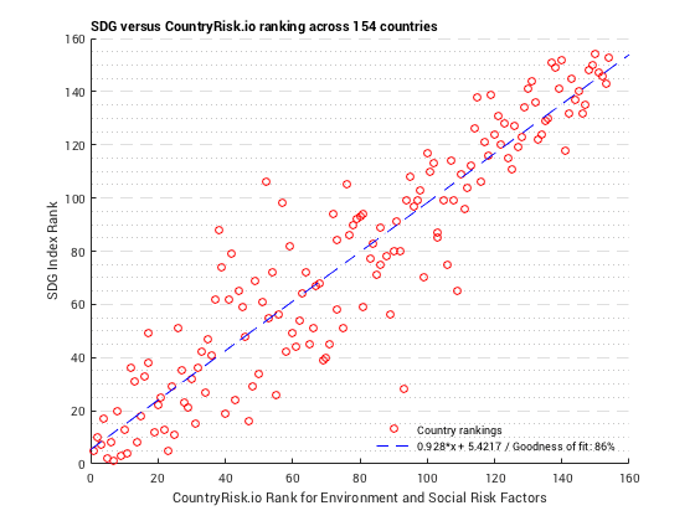

The CountryRisk.io environment and social (E & S) components track the performance of countries in terms of progress towards reaching SDGs well. The chart below compares the CR.io E&S ranking with the SDG index for 154 countries based on the latest 2018 data. There is a strong linear relationship and goodness of fit of 86%.

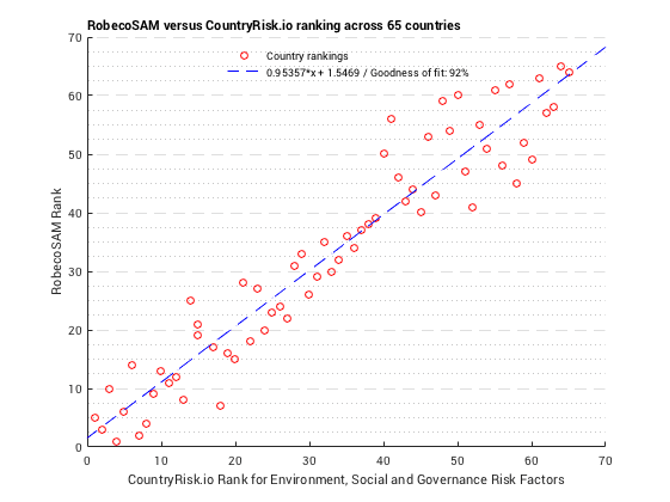

When comparing the CountryRisk.io scores with RobecoSAM’s ranking, the correlation is very high. The chart below compares the CountryRisk.io ranking based on the environment, social and governance (ESG) sub-indicators, with RobecoSAM ranking across 60+ countries, and we find a correlation of over 90% between the two measures.

Here’s a brief re-cap:

- CountryRisk.io E & S scores allow us to rank countries in terms of progress towards reaching SDG goals across 150+ countries.

- CountryRisk.io E & S & G scores and the RobecoSam sustainability rating measure very similar aspects. However, CountryRisk.io provides scores for a much larger universe (190 countries) than RobecoSAM.

- The SDG Index and RobecoSAM score are not explicitly designed to measure sovereign credit risk. The RobecoSAM score is supposed to be used as an addition to standard credit ratings.

- The overall CountryRisk.io score combines ESG and traditional credit risk indicators into a holistic measure of ESG sovereign credit risk.

Extending sovereign credit ratings with ESG factors

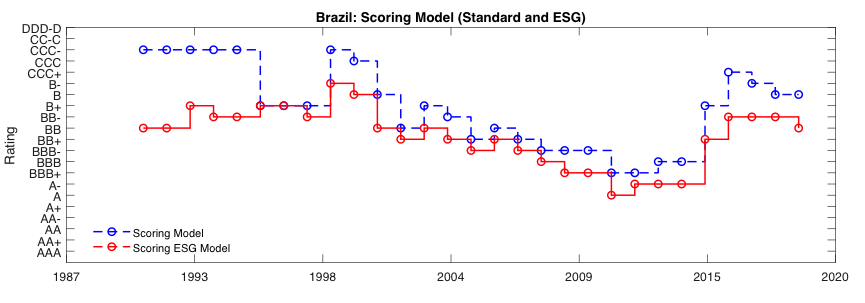

At CountryRisk.io we have produced standard sovereign credit risk assessments for several years. In addition, we also have provided our community with risk scores and ratings that incorporate ESG factors on a monthly basis. Compared to the standard model that includes of risk factors such as economic growth prospects, fiscal and public debt, balance of payment flexibility or governance indicators among others, the ESG version also includes environmental and social indicators. The ESG factors have a total weight of 40% of the overall score.

We publish letter ratings for both models going back more than 20 years. As both models share similar indicators, the ratings are certainly correlated. Nevertheless, the difference between the models can be several notches in both directions. For example, the ESG model for Brazil is some notches better than the standard model.

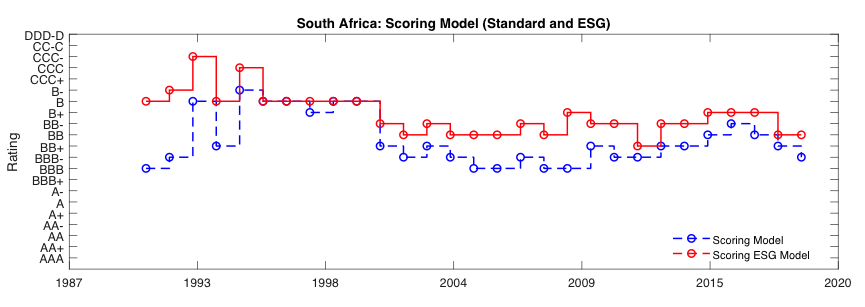

In the case of South Africa, its ESG rating is weaker than the standard model. This suggests that South Africa scores poorly in the areas of environmental and social indicators relative to the standard indicators. If more and more people consider ESG factors, we are likely to see pressure on South Africa’s rating and also higher financing costs.

In sum:

- Integrating ESG factors into sovereign credit ratings can lead to a several notch rating difference, higher or lower, compared to standard models.

- We find that the integration of ESG factors into sovereign credit ratings is especially valuable for better credit differentiation among least developed countries. Here, factors like the quality of the education or health system or vulnerability to environmental risks adds information. Among highest rated countries, ESG integration leads to smaller changes.

- We recommend monitoring ESG sovereign ratings regularly as it allows you to identify countries that are likely to see rating pressure if public awareness and investor requirements continue to grow for ESG risk integration.

- CountryRisk.io provides sovereign risk scores for 190 countries that integrate ESG factors and are explicitly designed to track sovereign credit risk.

Please get in touch with us at [email protected] if you want to receive the results for all 192 countries on a trial basis or are interested in augmenting your process with ESG factors.

Written by the co-founders of CountryRisk.io Bernhard Obenhuber and Jenny Asuncion

About CountryRisk.io

CountryRisk.io was started on the basic premise that we can improve the quality of sovereign risk ratings by making the analysis framework publicly available, and by aggregating the ratings for a specific country across many users. We are convinced that a crowd-sourced approach provides the community with a lot more valuable information, which is virtually lacking today.

In addition, the crowd-sourcing approach is also useful in the case of poor data quality as it serves as it provides survey information for the qualitative factors. We also see that new technologies can bring innovation in the area of data and aggregation.

Join the discussion and community

We want to invite everyone to join the ESG sovereign risk discussion and community. Together we can develop the best ESG sovereign risk rating framework and provide ESG ratings to the public.

References

“Climate vulnerability and the cost of debt” by Kling et al. SOAS University of London and German Development Institute, June 2018

“Climate change and the cost of capital in developing countries. Assessing the impact of climate risks on sovereign borrowing costs. Executive Summary” by Donovan and Volz. Imperial College London and SOAS University of London.

SDG Index: http://sdgindex.org/

RobecoSAM Country Sustainability Ranking: http://www.robecosam.com/en/sustainability-insights/about-sustainability/country-sustainability-ranking/index.jsp