Imagine producing a country risk report in just minutes...

Country risk analysis needn’t be protracted or complex. In this blog post, we introduce our CountryRisk.io AI Assistant. Our approach drives productivity and delivers value through independence, transparency, domain expertise and technology.

Bernhard Obenhuber

Aug 29, 2023

In March this year, we wrote about the research and development we’ve been doing to explore how natural language generation tools might support better, more efficient country risk analysis.

Now, after around six months of work by the CountryRisk.io team, we’re ready to make the first fruits of our labour available to our community.

What we’ve been working on: a quick recap

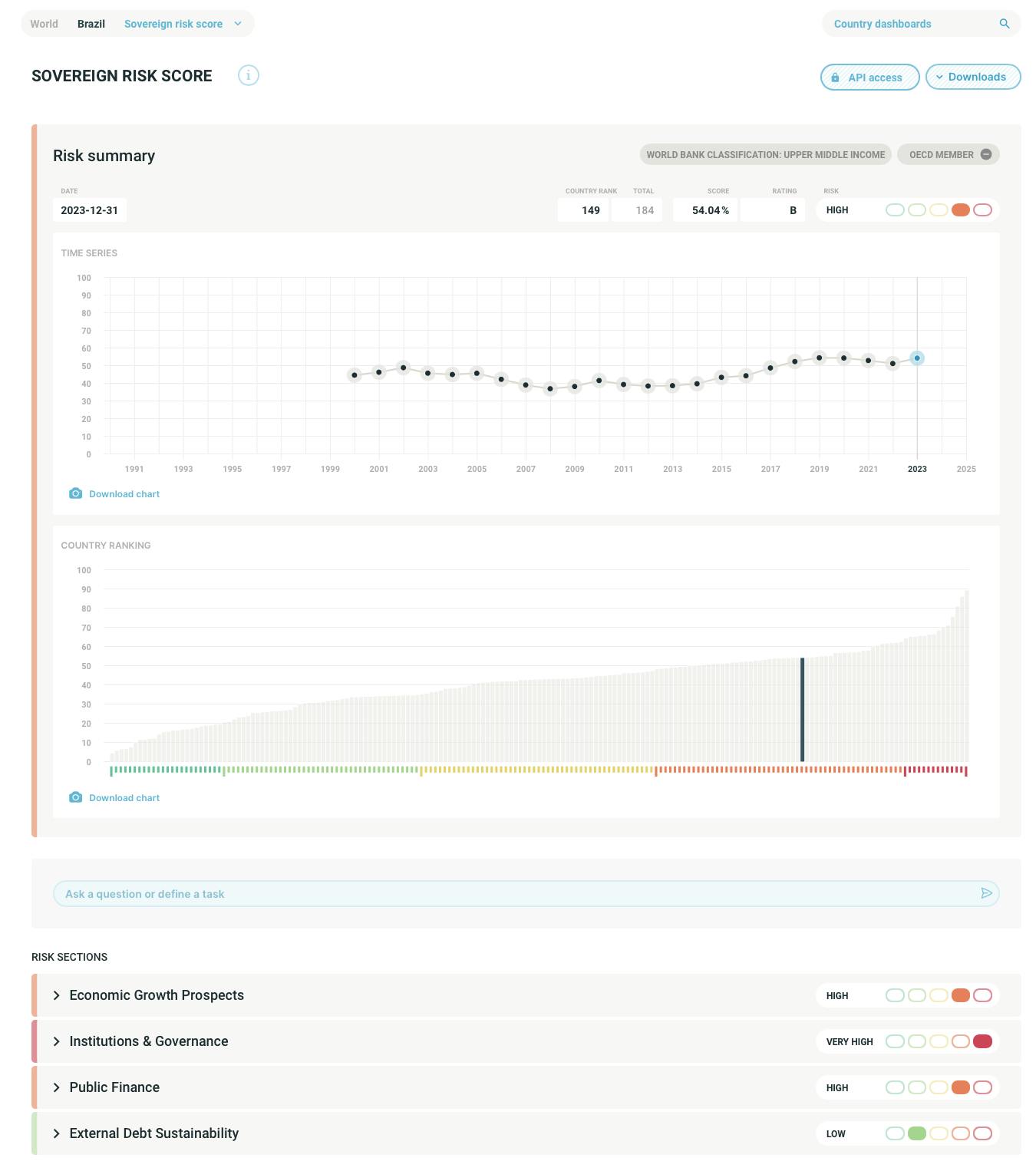

At CountryRisk.io, we use our risk scoring methodology to approximate sovereigns’ default risk. If you’ve been with us a while, you’re probably already familiar with that methodology; otherwise, you’ll find it here. (Link).

As a second step, we’ve been exploring how we can use natural language generation to convert data into text snippets, as well as adding details to numerical data. And, in tandem, we’ve been working to incorporate OpenAI’s large language model (LLM) into our platform, so our members can do so for themselves.

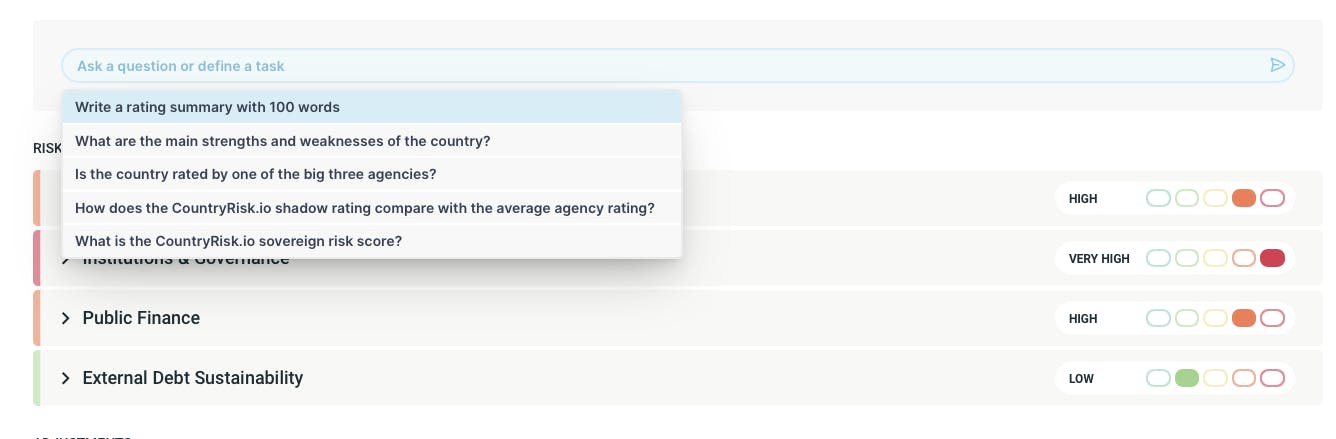

This feature is now available for our standard risk scores, which cover sovereign credit risk, ESG sovereign risk, AML, and supply chain country risk. When you select any country’s risk score, a new field will appear below the charts into which you can enter your question.

And, in case you could use some inspiration, we’ve pre-loaded the field with some common questions.

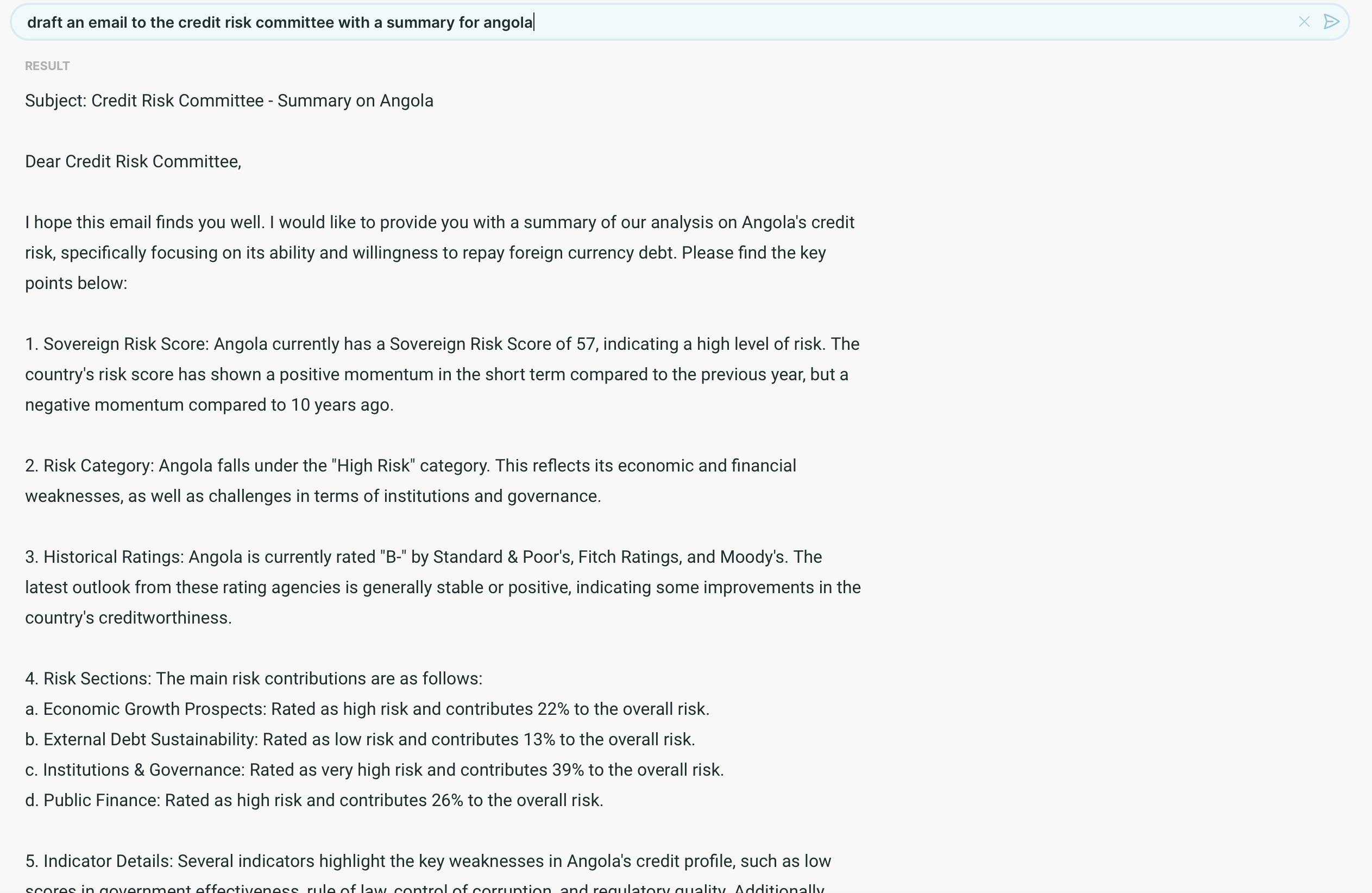

You can be creative and provide prompts like "Draft an email to the credit risk committee with a summary for Angola".

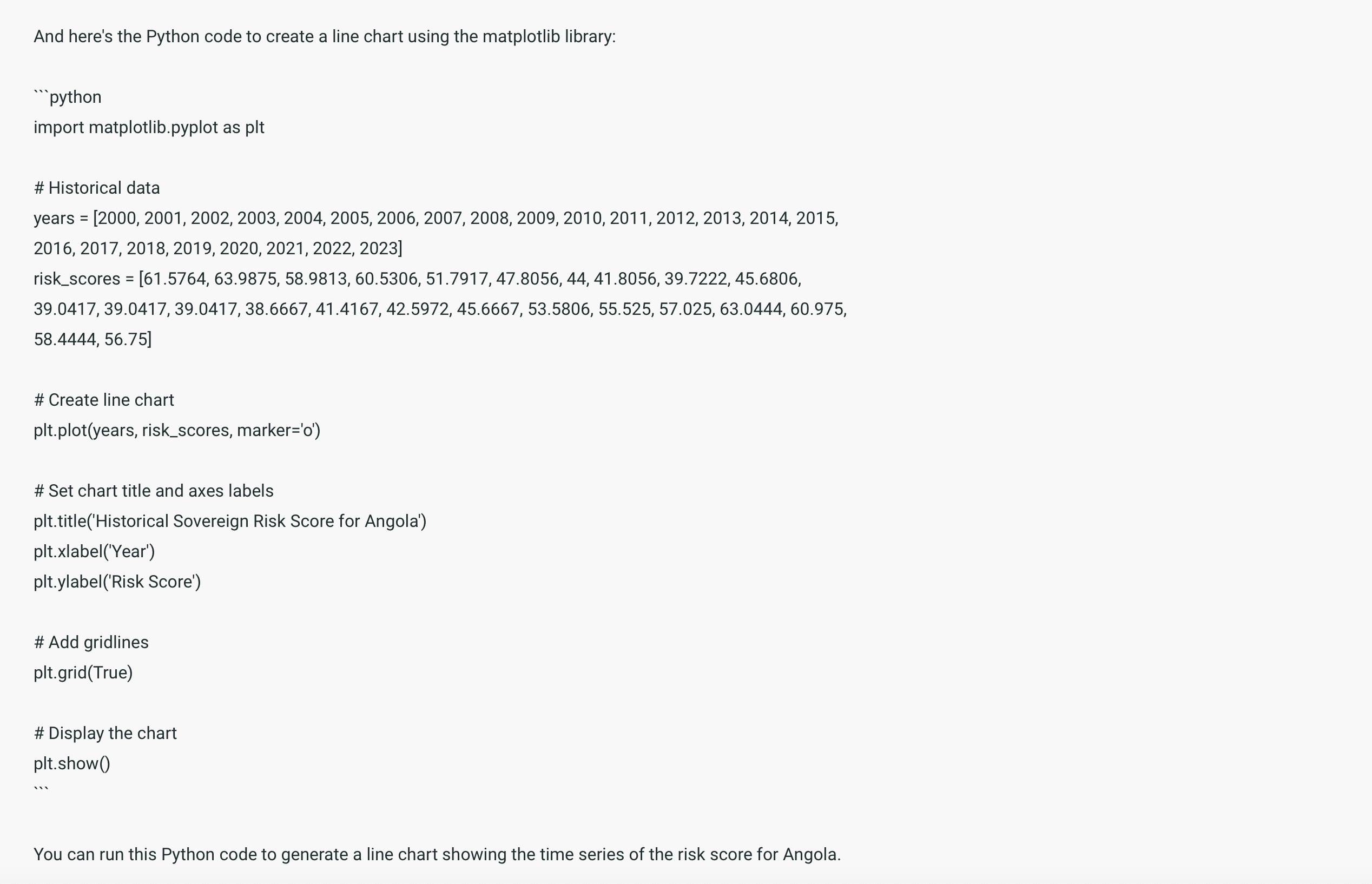

Or for instance "I need python code for making a line chart for the sovereign risk score for Angola". Your country risk assistant cannot do everything but a lot.

When using this new field, it’s important to remember that we’ve “instructed” the LLM to consider only the information we’ve provided. So, it can tell you all about Tunisia’s sovereign credit risk, but it won’t tell you which of the country’s sushi restaurants is best. While this restricts the amount of knowledge our LLM is able to talk about, it also significantly reduces the risk of hallucination without compromising its ability to answer the kinds of questions our community want to ask.

Give it a try and let us know what you think.

Use cases

Country risk information is needed in many different situations and formats, as well as by people with different levels of country risk expertise. This often means that economists must re-package the same content over and over again—a multi-page country report or presentation here, a statement for senior management there—all of which require additional time commitments.

As former country risk analysts, we’ve experienced the pain of losing all that time to such busy-work. Now, though, our community can use CountryRisk.io’s newly integrated LLM to start automating some of these rote tasks, so you have more time to actually use your hard-won expertise to add value through difficult, creative thought.

And this is just the beginning.

More features coming soon

We’ve started small with this first-generation version of our new LLM tool, and we’ve yet to unleash its full potential in terms of the amount of contextual data to which it has access. So, our focus now is on releasing more updates while integrating the tool elsewhere on the CountryRisk.io Insights platform.

For instance, we’re currently working on adding the ability to use the LLM to interrogate long-form documents. This would enable you to ask questions like, “How about climate change in Brazil?”, which would prompt the LLM to review the latest IMF Article IV reports and return a summary based on all relevant paragraphs throughout these documents. We also plan to integrate the assistant into the sovereign rating model, so you can ask about a specific aspect of sovereign risk (e.g. quality of public debt management) or get help with writing a rating rationale and outlook.

Finally, we’re working on a feature that will enable you to define your organisation’s specific exposure profile using criteria such as proportion of sales or portfolio investment exposure by country. This will unlock the ability to ask questions like, “Which countries contribute most to our country risk exposure?” or, “What are our organisation’s primary risk factors?”, and receive a response in natural language. We believe this exciting, unique feature has the potential to make our community members’ workflows significantly more efficient.

The changing role of economists and country risk analysts

It’s an exciting time to be working in our field. As the ongoing development of LLMs unlocks the possibility of automating an increasingly wide range of humdrum tasks, we’ll be able to use the time we save to produce better, more considered analyses.

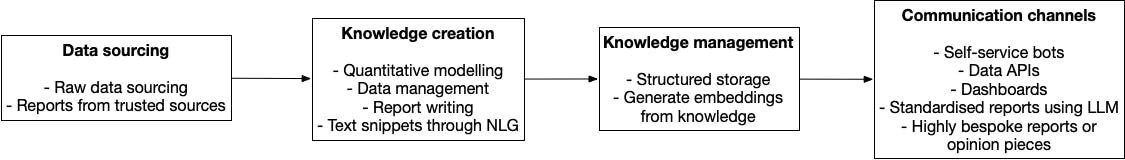

But we also believe that the nature of these professions and, in turn, the expertise they require, will change. As LLMs become more capable, analysts will have to focus more on orchestrating the entire process of knowledge generation and distribution:

Data sourcing

With so much relevant data and information out there, it’ll be increasingly important to be aware of alternative data sources—not just the go-to ones. You’ll also need the technical skill to access and work with such data, as well as the experience required to assess their quality. And, since LLMs can interrogate long-form texts, analysts will increasingly need to regard such documents as sources of quality data alongside sources of traditional numeric or time-series data—something that, for many of us, could take some getting used to.

Knowledge creation

Here, we’re talking about the identification and collation of knowledge from data, especially those that enable an assessment for a particular research question (e.g. likelihood of sovereign default or recession). Knowledge, then, can take the form of numerical data (e.g., GDP growth: 1.5%) or informed statements (e.g. “We believe that GDP growth will be lower in the next decade compared to the past due to declining productivity growth and a shrinking labour pool”). And, since LLMs are capable of quickly producing such statements by themselves, natural language generation via heuristics is set to become an increasingly crucial area of knowledge creation. However, it will also be important to maintain our focus not just on quantity of knowledge created, but also on quality. Even an inexperienced economist can generate plenty of new data and insights, and LLMs will make doing so easier than ever. But a good economist will be able to identify the data points that are most relevant to every research topic, as well as how to transform them and then translate the results into code.

Knowledge management

Of course, dumping the knowledge you create onto a shared drive is the easiest way to store it. But doing so will also make it difficult for anyone else to find and use that knowledge. And, should you decide to go elsewhere, your organisation may end up misplacing it entirely. To maximise the potential value of the knowledge you create, then, you must be able to make available to everyone in your organisation via a quality knowledge management system.

Communication channels

If you can do the first three steps well, this last one should be a piece of cake. Self-service bots and their APIs will increasingly be powered by our knowledge so other departments or even clients can easily integrate it into their workflows and dashboards, including the generation of text snippets for standardised reports. This will give you more time to create compelling presentations, reports, and other bespoke work capable of feeding value back into the overall cycle.

All of this amounts to a new era for country risk; one in which the very best analysts will be differentiated by a combination of extensive domain knowledge, confidence to form a view of the world, and mastery of the techniques and possibilities associated with machine learning.

Let us know what you think

If you’re interested in receiving a one-on-one demo of this new feature, learning about how you can apply the abilities it unlocks to your own data and risk scores, or have ideas for improvements, you can send us an email at [email protected].